Global Withholding Tax Rates 2019

Topics covered are taxes on corporate income and gains determi-nation of trading income other significant taxes miscellaneous matters including foreign-exchange controls debt-to-equity rules transfer pricing controlled foreign companies and anti-avoidance legislation and treaty withholding tax rates. In March 2019 the Czech government approved tax law changes which for the most part entered into force on 1 April 2019.

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

With some variation the topics covered are taxes on corporate income and gains determination of trading income other significant taxes miscellaneous matters including foreign-exchange controls debt-to-equity rules transfer pricing controlled foreign companies and anti-avoidance legislation and treaty withholding tax rates.

Global withholding tax rates 2019. Corporate tax individual income tax and sales tax including VAT and GST but does not list capital gains tax. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region. Additional coverage may include stated negotiating priorities and other important tax.

KPMGs corporate tax rates table provides a view of corporate tax rates around the world. However the current exemption from withholding tax on payments to pensioners would. From 2019 the requirements to apply the withholding tax exemptions and reduced withholding tax rates based on EU law or the applicable double tax treaties have been extended and more formalized.

Arithmetic average price of oil exceeds US30 per barrel and applies at rates ranging from 5 to 50. This difference is due to tax treaties between these countries and the US. The social security wage base limit is 132900.

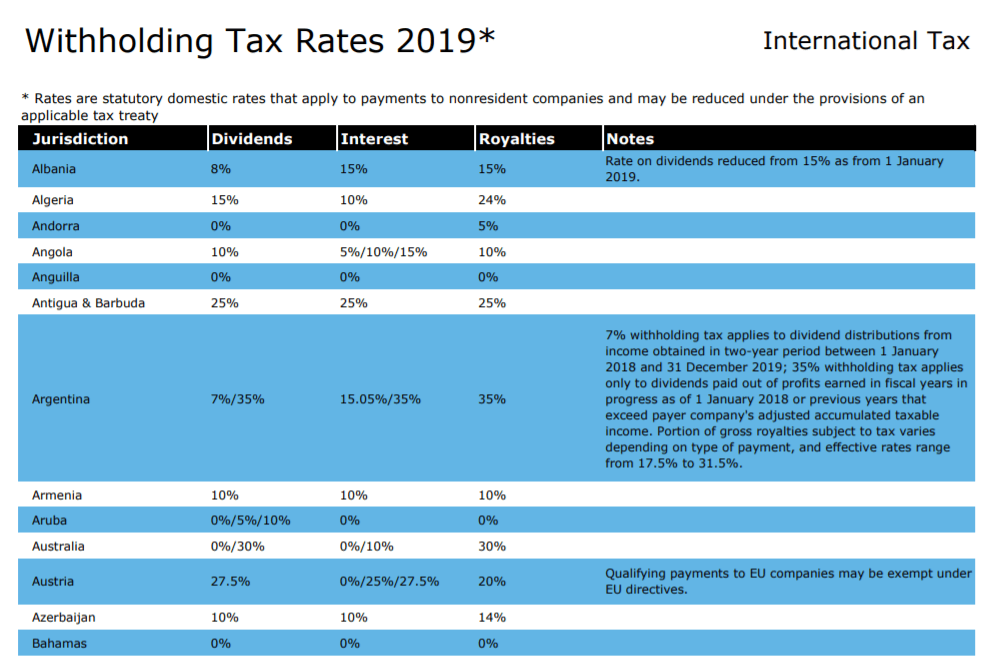

Deloitte International Tax Source DITS provides the domestic withholding tax rates for dividends interest and royalties for each DITS jurisdiction. The RD deduction in the amount of 150 percent is available already for the calendar year 2019 or a tax year which began after 1 January 2019 and the final increase of RD deduction to 200 percent will be applicable for 2020 or a tax year beginning after 1 January 2020. At the back of this Tax Guide you will find a list of the names and codes for all.

Value added taxgoods and services tax. Keep up-to-date on. The list focuses on the main indicative types of taxes.

Taxpayers need a current guide. The social security tax rate is 62 each for the employee and em-ployer unchanged from 2018. The Medicare tax rate is 145 each for the employee and employer unchanged from 2018.

The Deloitte International Tax Source DITS is an online database featuring tax rates and information for more than 60 jurisdictions worldwide and country tax highlights for more than 130 jurisdictions. Rates for Withholding Income Tax Updated to the Effect of Proposed Changes vide the Finance Bill 2018 APPLICABLE FOR TAX YEAR 2019 Nature of Payment Tax Rate Nature of Tax Filer Non-filer Advance Final Minimum Tax Page 2 SHIPPING OR AIR TRANSPORT INCOME OF NON-RESIDENTS Section 7 Division V Part I First Schedule Shipping income 8. The rate has increased from 7 to 10 for 3 years from 1 August 2019 to 31 July 2022.

Brackets for FY19 in COP. The decree provides for different rates depending on the type of contract. Companies subject to GILTI would compare a 21 percent domestic rate with a 105 to 13125 percent rate rather than a zero rate.

