Company Withholding Tax Rate Nz

The rate reduces to 0 if the investing company holds 80 or more of the shares in the other company and meets other criteria. NRWT is further reduced to 0 when a New Zealand borrower elects to pay a 2 Approved Issuer Levy AIL on the interest paid.

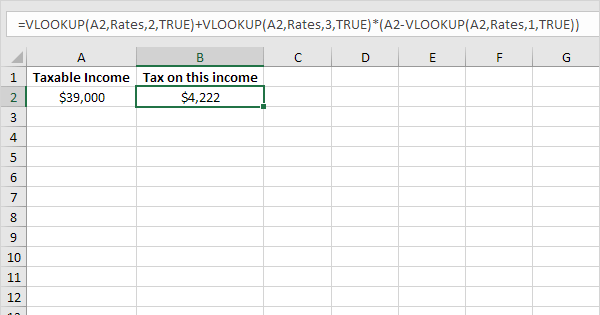

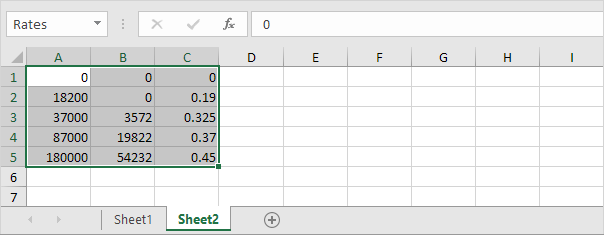

Tax Rates In Excel Easy Excel Tutorial

You will pay the withholding tax you deduct from the contractor payments to Inland Revenue at the same time that you pay any PAYE you deducted from employees.

Company withholding tax rate nz. If the contractor fails to provide you with a completed IR330 you are required to deduct a further 15 withholding tax making for a total tax deduction of 35 of the payment. The general rule for allowable deduction is the expense of loss must have been incurred in deriving income or incurred in the course of carrying on the company for the purpose of deriving income. RWT on Maori authority distribution is 175.

Taxpayers need a current guide such as the Worldwide Corporate Tax Guide in such a shifting tax landscape especially if they are contemplating new markets. New Zealand tax residents can pick any rate from 10 per cent up to 100 per cent. If the recipient is a company the default rate is 28.

The rate is 15 but generally reduced to 10 upon application of a Double Tax Agreement. However some resident contractors may be able to obtain a lower withholding rate as low as 0 by applying for a special tax rate certificate from the Commissioner of Inland Revenue. Withholding Tax Rates 2021 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction.

This will be particularly important for contractors operating through a company where they are subject. However the contractor must provide you with a completed tax code declaration IR330 form for the 20 rate to apply. New Zealand imposes non-resident withholding tax NRWT on New Zealand sourced interest paid to foreign lenders.

This is a flat rate and is taxed regardless of whether the contractor is GST registered. The rate in column 2 applies to dividends paid by a RIC or REIT. Companies pay income tax at 28 on profits.

What is withholding tax. However fully imputed dividends are subject to zero percent withholding tax if the shareholder owns more than 10 percent of the company or 15 percent otherwise. Non-resident withholding tax is imposed on interest at 15 percent and dividends at 30 percent or 0 percent if fully imputed.

Deducting tax from New Zealand payments of interest dividends and royalties to investors who do not live in New Zealand. According to the IRD not all contractors are created equal and some must pay Tax on Schedular PaymentsWithholding Tax depending on their activities. Interest received by a financial institution is tax exempt.

The minimum withholding rate that can be elected is 10 or 15 for non-residents or contractors with a temporary work visa. NRWT on dividends is reduced from 15 to 5 for an investing company that has at least a 10 shareholding in the company paying the dividend. If you do not choose a rate then the default rate of 33 applies.

RWT on dividend is 33. The NRWT rate on interest is 10 but is reduced to 0 if it is payable to eligible financial institutions. If the recipient is an individual person the tax rate is same as the recipients marginal tax rate.

Chapter by chapter from Albania to Zimbabwe we summarize corporate. Withholding tax is actually now known as Tax on Schedular Payments. Those hired and paid through a recruitment agency or other labour hire business must have tax deducted.

Tax rates for individuals operating as a business that is individuals who are self-employed are the same as for employees. Company is taxed on its income at a flat rate of 28. All contractors can pick the rate to have tax deducted at.

Withholding tax is deducted from schedular payments made to contractors. It will certainly cover any tax you owe as the top personal tax rate is only 33. Global tax rates 2021 is part of the suite of international tax resources provided by the Deloitte International Tax Source DITS.

See individual tax rates above Goods and Services Tax. Dividends paid to a non-resident are subject to withholding tax at 30 percent. The good news is that you can reduce the amount of tax being deducted down to a minimum amount of 10.

For Venezuela the rate is 495 if the interest is beneficially owned by a financial institution including an insurance company. These rates might be reduced further through the application of a double tax agreement if the recipient is resident in a countryjurisdiction with which New Zealand has entered into such an agreement. The content is straightforward.

If you dont let us know your IRD number or RWT rate you will be taxed at the default rate of 33. These rates may be reduced under a tax treaty. From 1 April 2020 the IRD is increasing their non-declaration rate to 45 for those customers who have not supplied their IRD number.

Paying dividends and interest to New Zealand residents and deducting resident withholding tax. Use this simple guide to confirm your Resident Withholding Tax RWT rate - itll only take a few seconds. Governments worldwide continue to reform their tax codes at a historically rapid rate.

