Withholding Tax Regime(rates Card) 2017-18

Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2019 updated up to June 30 2019 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. Detail of Sections Description Of Sections 1 DIVIDEND INCLUDING DIVIDEND IN SPECIE Section 150 236S Division I Part III First Schedule Clause 11B Part IV Second Schedule Received by individuals and AOPs where holding period of securities is up.

Latest Income Tax Slab Rates For Fy 2017 18 Ay 2018 19

The withholding tax rates may be reduced by double tax treaties see a list.

Withholding tax regime(rates card) 2017-18. Where the income of an individual chargeable under the head salary exceeds fifty per cent of his taxable income the rates of tax to be applied are as follows. Withholding Tax Rates Applicable Withholding Tax Rates. Income Tax Slabs 2017-18 Salaried Persons Finance Bill 2017.

Though the tax collection has seen an increase to about 60 in the past 3 years but at the same. Angola Last reviewed 24 June 2021 Dividends and royalties are taxed at 10 and the tax is withheld at source by the paying entity in Angola. Rates for Withholding Income Tax Updated to the Effect of Changes enacted vide the Finance Act 2017 APPLICABLE FOR TAX YEAR 2018 Nature of Payment Tax Rate Nature of Tax Filer Non-filer Advance Final Minimum Tax Page 2 SHIPPING OR AIR TRANSPORT INCOME OF NON-RESIDENTS Section 7 Division V Part I First Schedule Shipping income 8.

G orxu ploov dqg h hdohuv dqg vxe ghdohuv ri vxjdu fhphqw dqg hgleoh rlo rqo wkrvh dsshdulqj rq 7 0rwruffoh ghdohuv 6dohv 7d 5hjlvwhuhg q doo rwkhu fdvhv 6hfwlrq dlq lq glvsrvdo ri dvvhwv rxwvlgh 3dnlvwdq. A list of treaties that Canada has negotiated is provided in the Withholding taxes section along with applicable WHT rates. Affiliate a credit for withholding tax generally is available.

Updated up to June 30 2021. 15 10 0 but VAT 19 unless exempted. Dividends received by Canadian corporations from foreign affiliates are exempt if paid from exempt surplus.

Tax Card 2018. Download WITHHOLDING INCOME TAX REGIME WHT RATES CARD --- GUIDELINE FOR THE TAXPAYERS TAX COLLECTORS WITHHOLDING TAX AGENTS - AS PER FINANCE ACT 2020 UPDATED UP TO JUNE 30 2020. Taxable Income Rate of tax 1 Where the taxable income does not exceed Rs400000 0 2 Where the taxable income exceeds Rs400000 but.

International Tax Canada Highlights 2017 Investment basics. Withholding Tax Rates In Pakistan 2017-18 Time To Revisit The Withholding Tax Policy. 15 10 30 unless rates provided by Double tax treaties.

1 Tax Rate Who will deduct collect agent From whom When Collector of Customs Importer of goods. SrNo Title 1 Withholding Tax RegimeRates Card Guidelines for the Taxpayers Tax Collectors Withholding AgentsUpdated up to June 30 2021. Canadian CIT and withholding tax WHT can be reduced or eliminated if Canada has a treaty with the non-residents country of residence.

