Withholding Tax Rates Pdf

The original Statue Income Tax Ordinance 2001 as. Updated up to June 30 2020.

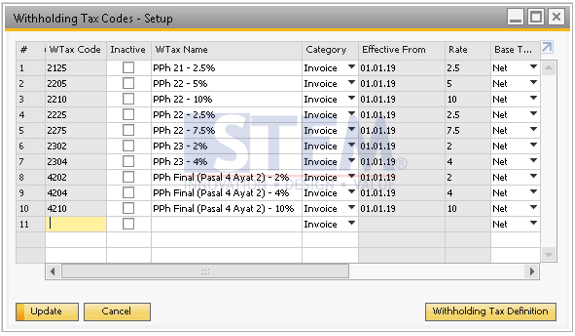

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

4 Dividends subject to Canadian withholding tax include taxable dividends other than capital gains dividends paid by certain entities and capital dividends.

Withholding tax rates pdf. Interest pertaining to regulated savings deposits except on the initial non-taxable amount no WT of interest of 1880 euros per year and per taxpayer liable to personal income tax in. The new tables are to be used on or after September 1 2021 and in future years. You can send us comments through IRSgovFormComments.

500000 5 5 Rs. Withholding tax rates are monitored by a third-party data provider and any rate changes are normally applied by FTSE Russell on the first working day of the month following receipt. 250000 - - Rs.

Federal Withholding Tables 2021 As with every other previous year the freshly adjusted 2021 Withholding Tax Table PDF was introduced by IRS to make with this years tax time of year. By way of an exception the WT rate reduced to 15 applies in particular to the following securities income. Issue the person from whose payment is deducted with copy B of the certificate WHTF1.

600000 1000001 2000000 Rs60000 15 of the amount exceeding Rs. A tax withheld calculator that calculates the correct amount of tax to withhold is also available. 3 Canada imposes no domestic withholding tax on certain arms length interest payments however non-arms length payments are subject to a 25 withholding tax.

200000 600001 1000000 Rs20000 10 of the amount exceeding Rs. Withholding Tax Rates 1 January 2021 Country Withholding Tax Country Withholding Tax Argentina1 7 Malta 0 Australia 30 Mauritius 0 Austria 275 Mexico 10 Bahrain 0 Mexico REITs4 30 Bangladesh 20 Montenegro 9 Belgium 30 Morocco 15 Bosnia 5 Namibia 20 Botswana 75 Netherlands 15 Brazil 0 New Zealand 30 Brazil Interest on Capital 15 Nigeria 10. A 30 reduction in the withholding rates previously in effect since January 1 2020.

Rate As from 1 January 2017 the ordinary rate of WT for securities income allocated or paid out is set at 30. It includes several changes including the tax bracket changes and the tax price annually along with the option to employ a computational link. These rates may be varied by a.

Currently there are three rates of withholding taxes including PAYE these being 3 10 75 and 15. 1000000 30 30 Senior Citizen who is 60 years or more at any time during the previous year Net Income Range Rate of Income-tax. Applicable Withholding Tax Rates.

This Withholding Tax Guide outlines the withholding procedure mainly pertaining to salary. Prime Ministers package for construction sector. Country treaty-based rates are available by contacting info.

Please make full use of this guide to ensure that taxes are properly withheld. WHT rate of 16695 0 from 1 January 2018 foreign non-UCITS funds should therefore be entitled to benefit from a comparable effective tax rate on their Belgian source dividend income. The new withholding tables are posted on the Employer Withholding Tax Web page which can be accessed by clicking.

The methods to ascertain the employees IRS 2021 Tax Tables PDF Printable are defined within the IRS-issued file referred to as Publication 15-T. Outline of the Withholding Tax System. In this particular record you d be able to find the step-by-step method to calculate withholding by two methods.

Internal Revenue Service Tax. The tabl es include the percentage and optional computer method. Rate of Income-tax Assessment Year 2022-23 Assessment Year 2021-22 Up to Rs.

1000000 20 20 Above Rs. Withholding tax rates are applied at individual security level with tax adjustments to dividends based on the tax residence of the company. Employees and employers may rely on these proposed regulations.

Interest can be. Payments under Section 82A Interest is not defined in the Income Tax Act but it is to be taken as an amount calculated according to a fixed ratio on debt or money lent. This document also contains the newest model of several worksheets with every of their applicable federal withholding.

Withholding taxes are deducted from amounts paid to both residents and to non-residents. Withholding tax rate for non-resident contractors at 20 or at the rate that the Commissioner-General may direct to give effect to the provisions in the exemption schedule or the Double Taxation Agreements. 1000000 2000001 4000000 Rs210000 20 of the amount exceeding Rs.

This Withholding Tax Guide has been prepared on the basis of income tax laws and regulations in force as of November 1 2018. WITHHOLDING TAX RATE TABLE - NIGERIA Companies Individuals Divident Interest Rent 10 10 Royalties 15 15 Commissions Consultancy Professional Technical Management Fees 10 5 Building Construction related activities 5 5 Contract of Supplies Agency arrangements 5 5 Director Fees 10 5. Wage bracket and percentage techniques which may be described more in the next portion.

Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. The link to the PDF is in the Get it done section. Tax withholding were published in the Federal Register on February 13 2020 at 85 FR 8344.

WHT amount 10 x K500 00000 K50 00000. We welcome your comments about this publication and your suggestions for future editions. Some are deducted as advance taxes includingpay-as- you-earn PAYE while others are a final tax.

Or you can write to. To get a copy of the PDF select the tax table you need and go to the heading Using this table. Amount due to transporter K450 00000.

3 Further to Frances second Amended Finance Act 2012 entering into force on 18 August 2012 the 30 WHT on dividend payments to foreign investment funds. After making the deductions the operator should prepare a Withholding Tax Certificate in triplicate and must. Tax Rate From To Up to 200000 NIL 200001 600000 5 of the amount exceeding Rs.

Tax tables with an asterisk have downloadable look-up tables available in portable document format PDF.

Singapore Tax Treaty Countries And Potential Withholding Tax Rates In 2021 Tax Rate Irs Taxes Tax

Https Www Dcms Uscg Mil Portals 10 Cg 1 Ppc Guides Gp Spo Deductions State Tax Withholding Exceptions Pdf

Step By Step Document For Withholding Tax Configuration Sap Blogs

How Do I Configure Withholding Taxes Which We Need

Revised Withholding Tax Table For Compensation Tax Table Withholding Tax Table Tax

Https Invoicemaker Com Template Payment Withholding Tax

Brazilian Withholding Taxes Bpc Partners

New Income Tax Table 2020 Philippines Income Tax Tax Table Income

Step By Step Document For Withholding Tax Configuration Sap Blogs

Brazilian Withholding Taxes Bpc Partners

Www Irs Gov Pub Irs Pdf P15 Pdf Irs Tax Guide Irs Taxes

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Tax

Screenshot Special Notice L 565 New Use Tax Collection Requirements For Out Of State Retailers Based On Sales Into California L565 P Tax California States

Step By Step Document For Withholding Tax Configuration Sap Blogs

Https Www Oregon Gov Dor Forms Formspubs Withholding Tax Tables 206 430 2020 Pdf

2021 Is Here Today Is A Great Time To Review Your W 4 For 2021 And Make Any Necessary Changes The Link Below Will Take You In 2021 Federal Income Tax Income Tax Irs

Brazilian Withholding Taxes Bpc Partners

Step By Step Document For Withholding Tax Configuration Sap Blogs

Posting Komentar untuk "Withholding Tax Rates Pdf"