Tax rate estimation tool for contractors. However that rate applies to dividends paid by a REIT only if the beneficial owner of the dividends is i an individual or pension fund in the case of. Once you have deducted business expenses there will be a sizeable refund but youll have to wait until the end of the financial year for that.

Dividends and unit trust distributions are all taxed at a RWT rate of 33 while portfolio investment entities PIEs are taxed at different rates depending on the type of fund.

Get To Know Misunderstood Business Tax Deductions Before Your Year End Planning Moneybyramey Com Business Tax Deductions Business Tax Tax Deductions

Facebook Messenger Chatbot 7 Reasons Your Business Needs It Chatbot Facebook Content Facebook Messenger

Firs S Vat Of N29 2 Million Imposed On Bank Reversed By Tribunal Capital Market Accounting Bank Account

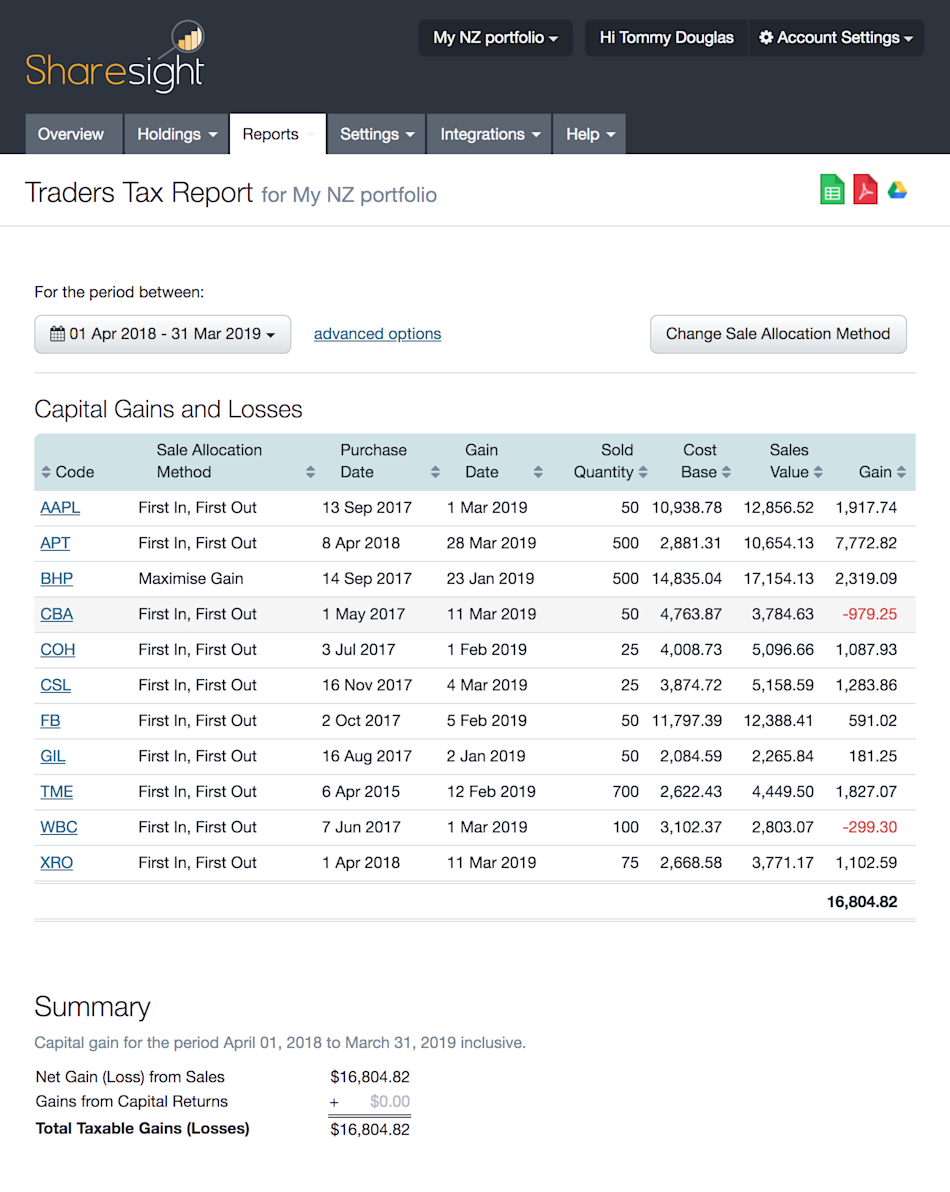

Calculating Taxable Gains On Share Trading In New Zealand Sharesight

Every Business Entity Is Required To Report Its Business Activity Through Filing Of Tax Returns Various Type Of Tax O Payroll Taxes Indirect Tax Business Tax

50 Highest Foreign Stock Dividend Yields June 2019 Seeking Alpha Dividend Stock Market Data Dividend Stocks

Tax Calculator Excel Spreadsheet Youtube

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Calculating Taxable Gains On Share Trading In New Zealand Sharesight

Hedge Funds Should They Advertise Created In Free Piktochart Infographic Editor At Www Piktochart Com Investing Infographic Implied Volatility

New Income Tax Table 2020 Philippines Income Tax Tax Table Income

Foreign Withholding Tax A Lost Opportunity Bkd Llp

Indian Stocks Soar But Banks Are Weighing On The Nifty 50 Http Taxguru In Finance Indian Stocks Soar Banks Weighing Nifty 50 Ht Nifty Finance Corporate Law

New 2016 Tax Incentive Enhancements Mo Tax Accountant Tax Payment Tax Accountant Business Tax

Posting Komentar untuk "Company Withholding Tax Rate Nz"