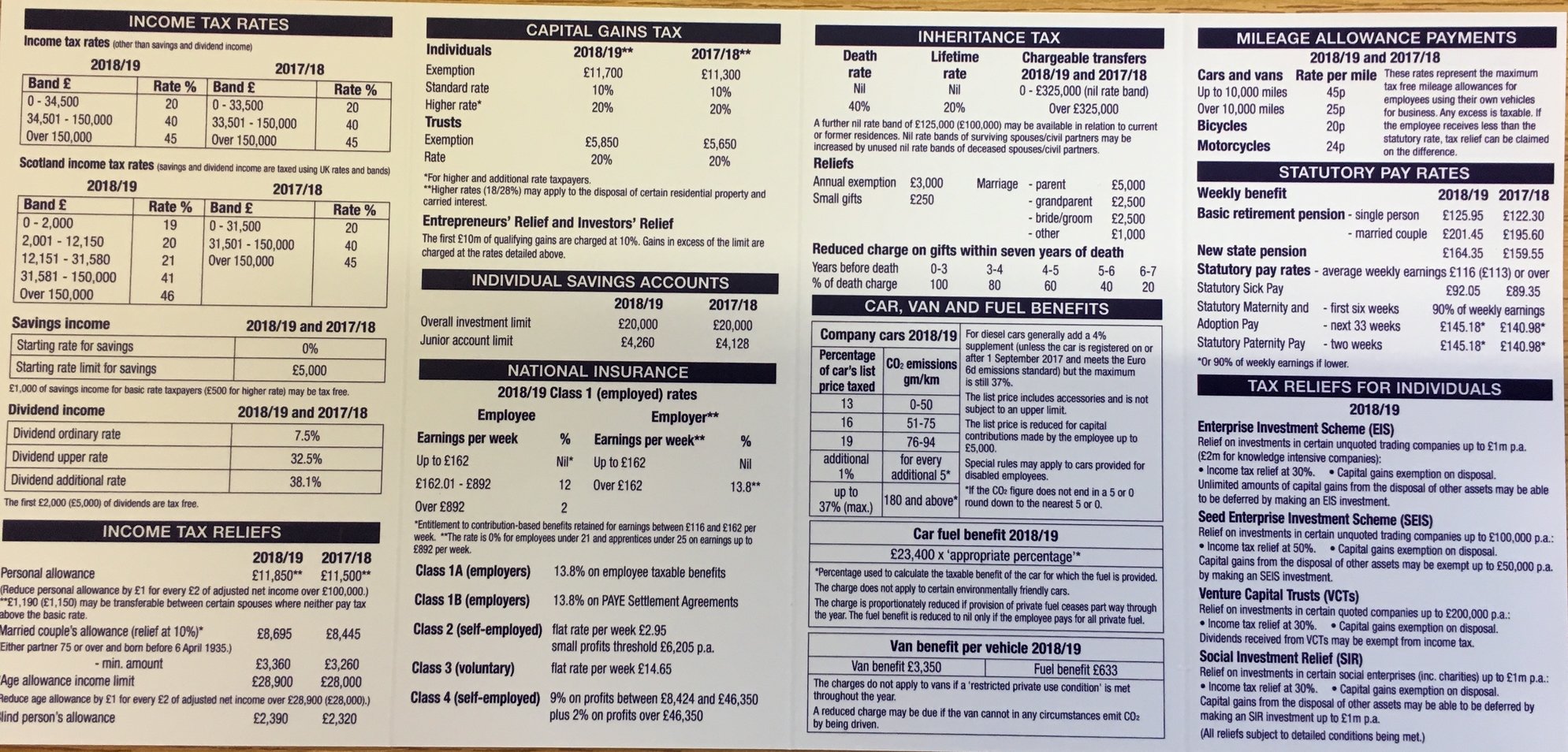

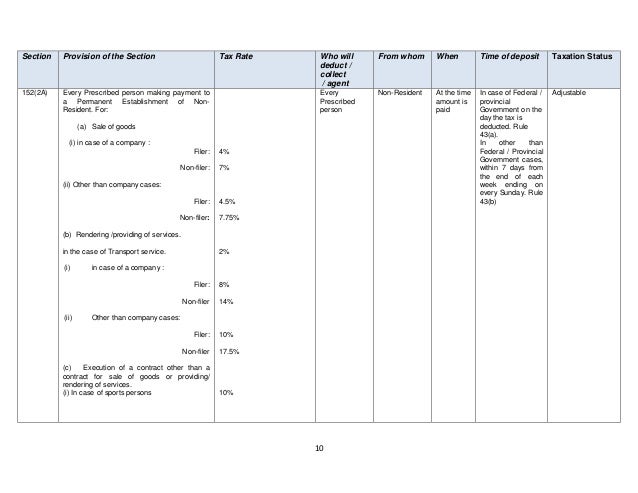

TAX CARD 2017 I S LYAS AEED Co Chartered accountants Page 1 of 15 DIRECT TAXES RATES Tax Rates for Salary Income Section 12 S. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Agents -as per Finance Supplementary Second Amendment Act 2019 updated up to March 09 2019 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding. Withholding Tax RegimeRates Card Guidelines for the Taxpayers Tax Collectors Withholding Agents Updated Upto 30th June 2017 Section Provision of the Section 148 Imports Tax to be collected from every importer of goods on the value of goods.

2017 the tax authorities reported additionally assessed tax of CZK 886 million and reduced tax losses of more than CZK 85 billion. Tax rates range from 11 to 16. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime.

In Direct taxes the contribution of WHT tax is about 60 to 70. Income Tax Withholding Rates For Tax Year 2017-18 Filer Non-Filer Slab rates WHT Rates Sr. Federal income tax The following rates apply for 31 December 2017 year-ends.

