Withholding Tax Rates China

China Taxation and Investment 2017 Updated July 2017 2. The royalties for patent trademark information know- how concerning industrial commercial or scientific experience etc.

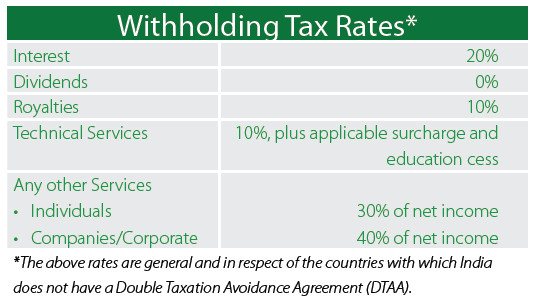

Asiapedia Withholding Tax Rates In India Dezan Shira Associates

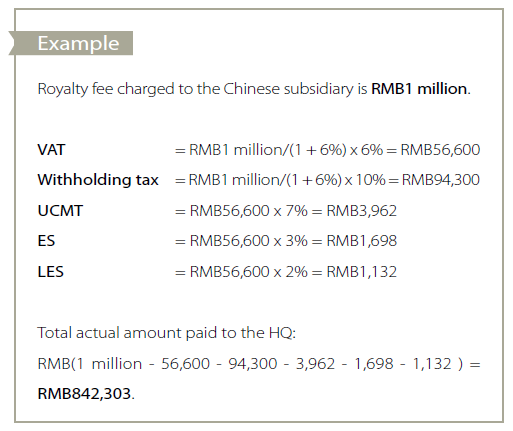

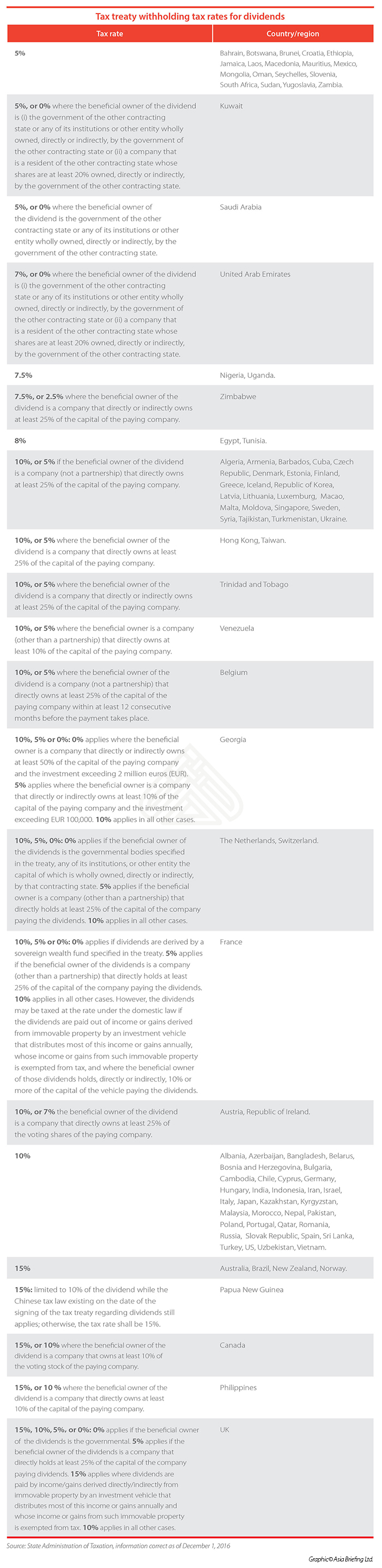

The actual tax burden for royalties in some cases may be lowered from 7 to 6 if the royalties are paid as consideration for the use of or the right to use any industrial commercial or scientific equip-ment.

Withholding tax rates china. Tax levied by the Customs. The prevailing China withholding tax rates for Beijing and Shanghai are 1672 and 1678 respectively which comprised the following. China operates the Golden Tax System which is a highly regulated invoicing system.

China has abolished most price controls with market forces now determining the prices of the majority of products traded. China Tax Profile. The updated tax treaties and new tax treaties China enters with other countries reflect recent developments of international tax regimes to combat tax evasion.

Filing status Each taxpayer must report IIT individually. China Highlights 2020 Page 5 of 9 Compliance for individuals. Stamp tax - a tax levied on enterprises or individuals who execute or receive specified documentation in China and the tax rates vary between 0005 to 01.

As of 2019 China taxes individuals who reside in the country for more than 183 days on worldwide earned income. One of a suite of free online calculators provided by the team at iCalculator. Access the latest income tax tables for China 2021 with historical tax tables for China from 2010.

