How Much Is Withholding Tax In Ghana

Any additional day is Gh10. Not yet in force.

Africa Tax In Brief 18 Feb 2020 Lexology

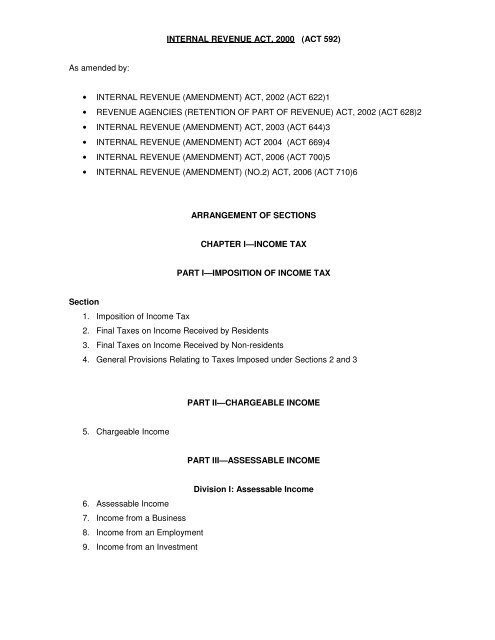

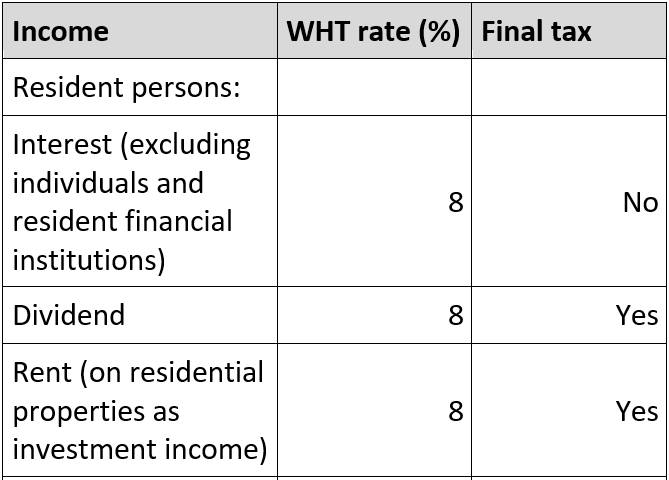

Tax components include corporate income tax Value Added Taxes Communication Service tax Withholding taxes and Import duties and other surcharges and social security contributions.