According to the Constitution of Pakistan the Federal Government in Pakistan can impose the following taxes in the. This Rate Card may be downloaded from Rates for Withholding Income Tax Updated to the Effect of Proposed Changes vide the Finance Bill 2018 APPLICABLE FOR TAX YEAR 2019 Nature of Payment Tax Rate Nature of Tax Filer Non-filer Advance Final Minimum Tax Page 3 IMPORTS Section 148 Part II First Schedule. Withholding Tax RegimeRates Card Guidelines for the Taxpayers Tax Collectors Withholding Agents Updated Upto 30th June 2017 Section Provision of the Section Tax Rate Who will deduct collect agent From whom When Time of deposit Taxation Status 148 Imports Tax to be collected from every importer of.

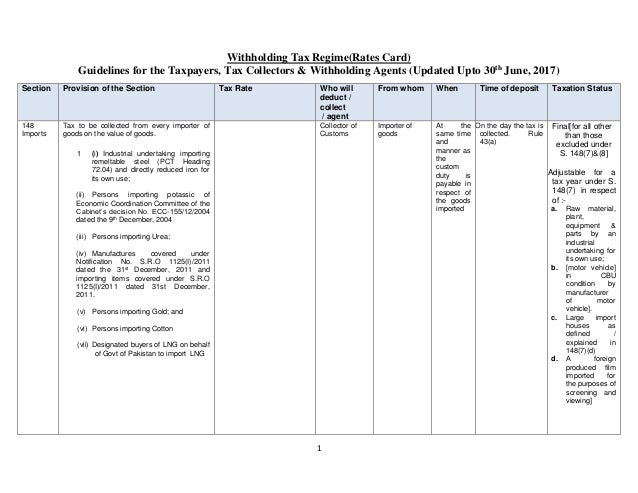

Hunter Gee Holroyd Tax Rates Card 2018 19 Hunter Gee Holroyd

Illustration Of Diesel Petrol Prices Build Up Under Gst Regime If Included Petrol Price Petrol Marketing Cost

Stand Alone Health Insurers Incurred Claims Ratio 2019 Data Health Insurance Companies Health Insurance Best Health Insurance