Each tax tables has a China Income Tax Calculator to allow calculation of salary after tax in China. The PAYG or pay-as-you-go tax which includes medicare levies and insurances. For exposure to Chinese stocks either buy stocks directly or through a Hong KongIreland-domiciled ETF.

DO NOT pick a US-domiciled ETF. Businesses must obtain a special VAT invoice and verify it before an input VAT credit can be. VAT invoices known as special VAT invoices must be issued on government-issued and regulated machines using government-issued and numbered invoicing paper.

Dividends paid to a non-resident are subject to withholding tax at 10 percent this rate may be reduced under certain treaties. International Withholding Tax Rates. The withholding CIT rate for non-tax resident enterprises in China is 20 percent currently reduced to 10 percent.

Enterprise income tax 1000 Enterprise Value Added Tax VAT 600 Urban construction and maintenance Tax 042 7 of VAT. In China the payroll tax is a specific tax which is paid to provinces and territories by employers not by employees. In general prices remain controlled only for goods and services that are deemed essential.

Customs duties - duties are imposed on goods imported into China and are generally assessed on the CIF cost insurance and freight value. The highest rate of 15 applies for a period of two years from the date on which the treaty takes effect. Joint filing of spouses is not permitted.

Shall be still subject to 10 withholding tax. Tax year The tax year is a calendar year. The withholding tax rates on.

The withholding CIT rate for non-tax resident enterprises in China is 20 percent currently reduced to 10 percent. The Chinese Government itself requires only one tax to be withheld from paychecks. For exposure to US stocks pick an Ireland-domiciled ETF.

