Employment Tax Rates Maryland

Every August new tax rates are posted on this website. Employers must withhold Maryland income tax for nonresidents using the 175 rate.

States With Highest And Lowest Sales Tax Rates

PERCENTAGE INCOME TAX WITHHOLDING RATES Maryland Resident Employees who work in Delaware.

Employment tax rates maryland. State Unemployment Tax Rate In Maryland the new employer SUI state unemployment insurance rate is 260 percent on the first 8500 of wages for each employee. Table of contribution rates. For 2021 tax rates for experienced employers are to range from 220 to 1350 compared with 030 to 750 in 2020.

Refer to the withholding formula for information on the individual county rates. Construction companies headquartered in another state will be assigned a tax rate. Both employers and employees are responsible for payroll taxes.

Detailed Maryland state income tax rates and brackets are available on this page. Maryland Department of Labor website The SUI taxable wage base remains at 8500 for 2021. The rate for new employers will be 23.

12 240 Percent Local Income Tax. The local income tax is calculated as a percentage of your taxable income. Maryland employers are assigned one of three different types of tax rate.

Local rates range from 225 to 320. How are my tax rates determined. Employers benefit ratio contribution rate 0000 - 220 0001 - 0027 310.

The new account rate the standard rate or the experience earned rate. For tax year 2020 Marylands personal tax rates begin at 2 on the first 1000 of taxable income and increase up to a maximum of 575 on incomes exceeding 250000 or 300000 for taxpayers filing jointly heads of household or qualifying widowers. New Account Rate New Employer means an employing unit that does not qualify for an earned rate.

1737 Chevy Chase Village. The range of tax rates for contributory employers in 2021 will be between 22 to 135 which is the Table F tax rate schedule. The Maryland State income tax formula contains a computation for Maryland county tax.

The local tax rate youll pay in Maryland is based on where you live not where you work. However each state specifies its own tax rates. 14 265 Percent Local Income Tax.

Be sure to use the correct rate for the local. 034 Montgomery County 06948. Each county in Maryland charges a different rate and they range from 25 to 32.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each are set by the IRS. You should report your local income tax amount on line 28 of Form 502. Under Maryland UI law there is a separate rate for new employers that are in the construction industry and headquartered in another state which will be 70 in 2021.

The tax rate for a new employer will be the average of the rates for all employers in the State during the last five years. Employers with previous employees may be subject to a different rate. Maryland State Unemployment Tax For 2021 Marylands Unemployment Insurance Rates range from 22 to 135 and the wage base is 8500.

The Maryland income tax has eight tax brackets with a maximum marginal income tax of 575 as of 2021. A financial advisor in Maryland can help you understand how taxes fit into your overall financial goals. Local officials set the rates which range between 225 and 320 for the current tax year.

Counties are responsible for the county tax rates local towns and cities are responsible for their tax rates and the state is responsible for the states tax rates. Plus employees also have to take local income taxes into consideration. 10 225 Percent Local Income Tax.

2020-2021 COUNTY MUNICIPALITY TAX RATES TownSpecial Taxing County District Tax Rate Tax Rate Galena 0235 Millington. Detailed Maryland state income tax rates and brackets are available on this page. The tax rate for new non-construction employers is to be 260 unchanged from 2020.

When you think of Maryland income taxes think progressive. Nonresidents are subject to a special tax rate of 225 in addition to the state income tax rate. 10 225 Percent Local Income Tax.

By law the nonresident tax rate must equal the lowest local income tax rate paid by Maryland residents currently 175 combined with the top state tax rate. In the event an employee does not file a State withholding exemption certificate then Single and zero 00 exemptions will be used as the basis for withholding. Your local income tax is based on where you live - not where you work or where your tax preparer is located.

Tax rates range from 2 to 575. Each tax rate is reported to the Department by local governments each year. Maryland Resident Employees who work in Delaware.

The new employer rate for 2021 continues at 26 except for a new foreign contractor account where the rate is 70 for 2021 up from 45. Marylands 2021 unemployment taxable wage base will also remain at 8500 for 2021 unchanged from 2020. The special nonresident tax rate has increased from 125 to 175 in 2016.

