Withholding Tax Rates On Bank Profit In Pakistan 2021-22

Royalties and fees for technical service paid to non-residents that have no permanent establishment in Pakistan are subject to withholding tax of 15 percent. However the effective rate is likely to differ on account of allowances and exemptions related to industry location exports etc.

Best Gst Filing Course In Uttam Nagar Goods And Services Goods And Service Tax Current Affairs Quiz

Federal Board of Revenue FBR has updated rate of tax on profit on debt applicable during tax year 2021 July 01 2020 to June 30 2021.

Withholding tax rates on bank profit in pakistan 2021-22. Latest Income Tax Slab Rates in Pakistan for Fiscal Year 2021-22 Latest Income Tax Slab Rates in Pakistan. Updated up to June 30 2021. All public companies other than banking companies incorporated in Pakistan are assessed for tax at corporate rate of 29 for the Tax Year 2022 and onwards.

TAX YEAR 2021. Such debt instruments must be purchased from a bank account maintained abroad a Non-Resident Rupee Account Repatriable NRAR or a foreign currency account maintained with a banking company in Pakistan. Previously this salary slab was not included in the income tax deduction bracket.

Capital Gain Tax on Property Sale. The withholding tax rate on the dividend is 125 percent where the recipient is a filer of Pakistan tax return and 20 percent where the recipient is a non-filer. 870 Profit on Special Savings Certificate 2021.

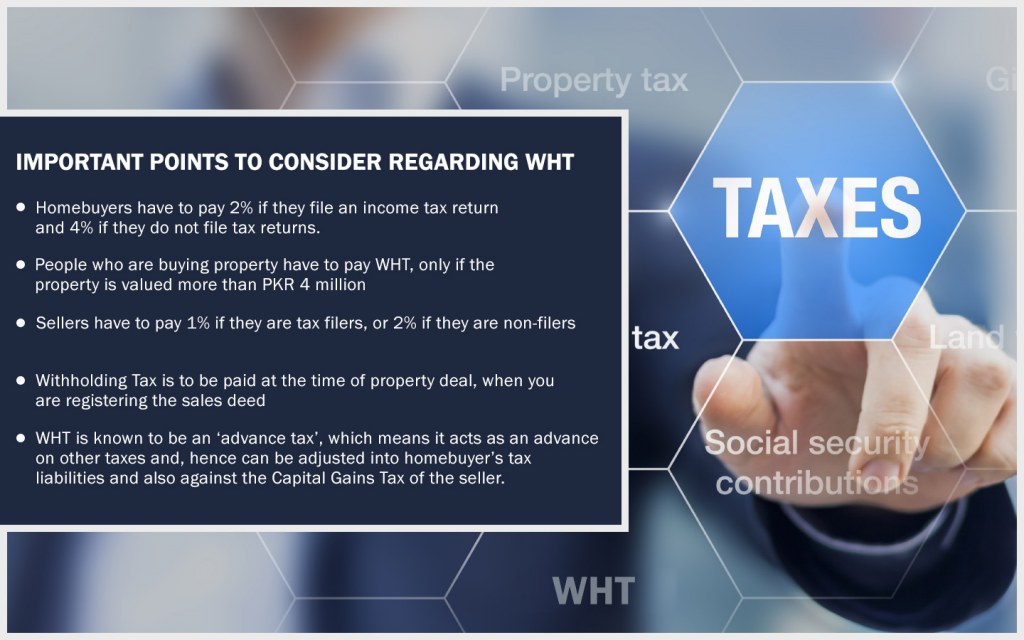

From 1 July 2020 a WHT rate of 10 is applicable on payment of profit on debt to non-resident individuals on debt instruments issued by the Federal Government under the Public Debt Act 1944. Tax rate on profit on bank deposits. At the present time usually people in Pakistan are well aware of this Tax.

The collection of withholding tax from profit on bank deposits registered unprecedented growth of 194 percent during first quarter of first fiscal year as the tax rates increased by 100 percent for persons not on the Active Taxpayers List ATL. It is different for filers and non-filers. All the payments will be given after withholding tax and zakat as per Rules of the State Bank of Pakistan.

