Withholding Tax Rate Calculator Nz

This tax calculator assists you determine just how much withholding allowance or extra withholding should be documented on your W4 Form. This calculator uses the new IRD rates post March 31st 2021 and does include the new 39 personal tax rate on remaining income over 180000.

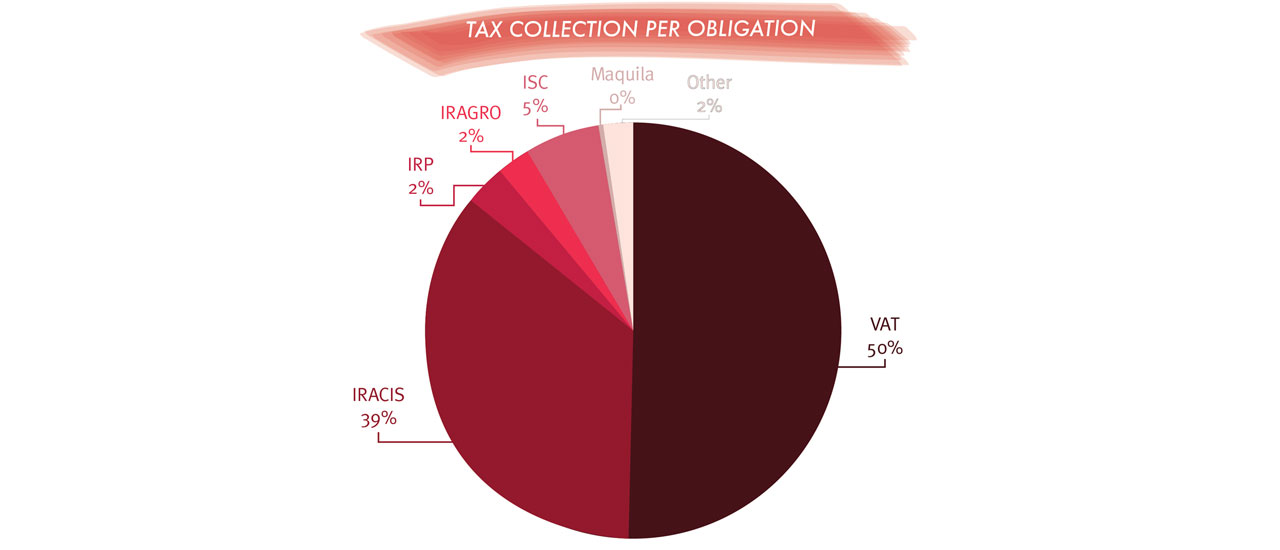

Modifications To The Tax System In Paraguay Ecovis International

To use this income tax calculator simply fill in the relevant data within the green box and push Calculate.

Withholding tax rate calculator nz. In some cases you will need to deduct a flat rate of tax when using a self-employed contractor even if that contractor is registered for GST. The residential land withholding tax rates for calculation 2 are. Dividends and unit trust distributions are all taxed at a RWT rate of 33 while portfolio investment entities PIEs are taxed at different rates depending on the type of fund interest payments are taxed at the non-declaration rate if you have not given your IRD number to the interest payer from 1 April 2020 the non-declaration rate is 45.

Pay As You Earn PAYE is a withholding income tax for employees in New Zealand. If you are a New Zealand tax resident and have supplied your IRD number but not your tax rate the default rate is 33. Foreign investment fund calculator The Foreign investment fund calculator is not working correctly and has been removed from our website.

We are often asked about the tax requirements for contractors. If you dont let us know your IRD number or RWT rate you will be taxed at the default rate of 33. To use the calculator for the previous rates please click here.

This includes taxpayers who owe alternative minimum tax or certain other taxes and people with long-term capital gains or qualified dividends. Interest and dividends paid between group companies and in certain other limited circumstances are exempt from the. Individual Tax Calculator The tax withholding estimator 2021 allows you to determine the federal income tax withholding.

However if youve supplied your IRD number but not your RWT rate RWT will still be deducted at the default rate. There is no tax free threshold in New Zealand and therefore any income you earn as a contractor or freelancer will be taxed. Calculate GST correctly with this super easy GST Calculator for New Zealand 15 GST.

If the recipient is an individual person the tax rate is same as the recipients marginal tax rate. The income tax rates for PAYE earners and self-employed. People with more complex tax situations should use the instructions in Publication 505 Tax Withholding and Estimated Tax.

When someone earns income from interest contract work or other sources that are not salary or wages there are some situations when the payer must withhold tax from that income and pay it to us on the persons behalf. Tax Rate Calculator The tax withholding estimator 2021 permits you to definitely compute the federal income tax withholding. 28 for companies and incorporated clubs and societies.

33 for individuals all other non-individuals and companies acting as trustees of a trust. It helps people to pay tax on all their income not just salary or wages. From 1 April 2021.

Up to 31 March 2021. If you are looking to find out your take-home pay from your salary we recommend using our Pay As You Earn calculator. This is commonly called withholding tax but the correct title is tax on schedular payments.

If you have not supplied your IRD number then the non-declaration rate is 45. The rate of RWT on interest is 45 where the recipient does not provide an IRD number. This Tax Withholding Estimator works for most taxpayers.

These rates might be reduced further through the application of a double tax agreement if the recipient is resident in a countryjurisdiction with which New Zealand has entered into such an agreement. It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC. Calculate your take home pay from hourly wage or salary.

From 1 April 2020 the IRD is increasing their non-declaration rate to 45 for those customers who have not supplied their IRD number. Withholding tax is a type of income tax deduction. It gets the name.