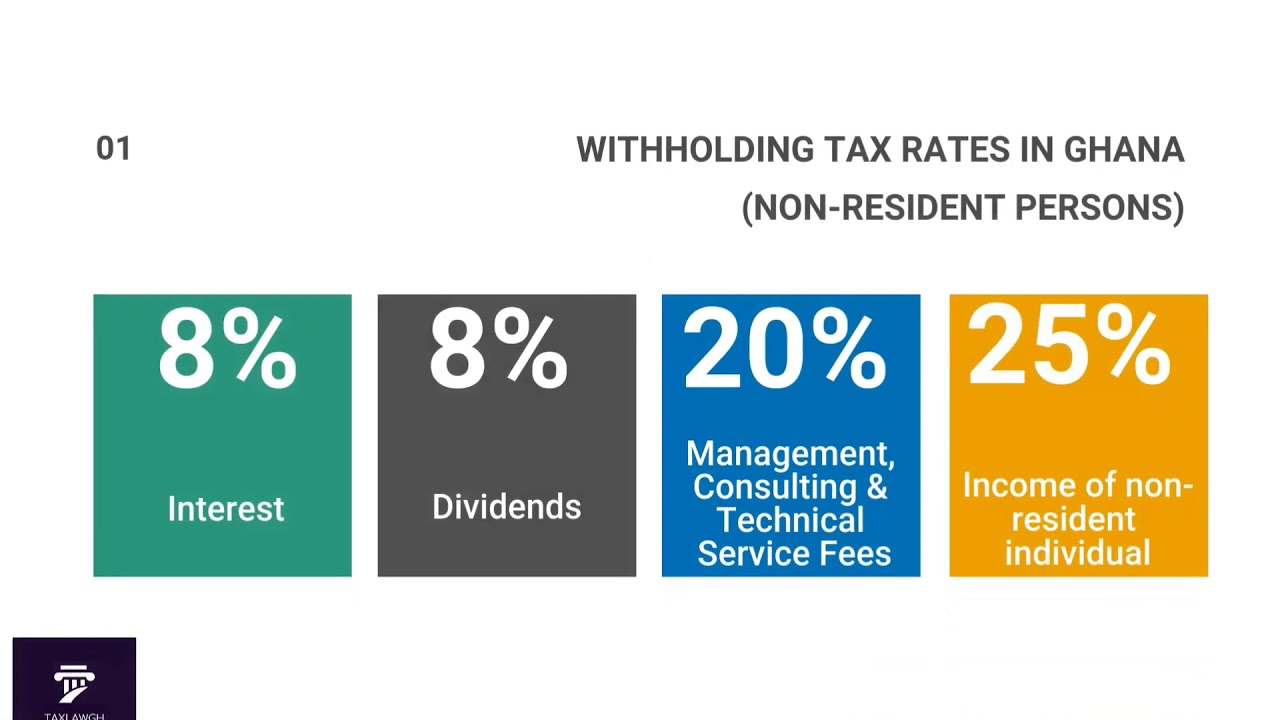

How much is withholding tax in ghana. Withholding agents are required to withhold taxes at 20 from payments of management and technical services. Withholding tax After 15 th you pay Gh500. It is the employers responsibility to file monthly tax returns on behalf of its employees.

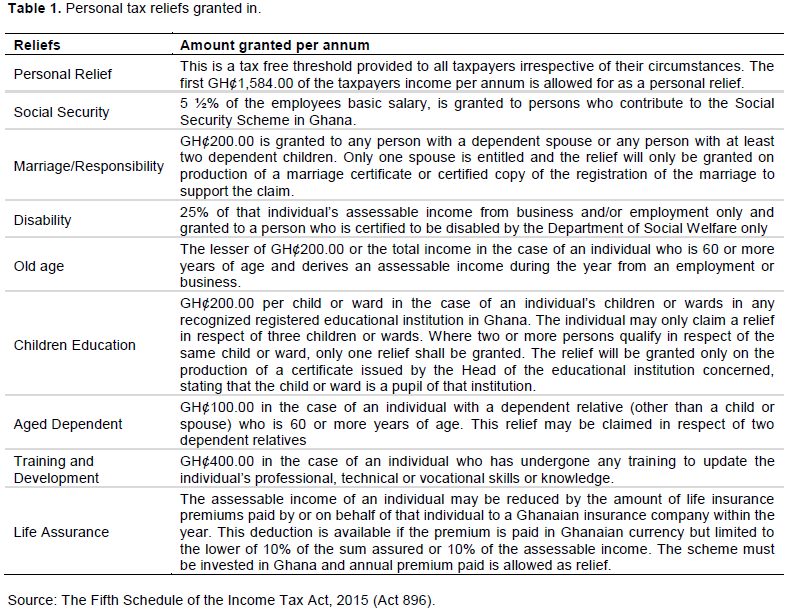

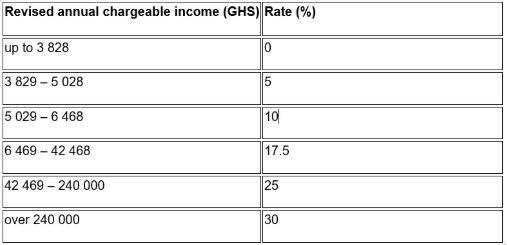

Residents are subject to tax at rates ranging between 0 and 30 on the following annual graduated scale of income. If state income taxes apply the employee must also pay this tax. The next GHS 1200 yearly which is equivalent to GHS 1000 per month is subjected to a tax of 10.

