Withholding Tax Rates On Services By Country

Updated up to June 30 2020. Official Email FBR Employees Government Links.

Withholding Tax Wht Calculation Sap Blogs

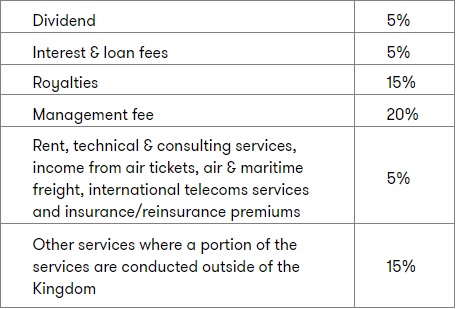

Applicable Withholding Tax Rates.

Withholding tax rates on services by country. 20 percent for personal services fees royalties lease and any other payment for the use of intellectual property. Corporate Tax Rates 2021 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits tax or branch remittance tax. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

2020 Global Withholding Taxes. So investors looking to avoid the withholding taxes can own Canadian stocks in retirement accounts. New Rules on Withholding Agents for Purchases of Services and Goods Revenue Regulations No.

With respect to dividends between qualifying related companies a mere notificationreporting procedure may be requested for the fraction of the Swiss WHT exceeding the residual WHT which is. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source non-business income. 20 percent for technical services technical assistance and consultancy either.

Digital services are subject to a 30 WHT as are nontechnical services. 10 or 20 0 20. Corporate - Withholding taxes.

The statutory rate of Swiss WHT is 35. Between 1 and 20 Non-resident. Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125 or more of the voting power.

11-2018 This Tax Alert is issued to inform all concerned on the new rules in determining the taxpayers required to withhold on purchases of goods and services other than those covered by other rates of withholding tax. In addition the 25 rate can be reduced to 15 by filing NR301 form with the Canada Revenue Agency CRA. 92 Zeilen As per revised DTTA with Kenya dated 19-02-2018 withholding tax on Fee for Technical Services is 10 instead of 175.

In the case of non-tax treaty countries the statutory withholding rates are as noted below. Qualifying payments to EU companies may be exempt or withholding tax rate reduced under EU Directives. Payments to non-tax residents are subject to withholding tax at the following rates among others.

This guide presents tables that summarize the taxation of income and gains derived from listed securities from 123 countries as of December 31 2020. 11-2018 a new classification of withholding agents is. As you can see some nations are far friendlier to foreign dividend investors than others.

Congo Democratic Republic of the Last reviewed 20 July 2021 Resident. 20 20 See the Withholding taxes section of Colombias corporate tax summary. 2019 Global Withholding Taxes.

What is exempt from Withholding Tax. WITHHOLDING TAX RATE TABLE - NIGERIA Companies Individuals Divident Interest Rent 10 10 Royalties 15 15 Commissions Consultancy Professional Technical Management Fees 10 5 Building Construction related activities 5 5 Contract of Supplies Agency arrangements 5 5 Director Fees 10 5. Investors should also pay attention to the difference in rates between REITs and non-REITs.

Withholding tax on interest and royalties levied on 50 of payment so effective rate is 15. Withholding Tax Rates 1 January 2021 Country Withholding Tax Country Withholding Tax Argentina1 7 Malta 0 Australia 30 Mauritius 0 Austria 275 Mexico 10 Bahrain 0 Mexico REITs4 30 Bangladesh 20 Montenegro 9 Belgium 30 Morocco 15 Bosnia 5 Namibia 20 Botswana 75 Netherlands 15 Brazil 0 New Zealand 30 Brazil Interest on Capital 15. As a general rule UK domestic law requires companies making payments of interest to withhold tax at 20.

For more details on this form go here. 10 or 20 0 or 20 20. You generally must withhold tax at the 30 percent rate on compensation you pay to a nonresident alien individual for labor or personal services performed in the United States unless that pay is specifically exempted from NRA withholding or subject to graduated withholding Wage Withholding under Internal Revenue Code Section 3402.