This income tax calculator will allow you to quickly and easily see your tax or government deductions based on your salary. 39 for individuals all other non-individuals and companies acting as trustees of a trust. Non-resident withholding tax is imposed on interest at 15 percent and dividends at 30 percent or 0 percent if fully imputed.

If the recipient is a company the default rate is 28. 28 for companies and incorporated clubs and societies. IRD calculate your income tax rate by summing the total of all your sources of income including PAYESalary jobs together with self-employed income investment income etc and then applying their standard tax rates.

Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. We expect to have it working correctly this week.

The tax rate can be found out at Sch 1. End of tax year Were sending income tax assessments out from late-May until the end of July. This estimator can be used by virtually all taxpayers.

New Zealands Best PAYE Calculator. This tax calculator aids you establish how much withholding allowance or added withholding must be documented with your W4 Form. RWT on interest varies from 105 - 33 depends on the the recipients tax conditions.

It also will not include any tax youve already paid through your salary or. If you are a non-New Zealand tax resident the default rate will be the withholding tax rate for your indicated country of tax residence. The rate of RWT on dividends paid is 33 but the tax is reduced by the aggregate imputation and withholding payment credits attached to the dividend or taxable bonus share.

Use this simple guide to confirm your Resident Withholding Tax RWT rate - itll only take a few seconds.

Possible Implications Of Integrating The Corporate And Individual Income Taxes In The United States In Imf Working Papers Volume 1990 Issue 066 1990

Payg Tax Tables Myob Accountright Myob Help Centre

Possible Implications Of Integrating The Corporate And Individual Income Taxes In The United States In Imf Working Papers Volume 1990 Issue 066 1990

Possible Implications Of Integrating The Corporate And Individual Income Taxes In The United States In Imf Working Papers Volume 1990 Issue 066 1990

Inflation Lags In Collection And The Real Value Of Tax Revenue In Imf Staff Papers Volume 1977 Issue 001 1977

Arborist Wellington Tree Removal Wellington Tree Services Tree Service Tree Removal Arborist

Possible Implications Of Integrating The Corporate And Individual Income Taxes In The United States In Imf Working Papers Volume 1990 Issue 066 1990

Get To Know Misunderstood Business Tax Deductions Before Your Year End Planning Moneybyramey Com Business Tax Deductions Business Tax Tax Deductions

Back Matter In Tax Law Design And Drafting Volume 2

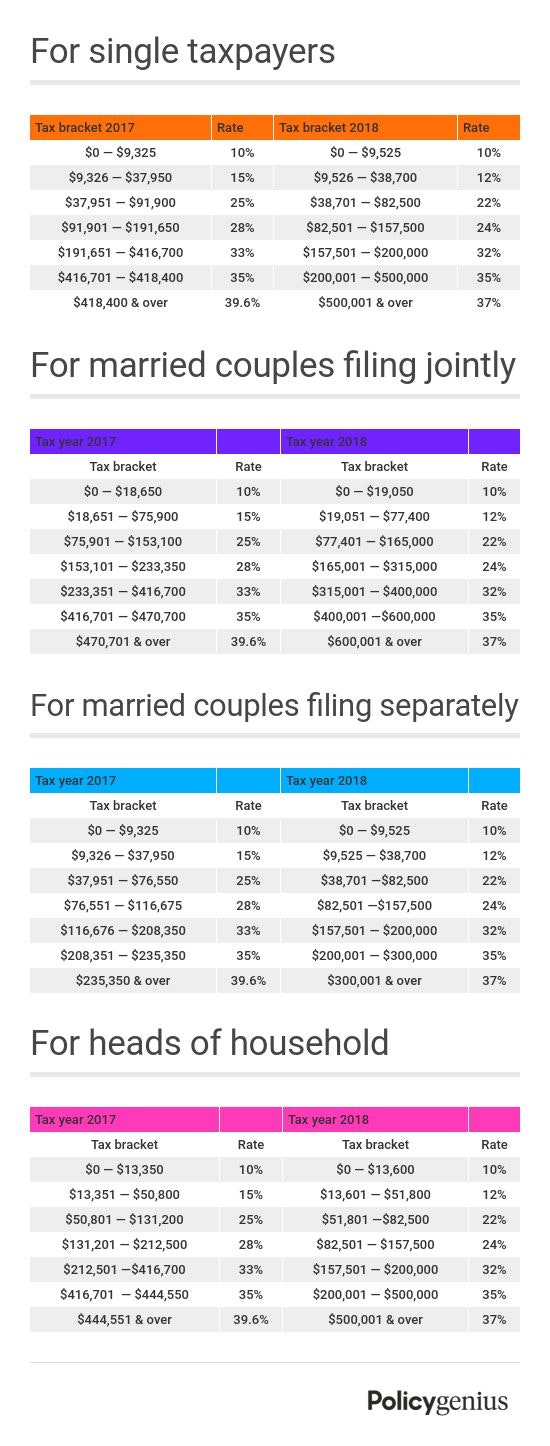

What Tax Bracket Am I In Post Tax Bill Edition

Tax Quiz How Much Do You Know About Filing Taxes Bankrate Com Filing Taxes How To Get Rich Bankrate Com

Tax Tips 101 Why You Shouldn T Celebrate Your Big Tax Return In 2021 Personal Finance Quotes Tax Refund Personal Financial Planning

Https Www Un Org Development Desa Financing Sites Www Un Org Development Desa Financing Files 2021 04 G To G Web Pdf

Http Www Imf Org External Pubs Ft Wp Wp9725 Pdf

Global Corporate And Withholding Tax Rates Tax Deloitte

Inflation Lags In Collection And The Real Value Of Tax Revenue In Imf Staff Papers Volume 1977 Issue 001 1977

Posting Komentar untuk "Withholding Tax Rate Calculator Nz"