Withholding Tax Table In Sap B1

Total Amount. I dont know how to active some of my suppliers that need to be withhold Thanks Alberto.

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Table for storing User permission forms OUSR.

Withholding tax table in sap b1. The rules for tax rate calculation and other important features are stored in a table for each tax code. This means that you have to maintain the minimum and maximum for the withholding tax amount the minimum base amount the withholding tax. Table for storing User authorizations for add-on forms UPT1.

The customer then pays the tax withheld directly to the appropriate tax authorities see diagram. PCH16 AP Invoice SnB properties. Withholding Tax Table Fields.

-AR Invoice send to customer 100 no idea on the of withholding tax-One month later get payment from customer 90 and know that there are 10 withholding tax which is 10-client reques to input withholding tax while doing incoming payment is that possible in SAP B1-or whether i can input withholding tax when doing Journal Entry. An exception to this rule is self-withholding. You define the withholding tax scales in a separate activity in the Implementation Guide for Financial Accounting.

INV5 RIN5 RDN5 RDN5 PCH5 RPC5 DPI5 DPO5 DRF5. Its a kind of Indirect Tax. Code and name of the withholding tax codes defined as defaults for the business partner.

You can define the different types of Withholding Tax codes from the Main Menu by going to. You should use tax codes with a 0 rate for tax-exempt or non-taxable transactions if the corresponding transactions are to be displayed in the tax returns. WithholdingTaxData is a child object of Documents object and represents the Withholding tax table related to the document.

BPWithholdingTax UserFields Fields Field ValidValues ValidValue. PCH10 AP Invoice Row Structure. Table for storing Message recipient list OALR.

Select the Withholding Tax checkbox. Administration Setup Financials Tax Withholding Tax. BPWithholdingTax is a child object of the BusinessPartners object that represents the withholding tax data related to the business partner.

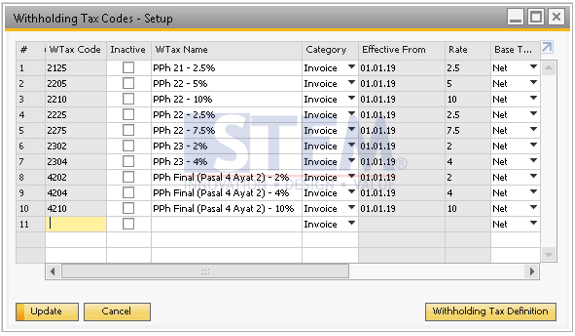

Use this window to define withholding tax codes for your company. The old codes with the. Withholding tax or Tax collected at source.

API BP Withholding Tax. The vendor subject to tax then has the right to pay the tax to the authorities himself. OWTT Withholding Tax Type.

Table for storing Dunning levels definition AOB1. LFBW Vendor master record withholding tax types X. OWTS Workflow Engine Task Table.

In India tax has to be collected at source by the seller from buyer on specific items like alcoholic liquor tendu leaves timber other forest produce on miningquarrying scrap. Table for storing Currency codes OUPT. All the configurations for the Withholding Tax is done in the following Tab only.

You can change these codes and choose any code that appears in the income tax withholding codes and in the VAT withholding codes. From the SAP Business One Main Menu choose Administration Setup Financials GL Account Determination GL Account Determination Sales Tax. SAP Business One is the trademarks or registered trademarks of SAP AG in Germany and in several other countries.

Table for storing Messages OCRN. To enable withholding tax on purchasing documents select the Withholding Tax checkbox in Administration Setup Financials GL Account Determination GL Account Determination Purchasing Tax. Withholding tax rate or TCS rate is generally 1 5 varying from product to product.

On the Tax subtab of the Accounting tab select the Subject to Withholding Tax checkbox. Its requirement of Government to deduct or withhold a particular percentage from paying to the vendor and pay such amount to the Government on behalf of other person. To define withholding tax codes in the application.

