Employment Tax Rates Delaware

File Quarterly UI Tax Reports and Payments. 58 2009 State Business Tax Climate Index.

Global Corporate And Withholding Tax Rates Tax Deloitte

Tax rate of 0 on the first 2000 of taxable income.

Employment tax rates delaware. Tax rates range from 0 to 66. Withholding of Delaware Income Tax Regulations Employers Duties and Withholding Tables. 0 - 66 Sales tax.

In Delaware the average income tax rate for counties and large municipalities weighted by total personal income within each jurisdiction is 016 Tax Foundation Background Paper No. It applies to all the earnings you withdraw from your Delaware business. New Employer Rate.

The minimum and maximum tax rates are 3 and 82 respectively. Workers do not pay any part of the Delaware tax and employers can make no payroll deductions for this purpose. Employment Training Investment Assessment The fifth component of your tax rate is the Employment and Training Investment Assessment ETIA.

In recent years established employer rates have ranged from 03 to 82. Delaware does not have any reciprocal agreements with other states. Tax rate of 22 on taxable income between 2001 and 5000.

There are seven tax brackets in the state and the highest income tax rate is 660. The Division of Revenue will approve an alternate formula that considers the allowable standard deduction and tax credits claimed by the employee using the tax rate schedule on the balance of the wages paid. The assessment is imposed on each employer paying contributions under the Texas Unemployment Compensation Act as a separate assessment of 010 percent of wages paid by an employer.

Taxes in Delaware Income tax. An approved method based on. This tax is also known as FICA Social Security or Medicare tax.

The State of Delaware has a progressive income tax similar to how the federal income tax works. Employers covered by Delawares wage payment law must pay wages at least once in a calendar month. Contact 302 761-8085 Employment Training 302 761-8328 Registered Apprenticeship apprenticeshipdelawaregov Registered Apprenticeship 302-761-8161 DWIB DeneishaTurnerDelawaregov DWIB.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each are set by the IRS. Delaware is known as a tax haven but even residents of the First State arent exempt from taxes. Delaware requires employers to withhold state income taxes from employee paychecks in addition to employer paid unemployment taxes.

1st Quarter returns and payments due on or before April 30. Employers use the federal W-4 form completed by employees when calculating employee wage withholdings for Delaware. The amount of credit an employer receives is.

Delaware JobLink Employer Programs RFP Contract Services Delaware Workforce Development Board DWIB Individual Training Account ITA Forms Delaware One Stop. Taxable Wage Base 000s. There are also local income taxes in Wilmington.

Unemployment tax rates are to be the same as in 2019 Rates are to range from 03 to 82 Delawares range of unemployment tax rates for experienced employers is to be unchanged for 2020 a spokeswoman for the state Labor Department said Dec. 16 Replies In Total. Find Withholding Due Dates NOTE.

However each state specifies its own tax rates. Tax rate of 39 on taxable income between 5001 and 10000. The employer must withhold at a rate so that no tax is estimated to be due on the wages paid when the employee files his or her personal income tax return.

Assessed employers can receive a credit up to 54 toward the 60 federal unemployment tax. All Delaware LLC business members or managers who take profits out of the LLC will need to pay self-employment tax. Effective for tax periods after December 31 2013 the income tax rate for income in excess of 60000 will decrease to 66.

Use the Delaware paycheck calculators to see the taxes on your paycheck. 056 average effective rate Gas tax. You can find Delawares tax rates here.

Accumulated tax assessments paid by employers who are subject to Delawares quarterly payroll tax on wages paid to each employee during the year. Report Hiring with our office using the Delaware Business One Stop. The more money your employees make the higher the income tax.

Employees who make more than 60000 will hit the highest tax bracket. If you have a question about your Delaware tax return you can contact the Delaware Department of Finance via email at email protected or call the general income tax. Both employers and employees are responsible for payroll taxes.

Labor The mission of the Delaware. 23 cents per gallon of regular gasoline 22 cents per gallon of diesel. The First State has a progressive income tax system with income tax rates similar to the national average.

All wages due must be paid within seven days from the close of the pay period. In Delaware UI tax reports and payments assessments are due by the end of the month following the end of each calendar quarter. Local Taxes There are local taxes in Delaware.

If youve newly started a business with employees or are about to hire employees make sure you report hiring to avoid penalties. For single taxpayers living and working in the state of Delaware. On top of paying Delaware state taxes employees who live or work in Wilmington have to pay a local.