Under Section 1511b banking company or financial institution shall collect the withholding tax from recipient of profit on debt at the time the profit on debt is credited to the account of the recipient or is actually paid whichever is earlier. Now lets learn more about the latest tax slab rates in Pakistan for the fiscal year 2021-22. WITHHOLDING TAX RATES SECTION WITHHOLDING AGENT Rate 1531a sales of goods Every Prescribed Person section 1537 Company 4 of the gross amount Other than company 45 of the gross amount No deduction of tax where payment is less than Rs.

If purchased immovable property is sold with a year then 100 of Profit gained against this transaction will be taxable. Rupees 4350 will be given after every six month and Rupees 4500 will be given annually on Special Saving Certificates Profit Rates 2021. If the purchased property is sold within the 2nd year then 75 of the profit will be taxable.

Every banking company shall collect withholding tax under Section 1511b of Income Tax Ordinance 2001 from persons receiving profits on their deposits maintained at respective banks. However 175 percent withholding tax rate for non-filers driving profit on. I will be more than happy if e.

75000-in aggregate during a financial year S1531a 1531b services Every Prescribed Person section. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. The original Statue Income Tax Ordinance 2001 as.

The FBR issued Income Tax Ordinance 2001 updated June 30 2020 after incorporating amendments introduced through Finance Act 2020. The applicable tax rate is to be increased by 100 Rule-I of Tenth Schedule to the Ordinance ie. Special Saving Certificates New rates 2021 have been issued.

35 Increase in TAX rates on NSS Profits Announced II WITHHOLDING TAX National SavingsI have started this channel on youtube. On the services of cash withdrawal a new Withholding tax rates in Pakistan 2021 has finalized now. Usually this money goes to the government from the customer.

According to the income tax slabs for FY 2021-22 a certain amount of income tax will be deducted from the salaries of individuals earning more than PKR 600000- per annum. 125 Persons not appearinq in the Active Taxpayers List The applicable tax rate is to be increased by 100 Rule-I of Tenth Schedule to the Ordinance ie. As per Finance Act 2021-22 capital gain tax on property saleprofit has been increased.

Under Section 151 of Income Tax Ordinance 2001 the withholding tax rate on profit on debt for filers is 10 percent with no limit on earned amount and 10 percent for non-filers up to Rs 05 million. The general rate of tax on turnover is 125 for tax year 2022 TY 2021. Withholding Tax Rates Applicable Withholding Tax Rates.

Withholding tax collection on profit from bank deposits surges by 194pc October 24 2019 March 4 2021 Anjum Shah Exclusive Taxation KARACHI. Taxation of certain contracts executed by non-resident persons. Withholding tax rates on profit on banking deposits January 18 2019 February 15 2021 Anjum Shah Taxation KARACHI.

25 Persons not appearinq in the Active Taxpayers List The applicable tax rate is to be. The tax rate shall be 10 percent of the gross yield profit on debt on payment of up to Rs500000. Minimum tax provisions on a turnover basis are now applicable on PEs of non-residents.

It is for the guidance that it is a kind of income tax that is applicable by using various types of bank services.

Tvs Ntorq Launches Special Edition Yamaha Introduces Its New Mt03 Bike Product Launch Automobile Companies Yamaha

Fbr Not To Tax Annual Property Rent Income Of Up To Rs0 2 Million

Income Tax Slabs Tax Rates Calculation For 2021 22 Old Vs New Youtube

Jubilation On Pakistan Stock Exchange Newspaper Dawn Com

Here Is A Summary Of Pakistan S Budget For Fiscal Year 2021 22

Budget 2020 21 Finance Bill Shows All Relief No Clear Revenue Plan Newspaper Dawn Com

Mab Tax Corporate Consultants Home Facebook

Everything You Need To Know About Property Taxes In Pakistan Zameen Blog

Pin On How To File Tax Returns On Stock And Futures And Options Trade

New Tax Rates For Rental Income And Property Sales Budget 2021 22 Mr Bankar

File Tax Return 2021 For Freelancer And Online Earning Person Youtube

How To Become Active Taxpayer In Fbr Income Tax Income Tax How To Become Income

Massive Taxation Relief To Boost Industrial Growth Newspaper Dawn Com

Updated Tax Provisions For Property Rental Income In Budget 2021 22 In 2021 Rental Income Budgeting Rental

Bank Transaction Withholding Tax Removed For Non Filers Budget 2021 Cash Withdrawal Tax Update Youtube

Pakistan Budget 2021 22 Real Estate Tax Changes And Analysis

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Posting Komentar untuk "Withholding Tax Rates On Bank Profit In Pakistan 2021-22"