82 Zeilen SAP Withholding Tax Tables. To open the window from the SAP Business One Main Menu choose Administration Setup Financials Tax Withholding Tax. If your company wants to maintain Withholding Tax system for sales and purchasing documents SAP Business One allows you to contain more than one type of Withholding Tax.

Youll have to define new tax codes if tax rates are changed by the government during the annual reviews. PCH14 AP Invoice Assembly Rows. This topic documents fields and other elements in this window that either are not self-explanatory require additional information or are localization specific.

SAP B1 DI-API C definition. How to Configure withholding Tax. Browse to the desired business partner record.

Table for storing Users of SAP Busi. PCH13 AP Invoice Rows Distributed Expenses. Contact This website is not affiliated with maintained authorized endorsed or sponsored by SAP AG or any of its affiliates.

You can check the details and break up of the withholding tax types involved in the document and also edit the withholding tax information as needed. From the Main Menu choose Business Partners Business Partner Master Data. We will see below process configuration for TCS on sale of affected products by.

To open this window in the relevant AP or AR transaction window click beside the WTax Amount field. When Purchase of Goods. The data for the Withholding tax table consists on WithholdingTaxCodes definitions.

How does it work. Total amount 10000. SAP BUSINESS ONE B1 COMPLETE TABLES LIST ODUN.

PCH1 AP Invoice Rows. Financial Accounting Global Settings - Withholding Tax - Extended Withholding Tax - Calculation - Withholding Tax Codes - Define Formulas for Withholding Tax CalculationAll calculations are made in the respective local currency. Displays whether the WT code is an income tax withholding or VAT withholding.

PCH12 AP Invoice Tax Extension. A Company collect Withholding tax behalf of Government from all supplier at the time of payment for purchase of goods or services. From the Main Menu choose Business Partners Business Partner Master Data.

BP Withholding Tax Object. Withholding Tax is also called as retention tax. PCH15 AP Invoice Drawn Dpm Appld.

The WithholdingTaxData object is relevant only to the following document types.

Rbwt Sap Table For Withholding Tax Data Incoming Invoice

Sap Business One Tables Sap Blogs

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Https Www Cosib De Files Cosib User Downloads Sap Business One Neuigkeiten Sap Business One 9 3 Pl10 Top Resolutions En Pdf

Enhanced Udf In Sap Business One Sap Business One Partner Usa Mtc Systems

Tax Procedure Vs Mm Pricing Procedure Tax Procedure Periodic Table

Pin By Opal Rabalais On Vitiligo Profit And Loss Statement Vitiligo Pharmaceutical

List Of Object Types Sap Business One Sap Blogs

5 Years Profit And Loss Statement Projection Model Profit And Loss Statement Profit Loss

S 4 Hana Do You Have An Issue In Bp Vendor Field Settings Check This Out Sap Blogs

5 Critical Conflicts Of Sod You Should Avoid And How To Detect Them

Sap Business One Tables Sap Blogs

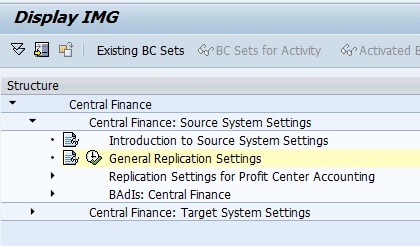

Sap S 4hana Central Finance Cfin Basic Setup Sap Blog Eursap

Setup Incoming Outgoing Differences Allowed Sap Business One Indonesia Tips Stem Sap Gold Partner

Https Www Unirez De Wp Content Uploads Sap Business One 93 Pl08 Topresolutions Pdf

Https Www Cosib De Files Cosib User Downloads Sap Business One Neuigkeiten Sap Business One 9 3 Pl10 Top Resolutions En Pdf

5 Critical Conflicts Of Sod You Should Avoid And How To Detect Them

Posting Komentar untuk "Withholding Tax Table In Sap B1"