Feb 2019 This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Income tax of 40 with no deductions must be withheld on most payments made to foreign-related parties whose income is deemed to be subject to a PTR in lieu of the tax provided in the domestic law for non-PTR foreign resident entities. Meanwhile some of the most popular foreign dividend companies including those in Australia Canada and Europe can have very high withholding rates between 25 and 35.

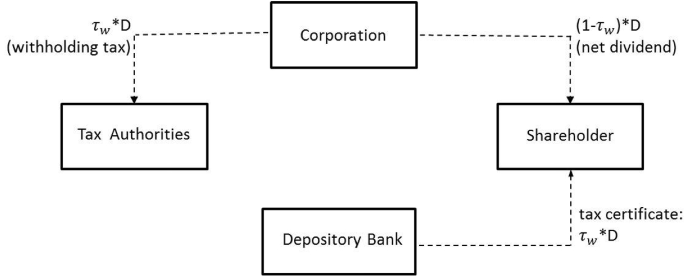

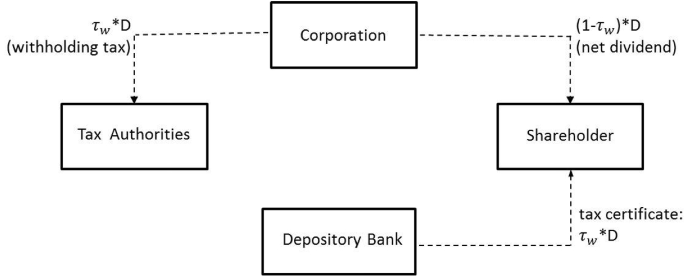

All persons making US-source payments to foreign persons withholding agents generally must report and withhold 30 of the gross US-source payments such as dividends. However there are a number of exceptions to this. Corporate Tax Rates 2021.

Marketing commissions and residue audit fees paid to foreign agents in respect of export of flowers fruits and vegetables. You can view the complete list of withholding tax rates for every country here. Relief if any is generally granted by refund.

Bulgaria Business Attraction In The Eu No More Tax

Withholding Tax Gross Up On Fixed Interest Rate On Borrowing Calculation In Sap Treasury Sap Blogs

Global Corporate And Withholding Tax Rates Tax Deloitte

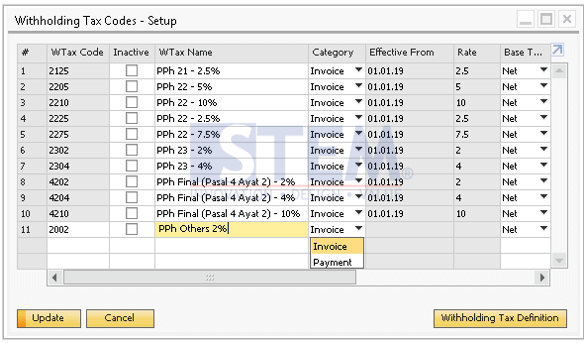

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Withholding Tax Wht Calculation Sap Blogs

Withholding Tax Wht Calculation Sap Blogs

Withholding Tax Non Compliance The Case Of Cum Ex Stock Market Transactions Springerlink

Global Corporate And Withholding Tax Rates Tax Deloitte

Withholding Tax Wht Calculation Sap Blogs

Withholding Tax Certificate For Interest Payments From Thailand And Foreign Currency Invoices In Thailand 4 Seiten Lorenz Partners

