Federal Withholding Tax Table 2021 Weekly

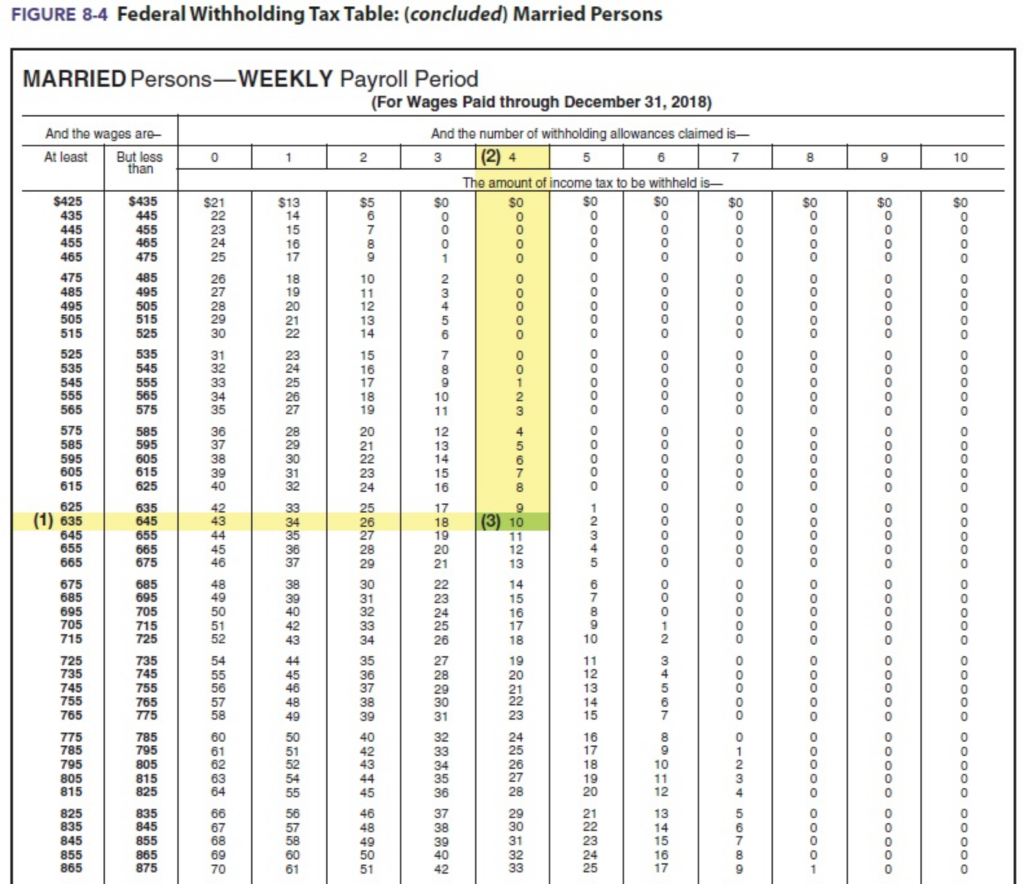

If the Form W-4 is from 2019 or earlier this method works for any number of withholding allowances claimed. 2021 tax calculator.

2021 Federal Payroll Tax Rates Abacus Payroll

The Social Security tax withholding is ranked at 62 by the federal government approximately the base of 2021 yearly wage at 142800.

Federal withholding tax table 2021 weekly. Federal Withholding Tables 2021 As with every other before year the newly altered Weekly Federal Tax Withholding Table was launched by IRS to prepare with this years tax period. The extension of the low and middle income tax offset announced at the Federal Budget is only. You should use this table if you make any of the following payments on a weekly basis.

This technique is a 4-step method in order to find the final amount of tax withheld. Weekly Tax Table 2021 The complete guidelines of Federal Income Tax Withholding are released by the IRS Internal Revenue Service each year. There is no commitment to pay for Social Security for the earned income above this base limitation and also the rate is equivalent for every single employee up to this limitation of income.

Read further to recognize exactly how the procedure functions formally. Federal Income Tax Withholding Method. Where 151978 NI 216511 BPAF BPAF 12421.

