How Does Withholding Tax Work In Thailand

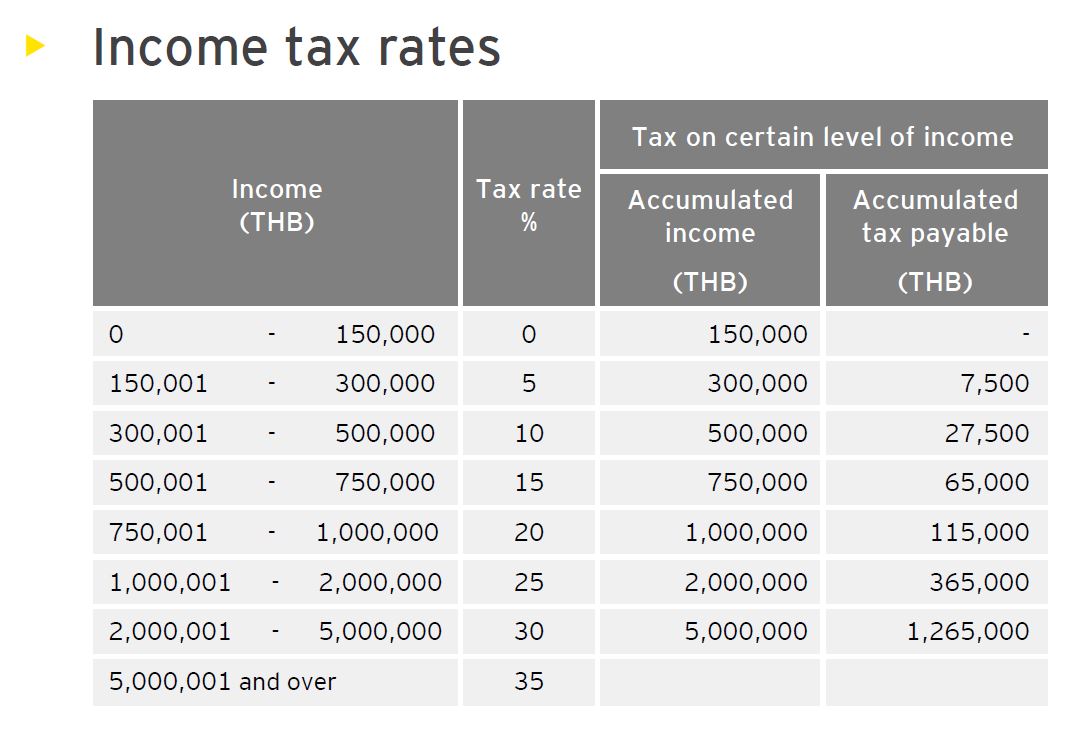

One saving grace is that Thailand does not have a 45 tax rate like some countries and in 2019 the 30 tax rate band was expanded so you can earn more at that rate before being put onto the 35 band. 1 of the appraised value or registered sale value of the property whichever is higher and if the seller is a company.

Doing Business In Thailand Withholding Tax Jarrett Lloyd

Companies and some other forms of businesses in Thailand have the duty to withhold taxes from their employees when paying for their compensation and from their vendors when making payments for most kinds of services.

