Employment Tax Rates Arkansas

For married taxpayers living and working in the state of Arkansas. The tax is calculated based on 20 of the market value of real and personal property and the average annual value of merchants stocks andor manufacturers inventories based on millage rates in individual school districts.

Us Tax Burden On Labor Tax Burden On Labor In The United States

Arkansas Wage and Hour Laws Employees covered by Arkansass minimum wage law must be paid 1100 an hour.

Employment tax rates arkansas. Employees complete form AR4REC Employee Withholding Exemption Certificate used for calculating withholdings. The 2020 tax rates range from 2 on the low end to 66 on the high end. You can find Arkansas tax rates here.

For information regarding changes to employers accounts regarding UI benefits and UI tax please read the Employer Newsletters. 988 The total of all sales taxes for an area including state county and local taxes Income Taxes. 2021 RATE STATEMENTS ARE NOW AVAILABLE.

Certain Arkansas employees in executive and administrative positions are exempt from the minimum wage law. The Arkansas Workforce Services Division has begun informing employers of their new unemployment insurance tax rates but theyll be eased by a. Withholding Tax Formula Effective 01012021 12102020.

This means that any income you earn in Texarkana if youre a resident there is exempt from Arkansas income tax. This 6 federal tax is to cover unemployment. State Electricity Manufacturing Tax.

These occupational employment and wage estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan areas in Arkansas. Tax rate of 4 on taxable income between 4001 and 8000. Click here to view 2021 Tax Alert.

According to the Tax Foundation the average sales tax rate in Arkansas in 2020 including state and local taxes is 953 second-highest in the US. Employees who make more than 79300 will hit the highest tax bracket. Tax Rates for Arkansas AR.

Residents of Arkansas face sales tax rates that are among the highest in the country. The state charges a progressive income tax broken down into six tax brackets. The tax rate is based on withholdings chosen on the employees W-4 form.

Tax rate of 2 on the first 4000 of taxable income. In most cases youll be credited back 54 of this amount for paying your state taxes on time resulting in a net tax of 06. State Manufacturing Utility Tax.

Arkansas does not have any reciprocal agreements with other states. Taxable wage base 7000 Rate 31 A business with no previous employment record in Arkansas is taxed at 31 on the first 7000 of each employees earnings until an employment record is established usually within three years. 700 The total of all income taxes for an area including state county and local taxes.

In calendar year 2017 a new employer just beginning business in the state of Arkansas is assigned a new employer rate of 32 and will remain at that rate until three 3. Tax rate of 59 on taxable income between 8001 and 79300. If youre a resident of Texarkana Arkansas you can claim the border city exemption.

This page has the latest Arkansas brackets and tax rates plus a Arkansas income tax calculator. State Reduced Food Tax. However Arkansas cities and counties do collect property tax which is the principle local source of revenue for funding public schools.

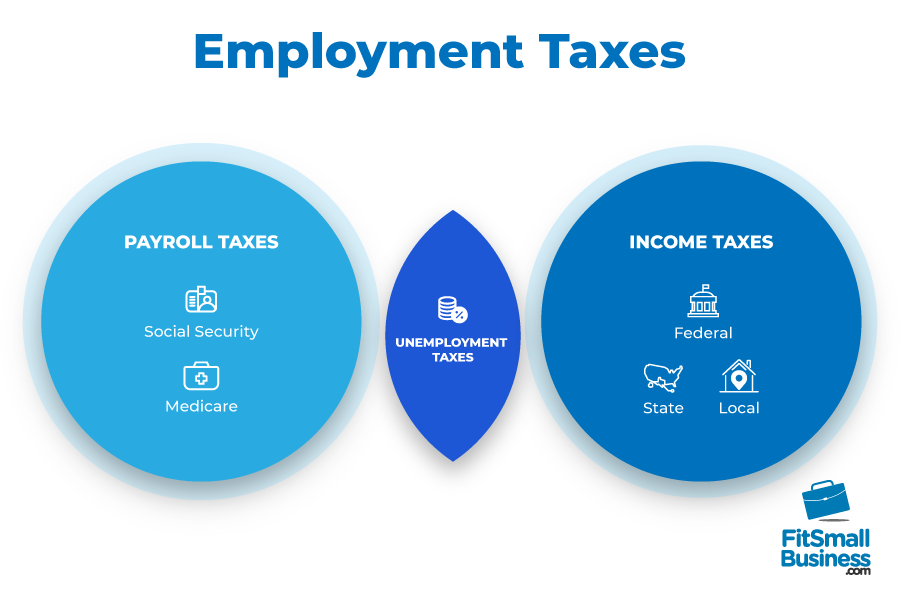

Arkansas requires employers to withhold income taxes from employee paychecks in addition to employer paid unemployment taxes. Arkansas 2021 income tax ranges from 2 to 66. Detailed Arkansas state income tax rates and brackets are available on this page.

Withholding Tax Tables for Employers. The Arkansas income tax has four tax brackets with a maximum marginal income tax of 660 as of 2021. Withholding Tax Instructions for Employers Effective 01012021 02032021.

Click here to view the DWS UI Employer Handbook. Additional information including the hourly and annual 10th 25th 75th and 90th percentile wages and the employment percent relative standard error is available in the downloadable XLS file. Tax rate of 66 on taxable income over 79300.

Federal income taxes are not included. There are seven tax brackets with rates ranging from 0 on your first 4500 up to a rate of 660 on income above 79300. Withholding Tax Tables for Low Income.

Now that weve gone through federal payroll taxes lets look at Arkansas state income taxes. Income tax tables and other tax information is sourced from the Arkansas Department of Revenue.

Income Taxes What You Need To Know The New York Times

2021 Federal State Payroll Tax Rates For Employers

Tax Withholding For Pensions And Social Security Sensible Money

Trump S Proposed Payroll Tax Elimination Itep

Tax Withholding For Pensions And Social Security Sensible Money

State W 4 Form Detailed Withholding Forms By State Chart

Trump S Proposed Payroll Tax Elimination Itep

Sui Sit Employment Taxes Explained Emptech Com

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

Pin By Joy Desmarais Lanz On Hr Payroll Employment Tax

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2021 Federal State Payroll Tax Rates For Employers

Sui Sit Employment Taxes Explained Emptech Com

To Beat A Tax Audit Independent Builders Roofers Finishers And Others Who Run A One Person Shop Must Keep All Business Income Tax Return Irs Taxes Income Tax

Support Of Arkansas Low Income Tax Rate Reduction Support Center

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

Posting Komentar untuk "Employment Tax Rates Arkansas"