Bir Withholding Tax Table 2018 Tax Table Withholding Tax Table Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Do Marginal Income Tax Rates Work And What If We Increased Them

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Do Marginal Income Tax Rates Work And What If We Increased Them

Understanding Estate Tax And How It Works In 2020 Estate Tax Death Tax Inheritance Tax

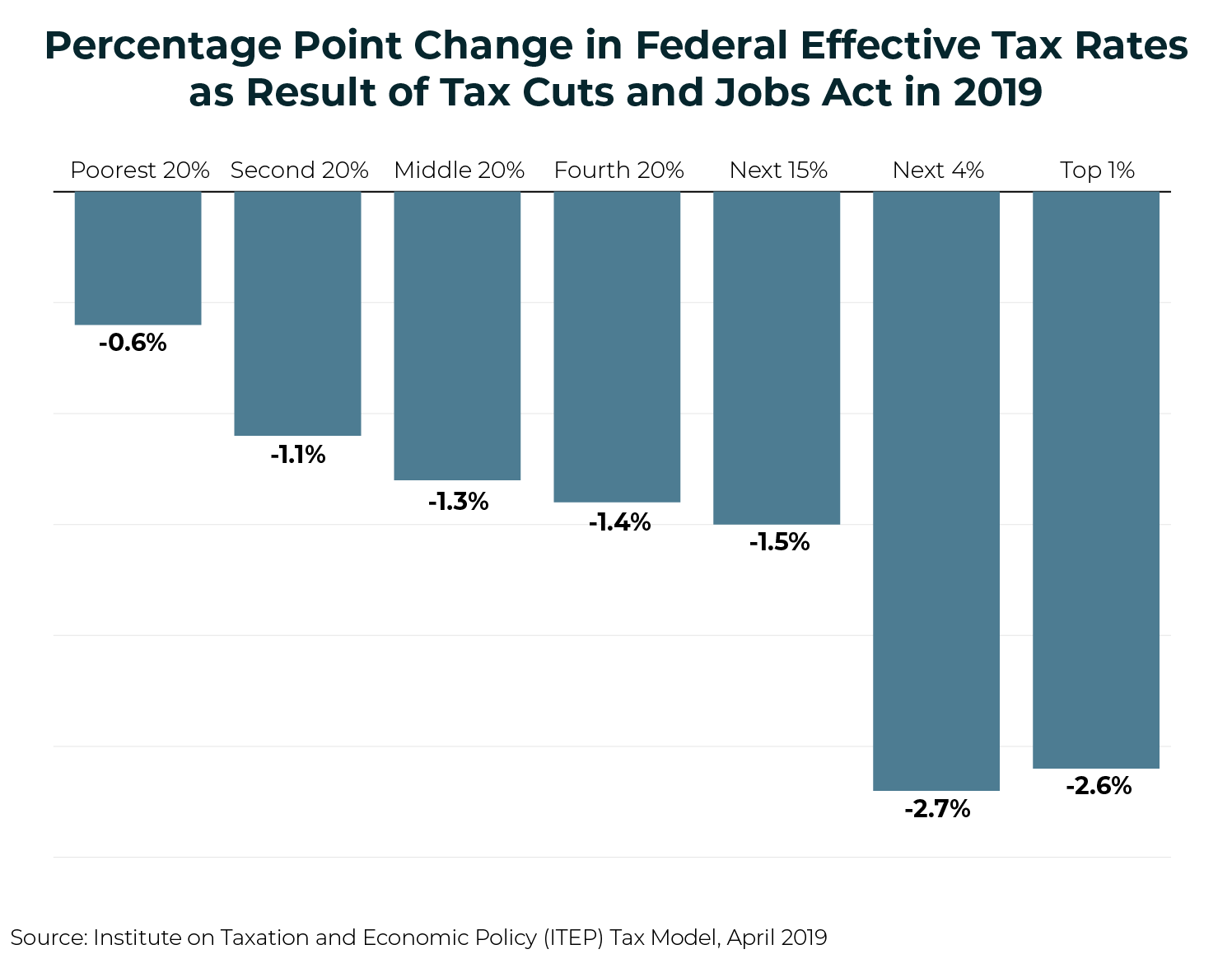

Who Pays Taxes In America In 2019 Itep

2017 Revenue Memorandum Circular No 105 2017 Source Www Bir Gov Ph Manila Bulletin Tax Table Withholding Tax Table Tax

How Do Marginal Income Tax Rates Work And What If We Increased Them

Who Pays Taxes In America In 2019 Itep

The Dual Tax Burden Of S Corporations Tax Foundation

What We Offer Networking Event That S Love Networking

High Taxes Mean Less Revenue For Some States Personal Liberty Map Illinois States

Wisconsin Sales Tax Small Business Guide Truic

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Posting Komentar untuk "Employment Tax Rates Maryland"