Turkeys Presidential Decision no. For example in developed Europe Switzerland has a very high 35 withholding tax rate for non-residents while the UK charges 0 for stocks only for Americans. Social security and Medicare tax for 2019.

842 published in the Official Gazette dated 21 March 2019 amends withholding tax WHT rates on interest obtained from deposits issued abroad and foreign exchange deposits. 25 0 0 The Parliament has adopted a 15 withholding tax. In order to benefit from a reduced rate or full tax exemption in accordance with the new regulations regardless of the value of payments made payers are required to exercise due diligence.

There is no wage base limit for Medicare tax. Geralamaniapt 935325353 0. DITS includes current rates for corporate income tax.

Data is also available for. Deloitte US Audit Consulting Advisory and Tax Services. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit.

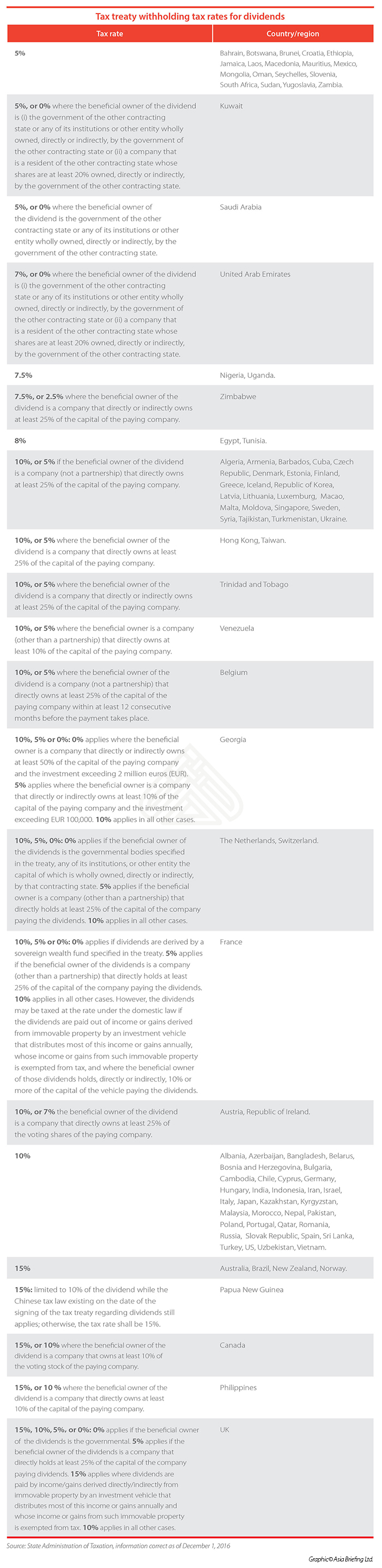

The 2019 form is. Withholding tax on dividends interest and royalties under tax treaties.

Online Tax Consulting In 2020 Online Taxes Tax Consulting Business Finance Management

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

Solved How To Record And Pay Withholding Tax On Supplier

Global Corporate And Withholding Tax Rates Tax Deloitte

Grassi Co Warning To Americans Investing In Certain Canadian Cannabis Stocks That Have A U S Presence