Rates Of Income Tax For Fy 2020 21 Assessment Year 2021 22 Cacube

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

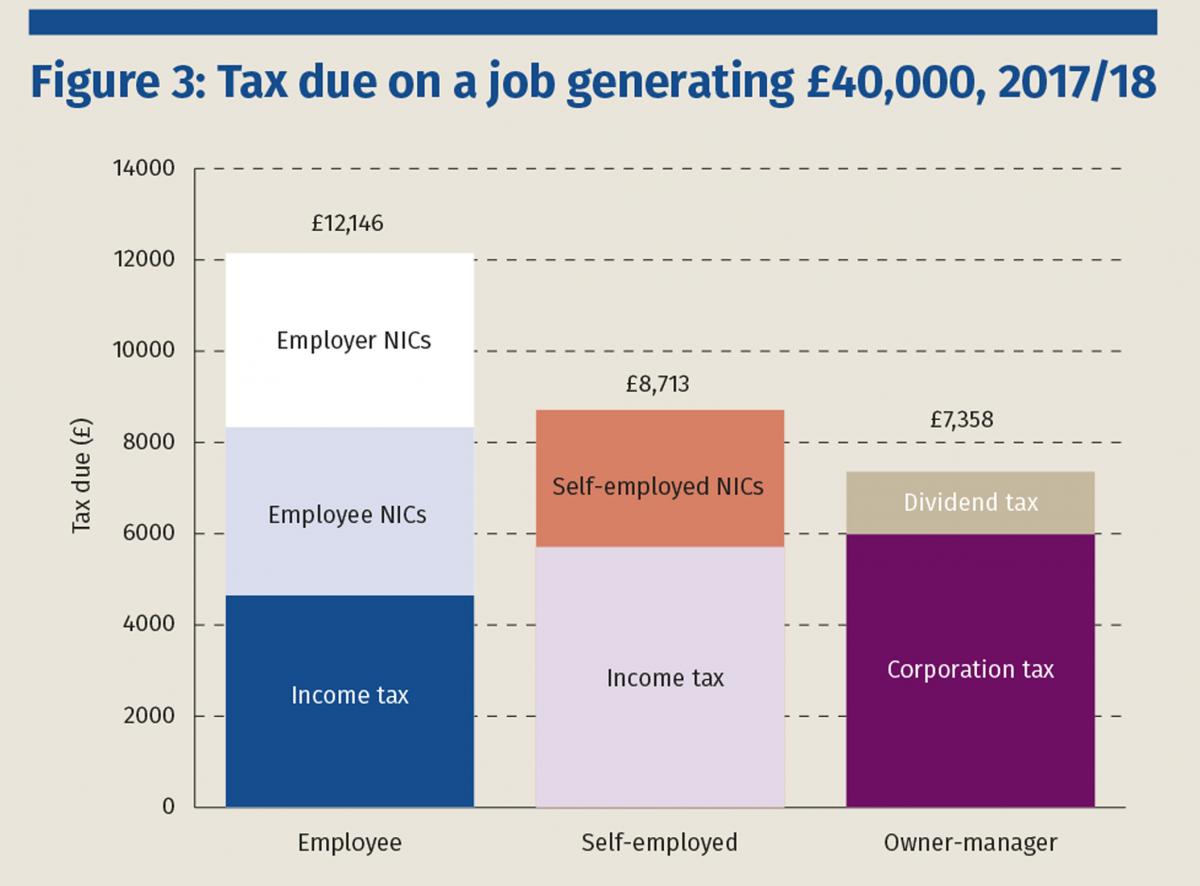

Tax In A Changing World Of Work

Latest Tds Rates Chart For Fy 2017 18 Ay 2018 19 Income Tax Tax Preparation Income Tax Preparation

Alam Aulakh Chartered Accountants Posts Facebook

Top 5 Best Senior Citizen Health Insurance Plans In India Health Insurance Plans Health Insurance India Health Insurance

Latest Health Insurance Incurred Claims Ratio 2017 18 Best Health Insurance Companies Health Insurance Companies Best Health Insurance Health Insurance Plans

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Current Income Tax Rates For Fy 2019 20 Ay 2020 21 Sag Infotech

Income Tax Slabs 2021 Revised Tax Rates For Fy 2020 21 Ay 2021 22 New Tax Regime

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only 4 D Income Tax Filing Taxes Tax Services

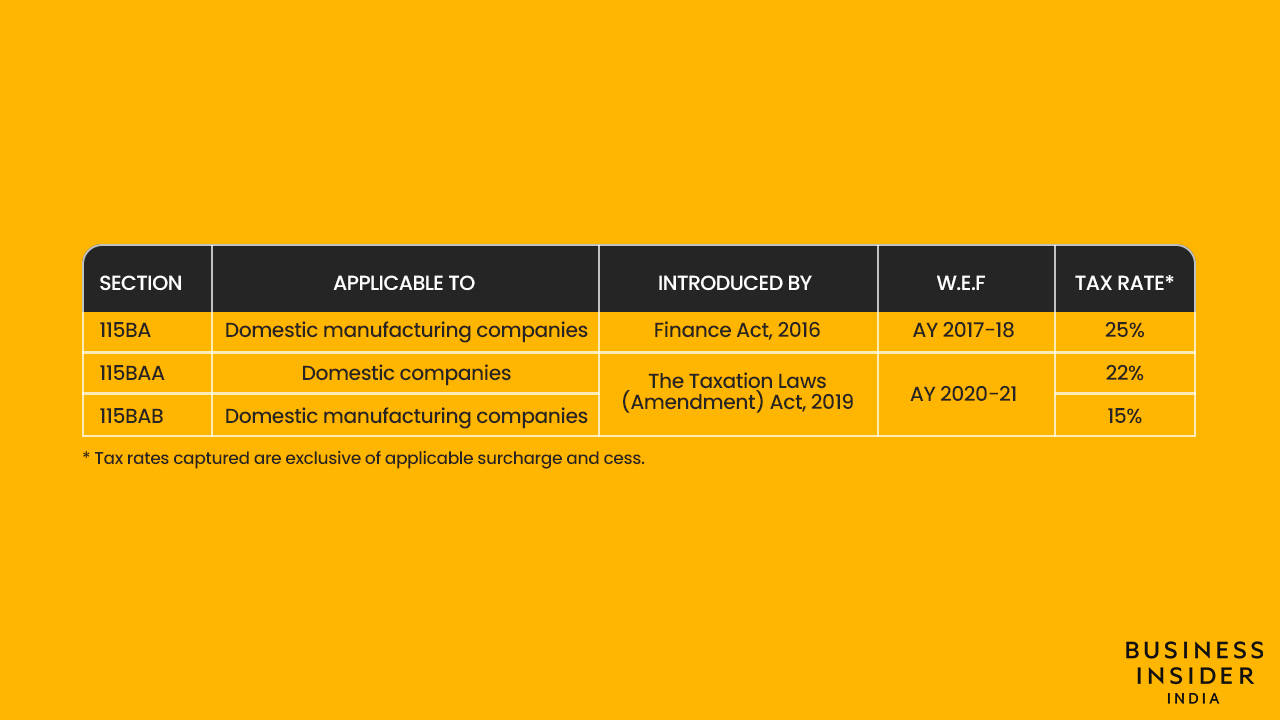

Lawyers Explain Why India S Power Producers Can T Avail The Lower Tax Rate

Posting Komentar untuk "Withholding Tax Regime(rates Card) 2017-18"