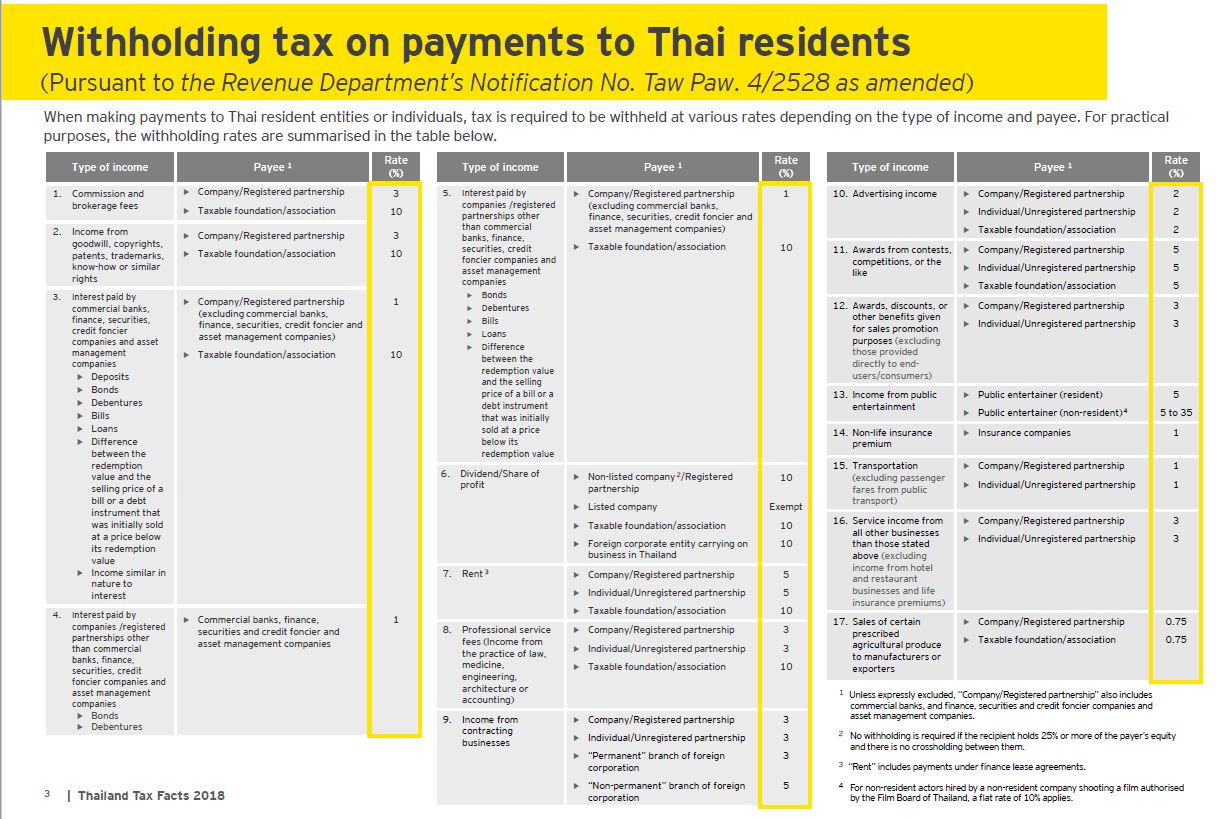

How does withholding tax work in thailand. Most expats making more than 150000 baht can assume that their earnings will be taxed. WHT rates depend on the nature of provided services cf. WHT is calculated on the amount before VAT.

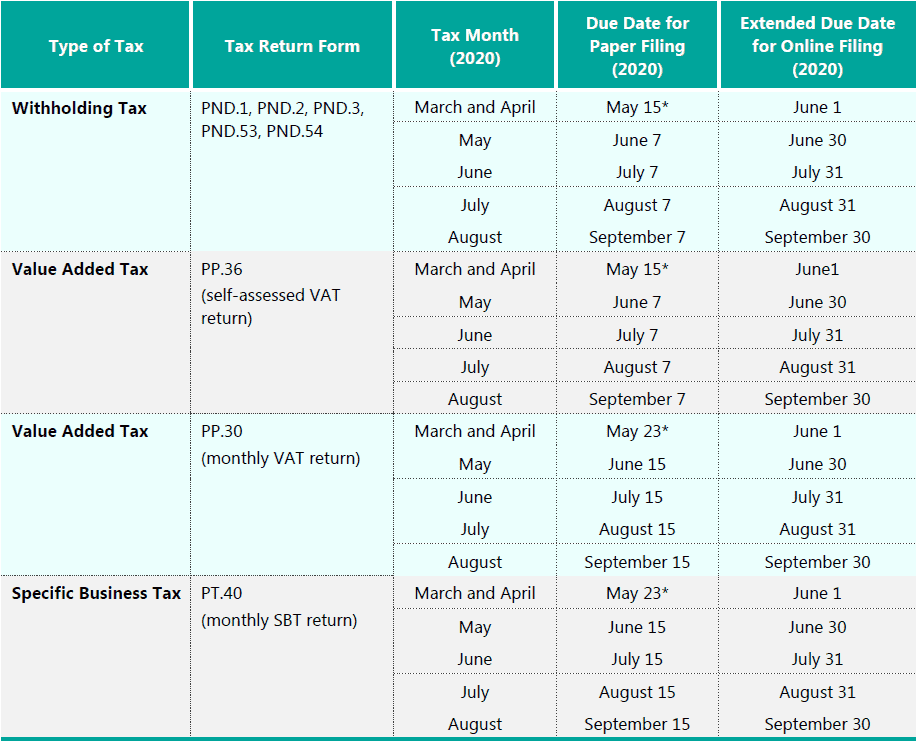

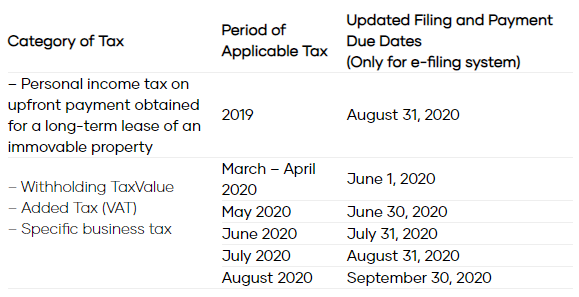

Withholding tax is the deduction of tax from payments made to suppliers who provide a service. Employers are responsible for submitting a monthly withholding tax return to the Revenue Department within the first 7 days following the month in which the payment was made. Thailands income tax is known as the personal income tax PIT and is the basic tax in Thailand that foreigners will have to pay.