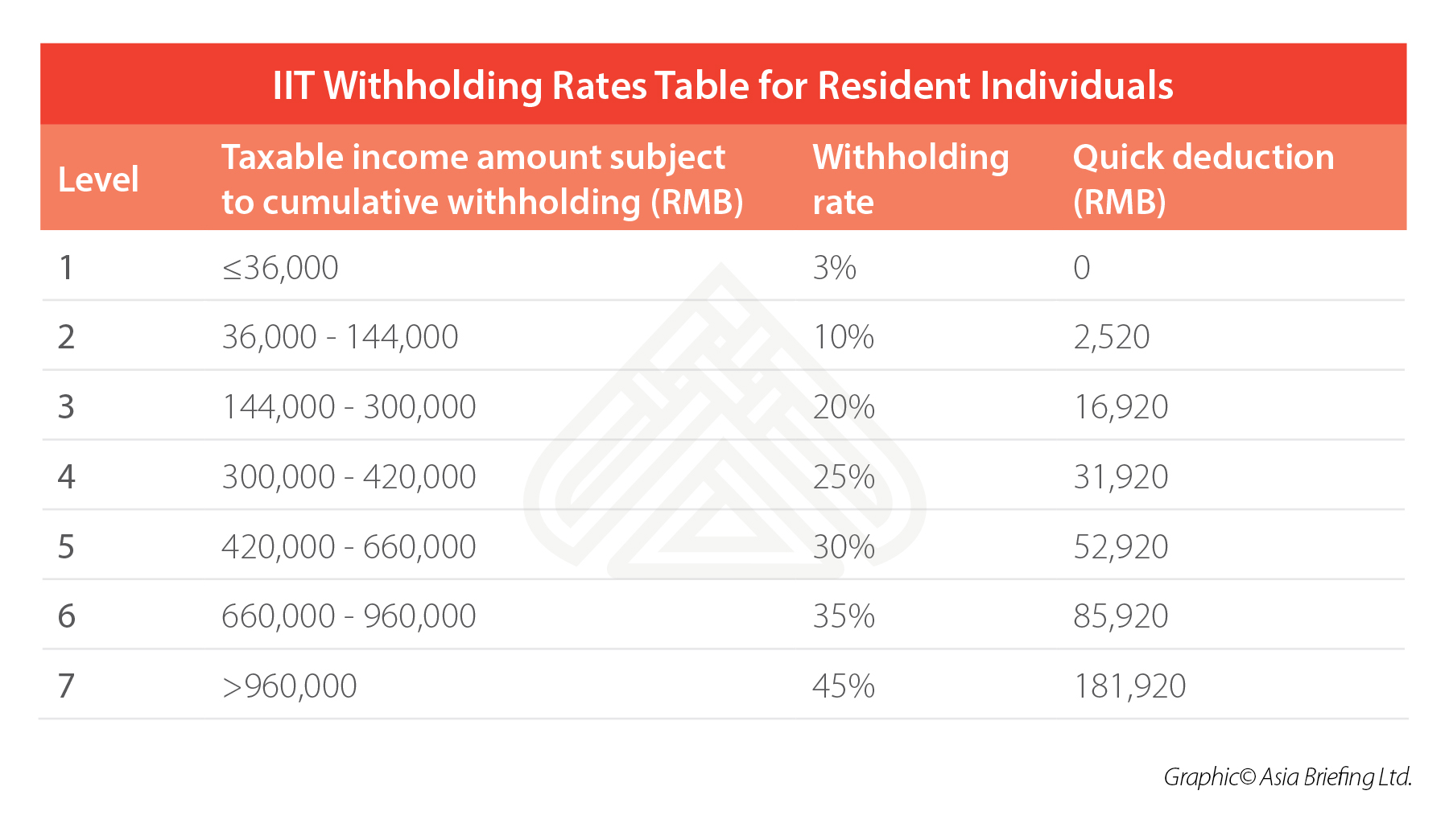

From Wikipedia the free encyclopedia The Individual Income Tax in China commonly abbreviated IIT is administered on a progressive tax system with tax rates from 3 percent to 45 percent. For income less than 4000 yuan the amount is fixed at 800 yuan for those higher than 4000 yuan tax amount is 20 of the income. The tax is deducted from the workers pay.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. The rate of 10 applies in other cases. A flat rate of 20 is applied on the remaining categories of income including incidental income rental income interest income dividends and capital gains unless specifically reduced by.

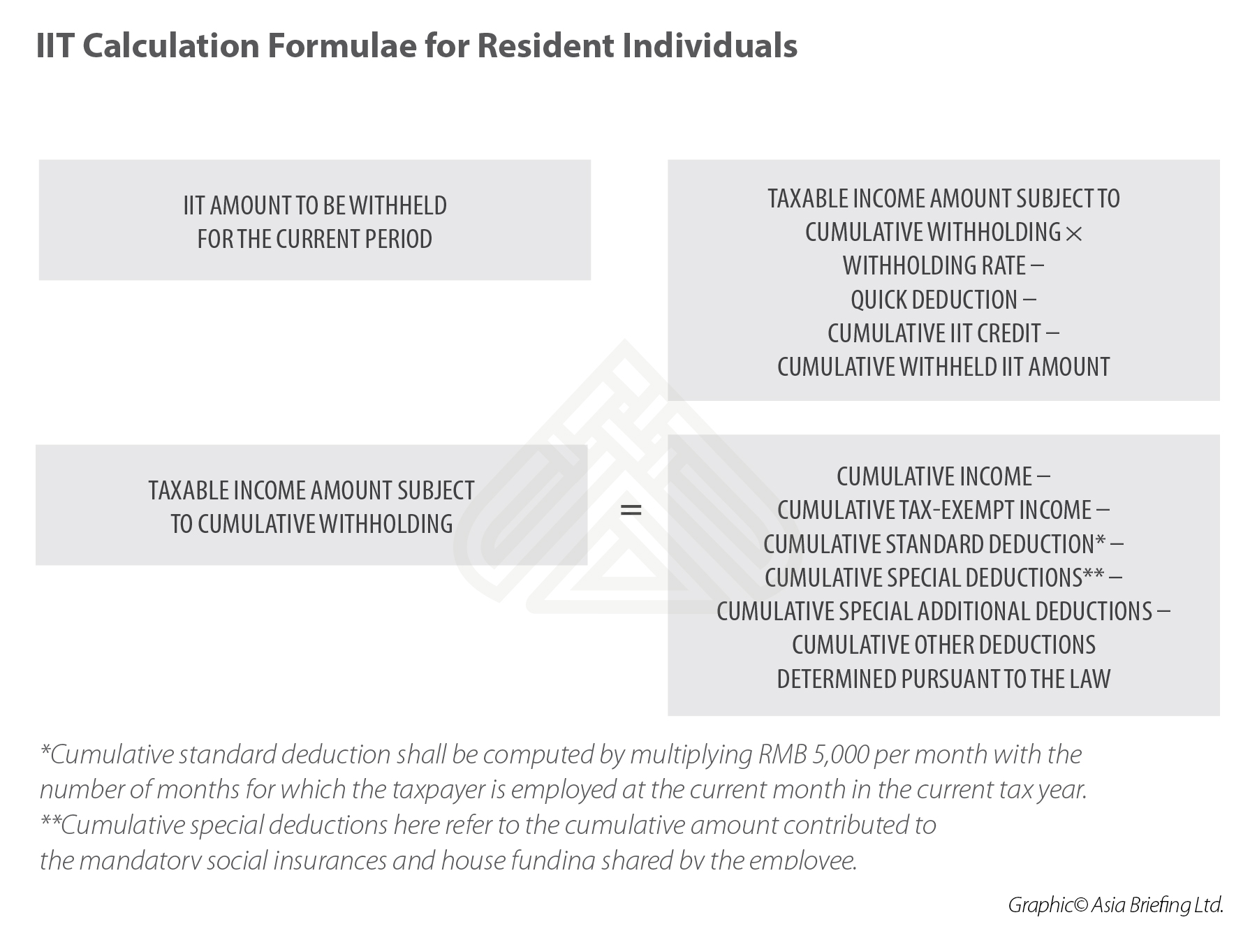

The dividend withholding tax for SG investors will be 37. Filing and payment Comprehensive income derived by residents is assessed on an annual basis with IIT collected through advance payments withheld and remitted to the tax authorities. Calculation of withholding tax for advanced payment and prepayment Personal service remuneration authors remuneration franchise royalty income minus relevant fees is defined as the final income.

