Withholding Tax Rates In Kenya 2020

Either 5 of the tax payable or twenty thousand shillings whichever is higher. Decrease of the resident corporate income tax from 30 to 25.

Https Www Dtcc Com Globals Pdfs 2020 September 28 14018 20

However the withholding tax rate on dividend payments to non residents has been increased from 10 to 15.

Withholding tax rates in kenya 2020. KRA Withholding Tax rates. However the KRA has in the past taken the position that the management or professional fees would fall on the Article on other income and should therefore be. Effective 1 st January 2020 turnover tax has been reintroduced at a rate of 3 on the gross turnover for businesses whose turnover does not exceed KShs 5 million.

This will provide additional disposable. The Finance Act 2018 introduced presumptive tax at the rate of 15 of the Single Business Permit fee issued by the County Government. In Kenya there are Withholding VAT under the Tax Procedures Act 2015.

These measures will come into force once approved by the National Assembly. For resident suppliers of goods and services and commercial properties landlords the withholding VAT rate is 6. The tax is payable by the 20th of the following month by the appointed agents to KRA.

Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125. 25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021 1 October 2021 for lease payments. Withholding tax Royalties are subject to withholding tax at a rate of 5 and 20 when paid to resident and non-resident persons respectively on the gross royalty payment made.

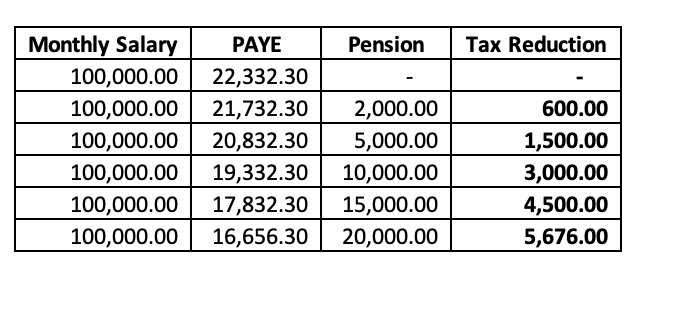

Review the 2020 Kenya income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in Kenya. What is exempt from Withholding Tax. Individual Tax Bands and Rates.

The new corporate tax rate will be. The withholding tax rate applicable for sales promotion advertising and transportation services is 20 on the gross fees while reinsurance premiums are to be taxed at 5. Repeal of the reduced corporate tax rate for companies operating recycling plants The measure The Bill proposes to delete Paragraph 2l of the Third Schedule to the Income Tax Act which prescribes a reduced corporate tax rate of 15 for the first 5 years for any company operating a plastics recycling plant.

Interest from banks at 15 dividends at 5 and royalties at 5 insurance commission at 5 and consultancy fee 5 for residents. The VAT is withheld by appointed agents only. KRA Withholding Tax rates This is a method whereby the payer of certain incomes is responsible for deducting tax at source from payments made and remitting the deducted tax to KRA.

The National Assembly included this change in the Act. Following the adjustments below were the final and verified tax rates in Kenya for the year 2020. The reduced rate was introduced through the Finance Act 2019 and has been.

Individual tax rates for 2020 are different from those in 2019In April the government adjusted the tax rates to cushion Kenyans against the economic impact of coronavirus. Kenya has two statutory income tax rates. Decrease of the value-added tax rate from 16 to 14 with effect from 1 April 2020.

Withholding Tax Transactions in Kenya. Withholding Tax is deducted at source from several income like. On 25 March 2020 the Kenyan President announced the following tax measures to help the Kenyan economy in response to COVID-19 and its impact on the local economy.

This is to ensure that non-residents who provide such services to a Kenyan resident are subject to tax in respect to income earned in or derived from Kenya. PwC Kenya 2 Tax Amendment Act 2020 Issue Previous Position Change in the Tax Laws CommentsImpact Amendment Act 2020 Resident corporate tax rate Turnover tax rate 30 3 25 1 Previously the National Treasury had omitted this change which was contained in the Presidential Directive. The Government has proposed a reduction of the top pay as your earn PAYE rate from 30 to 25.

The percentage deducted varies between incomes and is dependent on whether you are a resident or non- resident. The person making the payment is responsible for deducting and remitting the tax to Kenya Revenue Authority KRA. Businesses liable to turnover tax will still be liable to presumptive tax.

One of a suite of free online calculators provided by the team at iCalculator. With effect from 25th April 2020. In addition the Act has increased the withholding tax rate for dividends paid to a nonresident person from 10 to 15.

These changes aim to increase government revenue by taxing income that was previously untaxed. Individual tax bands and rates with effect from april 2020. For individual taxpayers whose income tax per year is more than kshs 40 000 they are expected to pay the tax on instalment basis four times by.

100 tax relief for gross income of up to KES24000 per month The Government has proposed to extend 100 tax relief to persons earning gross monthly income of up to KES24000. Deloitte US Audit Consulting Advisory and Tax Services. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Withholding tax at the rate of 20 on payments made to a non-resident entity in respect of sales promotion marketing advertising services and transportation of goods excluding air transport services has been introduced. The new rates took effect in january 2017.