Income from or in Thailand usually in the form of service fees royalties interest dividends capital gains rent or professional fees are subject to a flat rate of corporate income tax. It is the duty of the payer only to deduct and submit the. This tax is also applicable to the payment of dividends and interests.

As prescribed in Section 70 of the Thailands Revenue Code law - when a payer in Thailand pays specified types of income to a corporate entity established under a foreign law and not carrying on business in Thailand the payer shall withhold tax from the payment and remit it to the Thailand Revenue Department. The tax due must be paid at the time of filing the return. According to FP Accounting Payroll Outsourcing Service Thailand Withholding tax WHT is a deduction from payments made to suppliers who provide a service.

The withholding tax rates can vary depending on the types of income and. A minimal taxation mistake may further slow down your tax refund which is already a very slow process. What is withholding tax in Thailand.

The 1 rate applies to interest paid to all resident corporations other than banks or finance companies except where interest arises from bonds or. The withholding tax or WHT is a deduction given on payments to suppliers for the services provided. All forms of earnings are generally taxable and fall under the personal income tax bracket.

This is a final tax but is collected in the form of withholding tax based on gross income see Section 9 below for more information on Withholding Taxes. Lets look further into withholding tax. When doing a payment the recipient will receipt a WHT certificate from clients in order to justify the deduction.

Withholding Tax in Thailand - Mazars - Thailand. Withholding Tax WHT The withholding tax WHT is a tax deducted at source from the payment of a service invoice. This ranges from a work salary to capital gains or dividends lease transactions or even selling.

CONSULT WITH A SPECIALIST. It applies to services only. Tax must be reported to the Thailand Revenue Department.

Be reminded that the Withholding Tax applies to services and NOT to the purchase of. Whether WHT is applicable and what rate to deduct depends on the nature of the service provided. Income tax rates in Thailand range from 0 for the lowest-earning employees to 35 for those earning over 4000001 Baht.

Withholding tax WHT is a deduction from payments made to suppliers who provide a service. WHT Rates Reduced or Exempted under Thailand. The types of payments and withholding tax rates prescribed in Section 70 are.

How does Withholding Tax work in Thailand. Whether WHT is applicable and what rate to deduct depends on the nature of the service provided. Imprisonment is another common penalty for failing to follow tax laws in Thailand.

The tax withheld shall then be credited against tax liability of a taxpayer at the time of filing tax return. The purpose of withholding tax in Thailand is to reduce to burden of the taxpayer and not have to pay a lot of tax at once at the end of the year. If the seller is an individual withholding tax is calculated at a progressive rate based on the appraisal value of the property.

WHT also applies to interest and dividend payments. How do withholding taxes in Thailand work. Employers in Thailand have withholding obligations to their employees and must make income tax and social security contributions on their behalf.

Withholding Tax in Thailand is a deduction at sources from payments from clients to suppliers who is a service providers and also applicable to the payment of dividends and interests. For employment income a withholding system is in operation whereby the employer deducts income tax from the employees salary or wage before paying it. The zero rate applies to a recipient company listed on the Stock Exchange of Thailand and any other limited company that holds at least 25 of the total shares with voting rights in the company paying the dividend without any cross shareholding.

Those making less are exempt from the PIT. How does Withholding Tax work in Thailand. How do withholding taxes in Thailand work.

Duty of the payer. Even a small case like forgetting to deduct withholding tax in a single invoice may give you one month in jail. This is an indirect penalty thats not mentioned in the Revenue Code of Thailand.

A number of income sources may be included in this assessment. Here we want to talk more on vendors withholding tax. Withholding Tax commonly written WHT consists in deducting a tax from payments done to service suppliers.

Thailand Reduction In Withholding Tax Activpayroll

Reduction For E Withholding Tax Rates Mpg

The Withholding Tax System In Thailand Lorenz Partners

Real Estate Taxation In Thailand Thai Property Group

Further Extension For E Tax Filing In Thailand Tilleke Gibbins

Thailand Tax Update Further Deferral Of Tax Filings And Payments Lexology

Ecosoft Thai Withholding Tax Adempiere

Thailand Easy Access Membership Long Term Visa 5 Year Renewable Multiple Entry Visa Perfect For Busin Business Person Concierge Services Business Networking

Reduction For E Withholding Tax Rates Mpg

Thailand Income Tax For Foreigners Do You Need To Pay

Have Your Tax Withheld At One Step With E Withholding Tax

Accounting And Tax Service With Company In Bangkok Phuket Thailand

Legal Amp Tax Mistakes Hiring Foreign Employees In Thailand

Thailand Payroll And Tax Information And Resources Activpayroll

Real Estate Taxation In Thailand Thai Property Group

Thailand Tax Update Covid 19 And Tax Relief Measures In Thailand Lexology

How Much Tax Does Expats Pay In Thailand The Phoenix Capital Group

The Withholding Tax System In Thailand Lorenz Partners

5 Most Common Tax Mistakes In Thailand And How To Avoid Them My Business In Asia

Posting Komentar untuk "How Does Withholding Tax Work In Thailand"