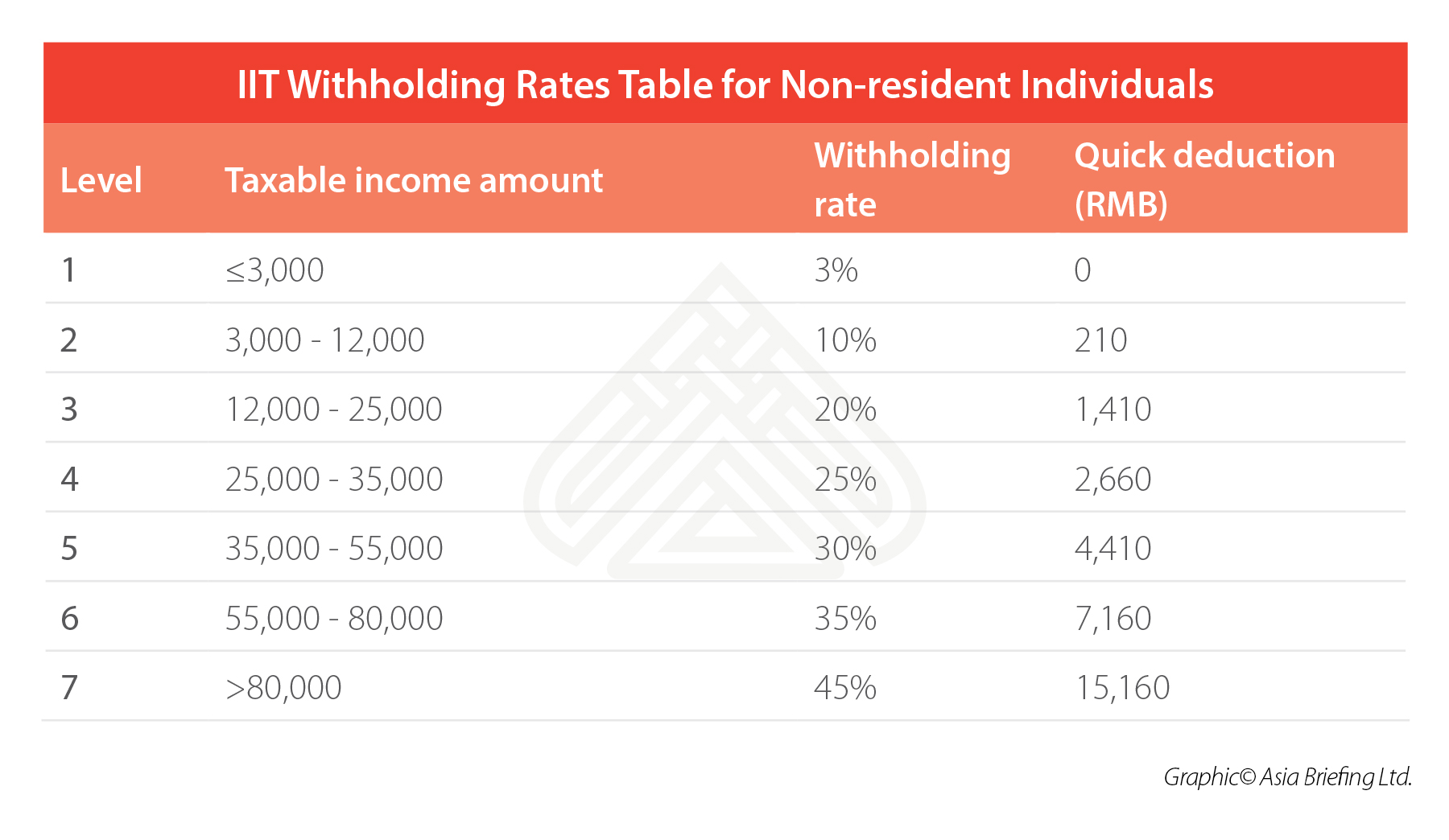

How To Calculate And Withhold Iit For Your Employees In China

Withholding Tax Gross Up On Fixed Interest Rate On Borrowing Calculation In Sap Treasury Sap Blogs

German Ip Withholding Tax White Case Llp

Taxes In Switzerland Income Tax For Foreigners Academics Com

Panama Tax Treaties Tax Panama

Withholding Tax Gross Up On Fixed Interest Rate On Borrowing Calculation In Sap Treasury Sap Blogs

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Posting Komentar untuk "Withholding Tax Rates On Services By Country"