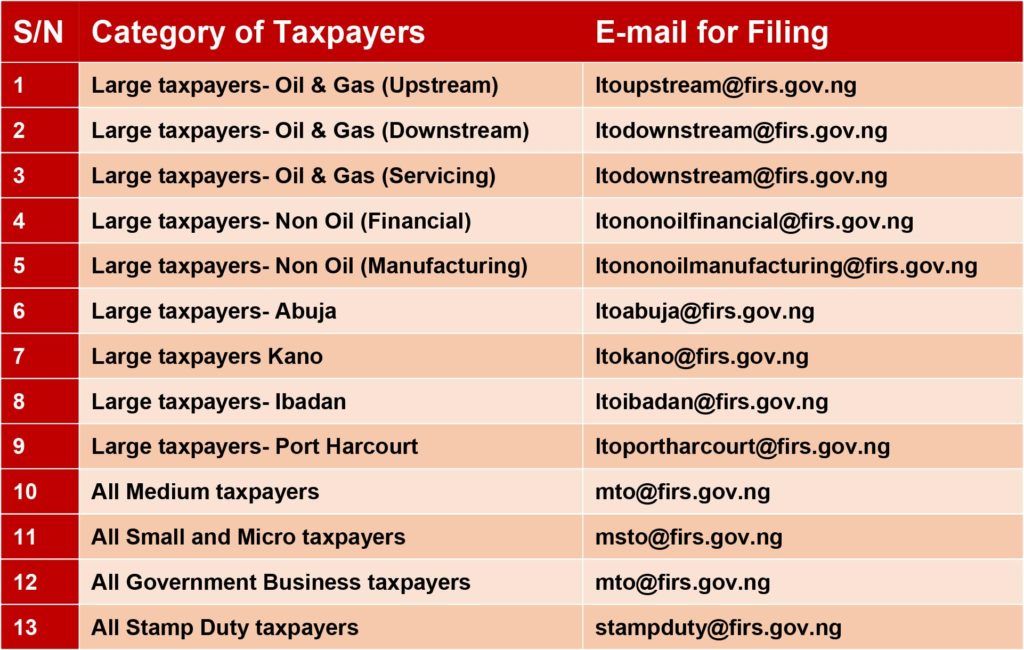

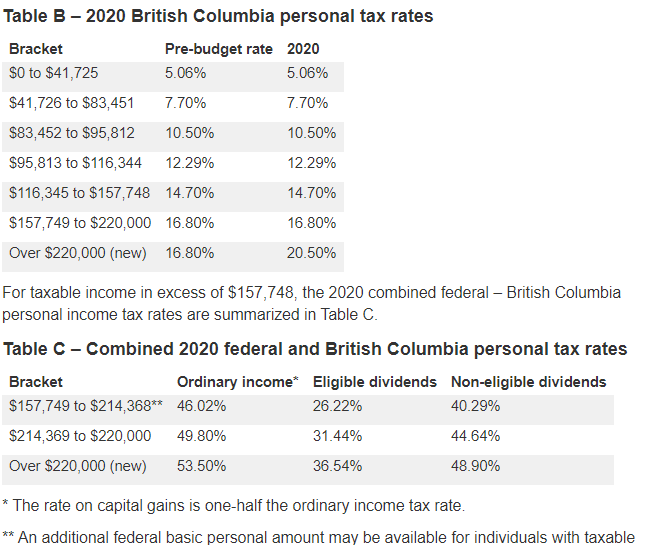

Covid 19 Firs Extends Cit Vat Wht Filing Deadlines Tax Nigeria

Kenya Revenue Authority Withholding Tax Facebook

Taxation Of Self Employed Professionals In Africa Three Lessons From A Kenyan Case Study Ictd

Global Corporate Tax And Withholding Tax Rates Deloitte Yemen Tax Services Article News

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Global Corporate Tax And Withholding Tax Rates Deloitte Yemen Tax Services Article News

Countrywise Withholding Tax Rates Chart As Per Dtaa

Withholding Tax On Vat Kra Csv File Anziano Consultants

Tax Insights Deloitte Australia Tax Insights

Global Corporate Tax And Withholding Tax Rates Deloitte Yemen Tax Services Article News

Https Www2 Deloitte Com Content Dam Deloitte Ke Documents Tax Kenya 20insights 202019 20 20final Pdf

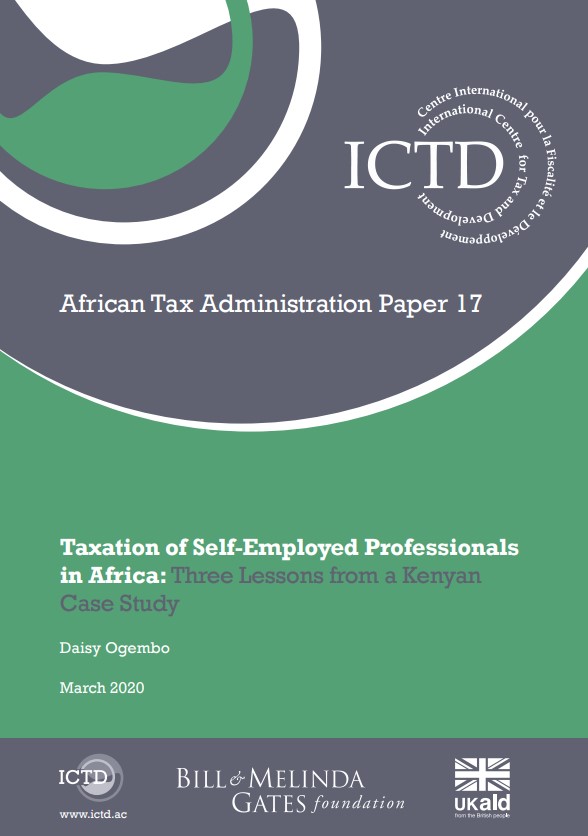

Canada British Columbia Issues Budget 2020 21 Ey Global

Https Www2 Deloitte Com Content Dam Deloitte Ke Documents Tax Tax 20alert 20 20the 20tax 20laws 20act 202020 Pdf

How To Reduce Your Tax Obligations In Kenya By Jidraph Njuguna Medium

Posting Komentar untuk "Withholding Tax Rates In Kenya 2020"