40 Zeilen Withholding Tax Rates in Ghana. On the other hand the applicable rates for this classification of tax range between a minimum of 5 to a maximum of 15. What is the percentage of withholding tax in ghana Employers are required to withhold federal and in most cases state taxes from employees wages.

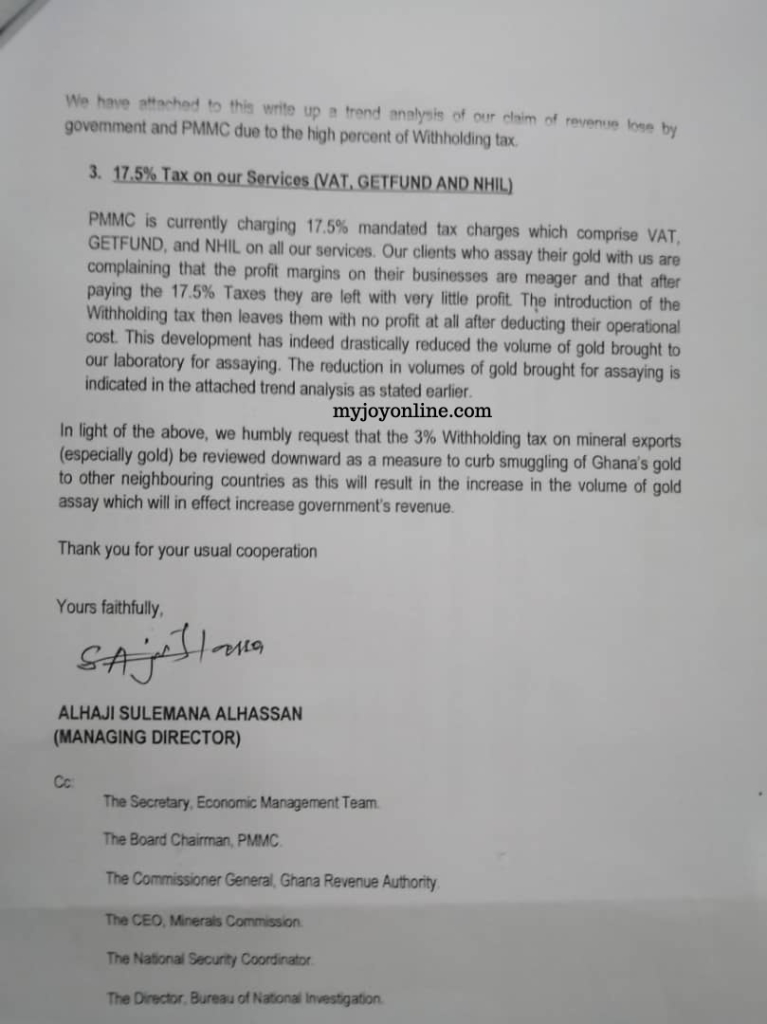

The 20 percent rate was at 2700 and the 15 percent rate was at 270 per year. The VAT registered taxpayer who has made supplies and has suffered withholding VAT will continue to file both their VAT and levy returns and account for these imposts in accordance with the provision of the VAT Act 2013 Act 870 NHIL and GETFund Act respectively to the Ghana Revenue Authority. Or - interest paid to an individual on bonds issued by the Government of Ghana.

There was also a wealth tax currently suspended. Annual audited financial statement not late than 31 st May of the year. The next GHS 33720 which is equivalent to GHS 2810 monthly is exposed to a tax of 175.

Unlike general service fees management and technical service fees are not linked to Ghana in a way to say their payments indicate income sourced from Ghana in order for them to be taxed. Federal taxes include federal income tax and Social Security and Medicare FICA taxes. Withholding VAT Scheme VAT returns from August 2018 onwards should not capture input taxes relating to NHIL and GETFL on transactions that took place from August 2018.