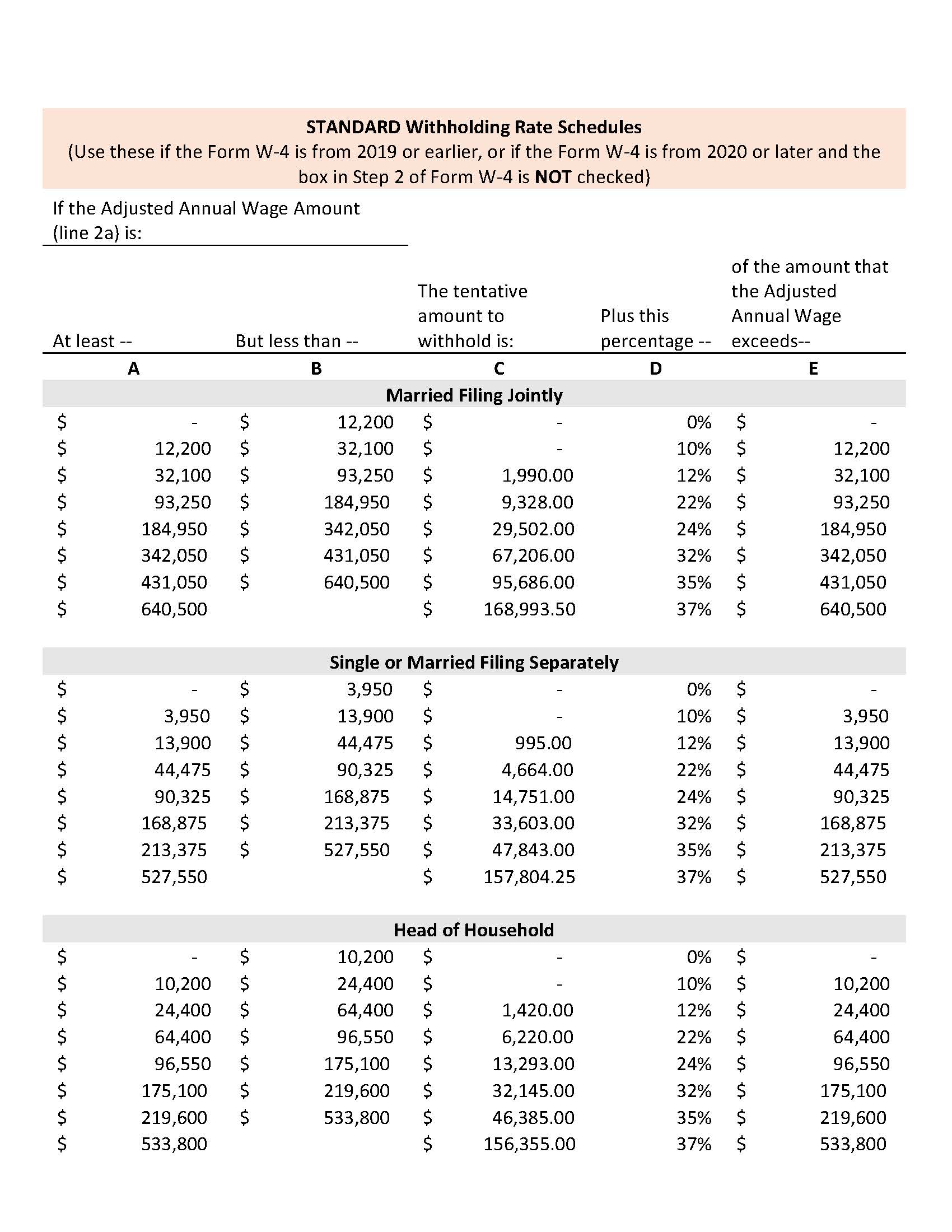

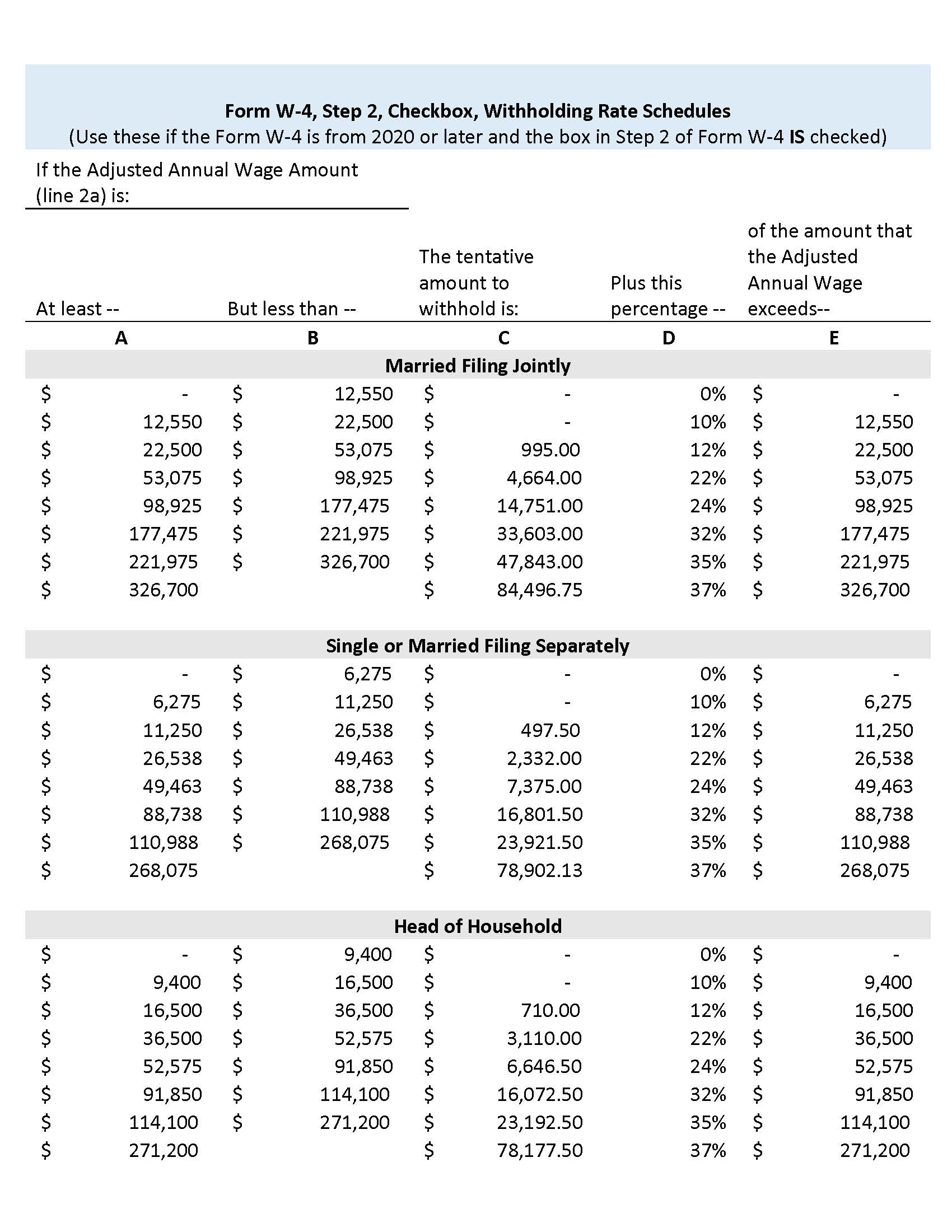

Federal Withholding Tables 2021. Federal Withholding Tables 2021 As with any other before year the newly adjusted Weekly Tax Table 2021 was introduced by IRS to make for this particular years tax time of year. Federal Withholding Tables 2021 The IRS has just lately issued the newly publicized Federal Income Tax Withholding Methods use within 2021.

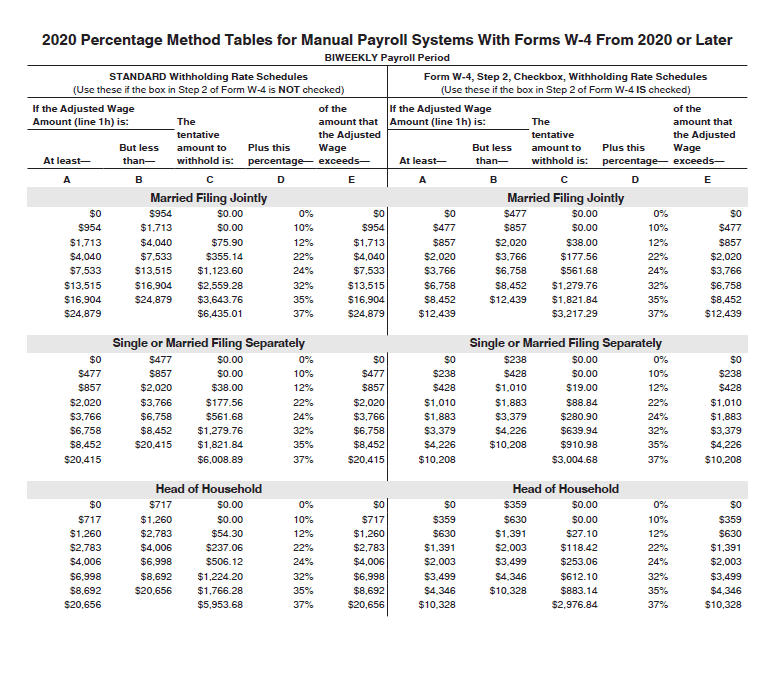

Now use the 2021 income tax withholding tables to find which bracket 2020 falls under for a single worker who is paid biweekly. Weekly Federal Tax Withholding Chart The full directions of Federal Income Tax Withholding are issued by the IRS Internal Revenue Service each year. This publication known as Publication 15-T is utilized to declare the real difference in tax level and to offer employers the ways to find out how much wage they should withhold from the workers.

This year of 2021 is also not an exception. There are no changes to most withholding schedules and tax tables for the 202122 income year. Using the chart you find that the Standard withholding for a single employee is 176.