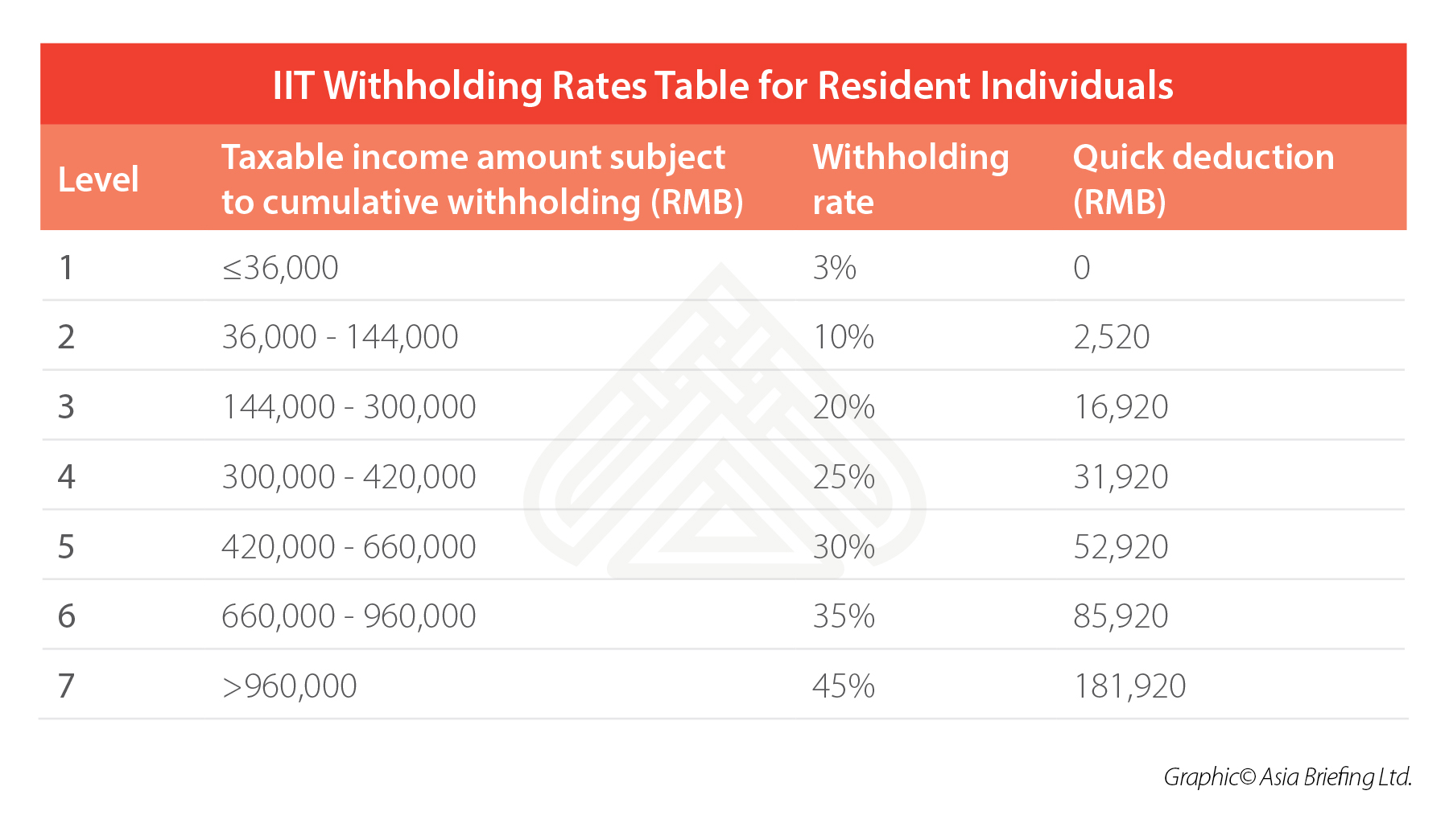

How To Calculate And Withhold Iit For Your Employees In China

Solved How To Record And Pay Withholding Tax On Supplier

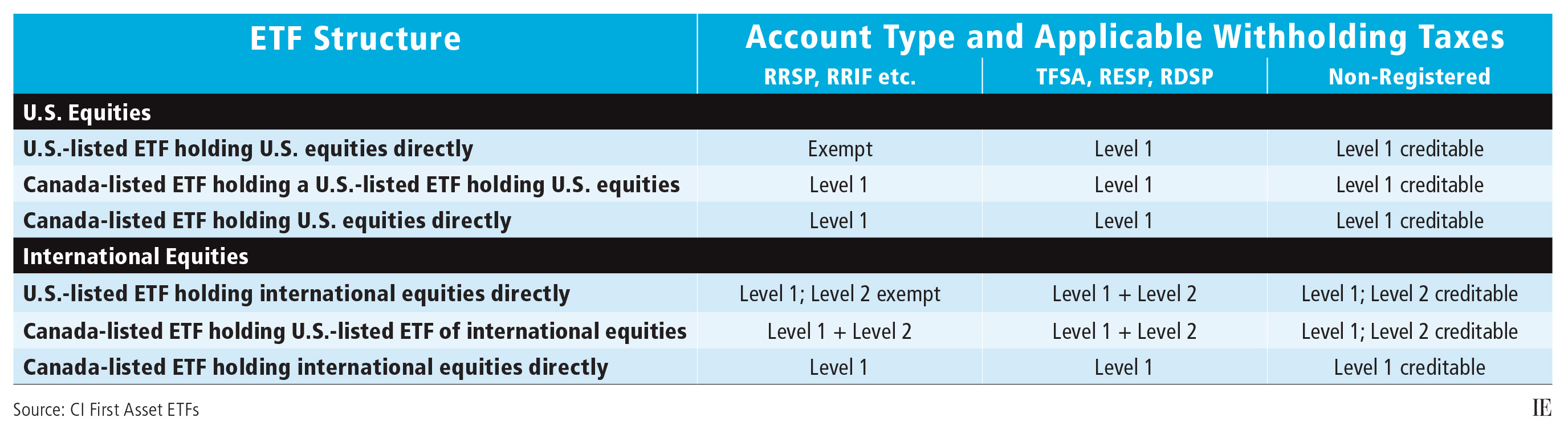

Etfs And Foreign Withholding Taxes Investment Executive

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Withholding Tax In China China Briefing News

Panama Tax Treaties Tax Panama

Global Corporate And Withholding Tax Rates Tax Deloitte

Is Dividend Withholding Tax Important In Investing Investment Moats

New Feature Global Withholding Tax In Msd365 Fo Dynamics 365 Finance Community

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Posting Komentar untuk "Global Withholding Tax Rates 2019"