Contract Payments The 7 withholding tax on contracts does not apply. Income tax is levied in each year of assessment on the total income of both resident and non-resident persons in Ghana. 10 in any other case.

- to a contract not exceeding fifty. The tax withheld must be filed and payment made by the 15th of the month following the month in which the tax. Payment to a temporary worker is is taxed as if that worker was a permanent worker.

- interest paid to an individual by a resident financial institution. Branch profits repatriation final non-resident. In addition Ghanaians paid a 125 percent Value Added Tax VAT.

- interest paid by an individual. To ensure smooth transition VAT registered. Any additional day is Gh10.

Thus the telecom sector contributes notably in taxes to Ghana. 1 The property is jointly owned by husband and wife. It is therefore irrelevant if the non-resident person is deriving any income from Ghana.

The higher rate applies in any other case. These changes have implications on the computation of tax for VAT Registered persons. Gross rental income earned by nonresident individuals from leasing nonresidential properties is taxed at a flat rate of 15 withheld at source.

The 2018 Mid-Year budget amended the VAT rate from 15 to 125 and delinked the National Health Insurance Levy NHIL and Ghana Education Trust Fund GETFund from VAT by removing their input tax deductibility. Non-residents pay taxes at the flat rate of 25. 2 Exchange rate used.

The employer is required to withhold the employees taxes and pay to the Ghana Revenue Authority GRA. The total contributions of GHC 22 billion represents approximately 9 percent of Ghanas annual total tax revenue earnings. With respect to resident persons the income must be derived from.

Withholding tax 15 th of the month. VAT After the last working day you will pay Ghc500. 5 for non-resident banks.

CEO of the telecoms Chamber revealed the figures at a media briefing. 100 US 400 GHS 3 Gross rental income earned by nonresident invidiuals from leasing residential properties is taxed at a flat rate of 8 withheld at source. Any amount with exceed 38892 is taxed at 25.

Withholding VAT agents will continue to file withholding VAT returns by the 15 th of the month. The VAT Withholding Agent shall issue the suppliers with withholding VAT certicate showing the amount of VAT withheld. Ii Interest The 10 withholding tax on interest paid by a resident person to another resident person does not apply to.

A payment to a casual worker is subject to 5 final withholding tax. The threshold for withholding tax in Ghana is set at GHC 2000. Federal income tax and state income tax amounts depend on the employees withholding.

Click HERE to File and Pay for your NHILGETFund. Filling of VAT NHILGETFL Returns 4. Income tax PAYE 15 th of the month.

Penalty for late filing of tax returns are. This does not mean that all the salary will be subjected to this tax. The government of Ghana is pursuing DTTs with various countries including Nigeria Qatar Sweden Syria the United Arab Emirates and the United States.

The next GHS 840 yearly which is equivalent to GHS 60 is subjected to a tax of 5. This is the minimum amount that attracts WHT as stipulated in the law.

Ghana Income Tax Rates 2021 Youtube

All Withholding Tax Ghana Revenue Authority Official Facebook

Ghana Income Tax Rates 2021 Youtube

Ghana Tax Laws Photos Facebook

Ghana Income Tax Rates 2021 Youtube

Tax Compliance In Ghana A Review Of Interest Penalties And Fines In Ghana

Ghana Tax Laws Innlegg Facebook

Taxation Understanding The Tax System In Ghana Presented By Joseph Kyei Ankrah Ppt Download

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Taxation Understanding The Tax System In Ghana Presented By Joseph Kyei Ankrah Ppt Download

Ghana Income Tax Rates 2021 Youtube

Ghana Acep Reveals 95 Of Small Scale Miners Never Receive Tax Certificate After Payments African Eye Report

Act 592 Ghana Revenue Authority

Journal Of Accounting And Taxation Utilization Of Personal Tax Relief Schemes An Empirical Analysis In The Context Of Tax Evasion

Withholding Tax In Ghana Current Rates And Everything You Need To Know 2021 Yen Com Gh

Posting Komentar untuk "How Much Is Withholding Tax In Ghana"