August 2014 Produced in conjunction with the.

Withholding Corporate Income Tax In China China Briefing News

Global Corporate And Withholding Tax Rates Tax Deloitte

How To Calculate And Withhold Iit For Your Employees In China

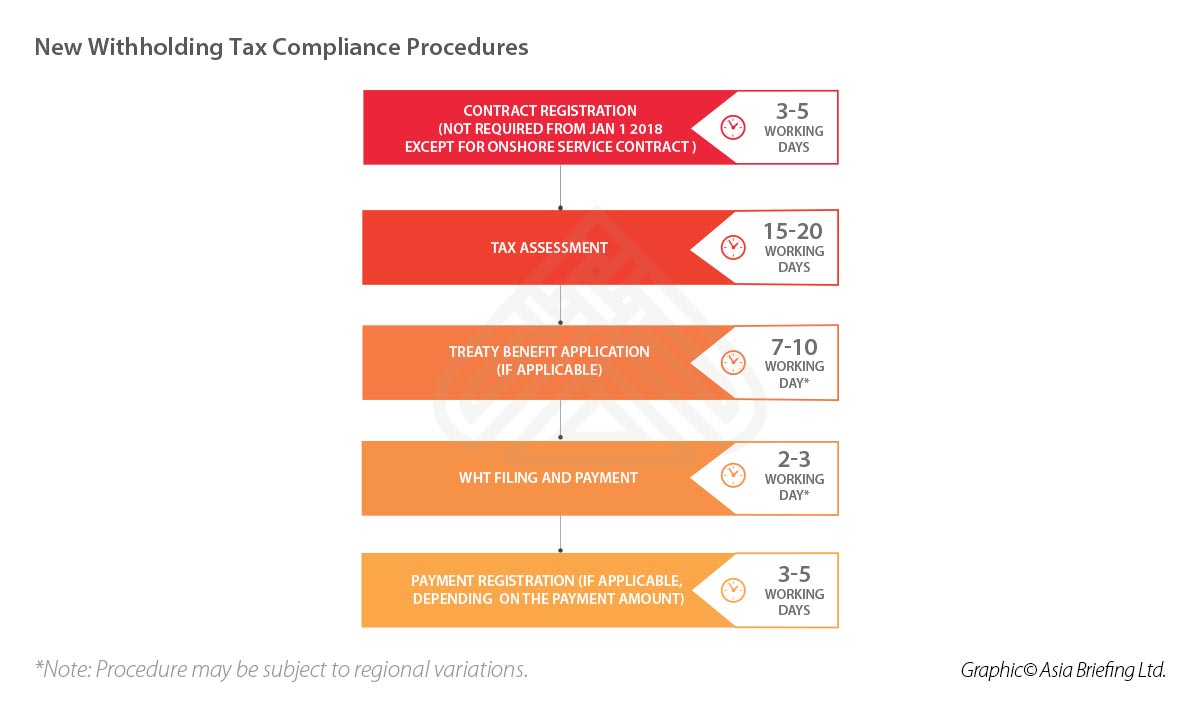

The Withholding Tax System In Thailand Lorenz Partners

How To Manage Withholding Taxes Odoo 9 0 Documentatie

Russia S Double Tax Treaty Agreements Russia Briefing News

Practical Example On How To Use Corporate Investment Income Case Study Ibfd

Practical Example On How To Use Corporate Investment Income Case Study Ibfd

Global Corporate And Withholding Tax Rates Tax Deloitte

German Registered Ip New Taxation Of Transactions Between Non German Parties Morrison Foerster

How To Calculate And Withhold Iit For Your Employees In China

Myanmar Tax Update Myanmar Withholding Tax Rates To Be Slashed

Taxes In Switzerland Income Tax For Foreigners Academics Com

How To Manage Withholding Taxes Odoo 9 0 Documentatie

Practical Example On How To Use Corporate Investment Income Case Study Ibfd

Remitting Royalties From China Procedures And Requirements China Briefing News

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Posting Komentar untuk "Withholding Tax Rates China"