Salary wages allowances and leave loading to employees. You find that this amount of 2020 falls in the At least 2000 but less than 2025 range. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Weekly tax table. Tax tables that continue to apply from 1 July 2021. Review further to recognize exactly how the procedure functions officially.

We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2021. One of them is the wage bracket technique. One of a suite of free online calculators provided by the team at iCalculator.

Weekly tax table 2021 excel Federal Withholding Tables 2021. Use the Withholding lookup tool to quickly work out the amount to withhold XLSX 34KB This link will download a file. This year of 2021 is also not an exemption.

Weekly Tax Table The total guidelines of Federal Income Tax Withholding are issued by the IRS Internal Revenue Service every year. Important information July 2021 updates. If you have an automated payroll system use the worksheet below and the Percentage Method tables that follow to figure federal income tax withholding.

The federal Basic Personal Amount has been changed to the following. The Weekly Tax Table 2021 can be used after you follow the method to determine the federal tax withholding. You might use the tables to determine the sum.

2021 payroll federal tax weekly withholding tablepage16 2021 pay periods federal tax weekly withholding tablepage16 2021 pay schedule 3 federal tax weekly withholding tablepage16 gsa opm federal pay scale. For 2021 employers can use a BPAF of 13808 for all employees while payroll systems and. This method works for Forms W-4 for all prior current and future years.

It reflects some income tax changes recently announced which if enacted by the applicable legislature as proposed would be effective January 1 2021. Federal Withholding Tables 2021. Tax tables that were updated and apply from 1 July 2021.

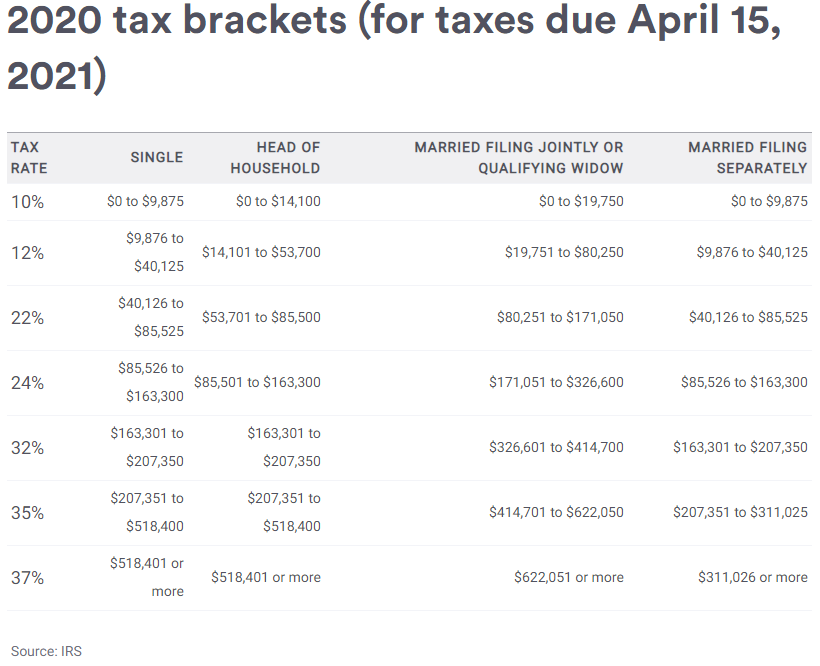

It provides a number of changes including the tax bracket changes and the tax rate annually together with the alternative to employ a computational connection. It provides several changes including the tax bracket changes and the tax price annually along with the option to employ a computational bridge. This year of 2021 is also not an exception.

Enter your Weekly salary and click enter simple. It provides a number of changes like the tax bracket changes and the tax level yearly along with the choice to utilize a computational connection. This publication is the Payroll Deductions Tables for Manitoba effective January 1 2021.

If you use this method you will be required to do. Federal Withholding Tables 2021 Just like any other prior year the freshly modified IRS Weekly Withholding Income Tax Table was introduced by IRS to make with this years tax period. Read additionally to comprehend how the procedure functions officially.

For payments made on or after 13 October 2020. This method also works for any amount of wages. Federal and State Tax calculator for 2021 Weekly Tax Calculations with full line by line computations to help you with your tax return in 2021.

How To Calculate Payroll Taxes For Your Small Business The Blueprint

New Federal Income Tax Rates For 2021 Money Savvy Mindset

Federal Withholding Table 2021 Payroll Calendar

How To Calculate Income Tax In Excel

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Calculating Federal Income Tax Withholding Youtube

2021 Federal Tax Brackets What Is My Tax Bracket

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Income Tax In Excel

Use A The Percentage Method And B The Chegg Com

2020 2021 Federal Income Tax Brackets

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Calculate Income Tax In Excel

Computing Federal Income Tax Using The Table Chegg Com

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Posting Komentar untuk "Federal Withholding Tax Table 2021 Weekly"