How Does Getaround Handle Taxable Income Income 1099 Tax Form Tax Season

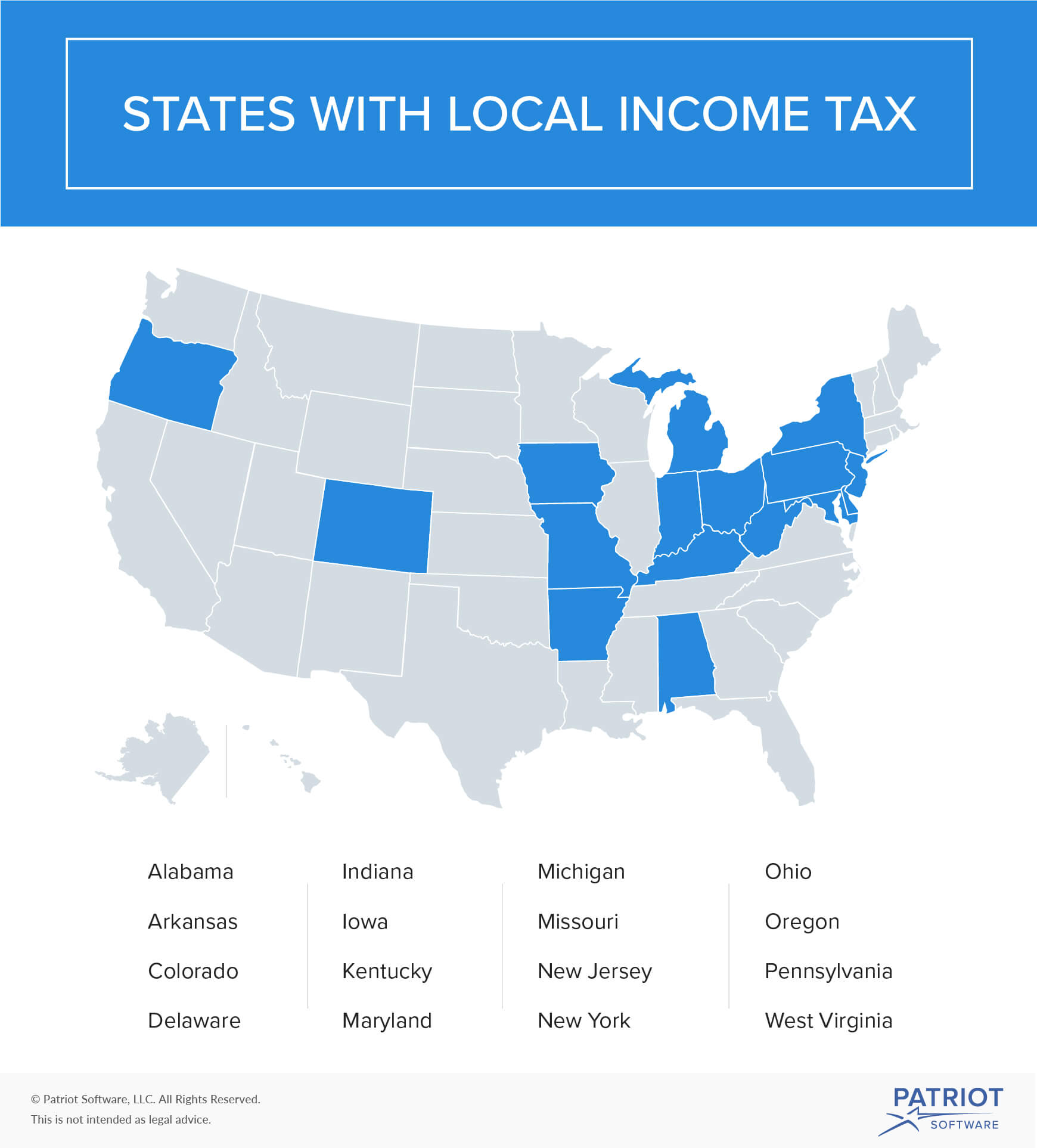

What Is Local Income Tax Types States With Local Income Tax More

Http Www Mymoneyblog Com Images 0902 Scorp Gif Self Employment Income Tax S Corporation

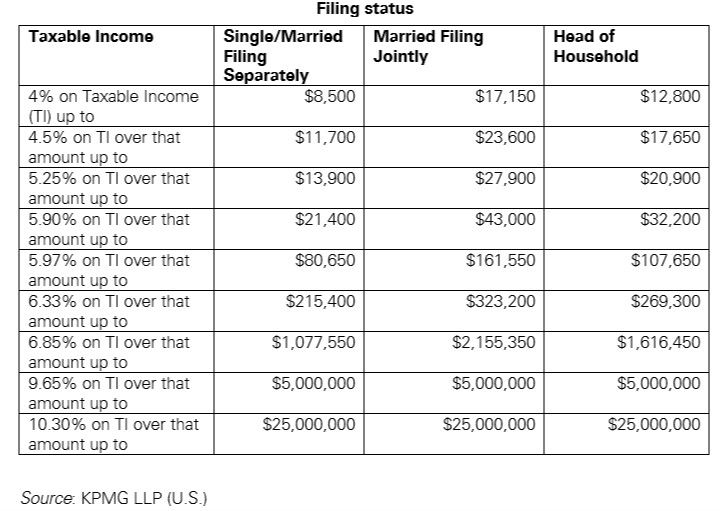

Us New York Implements New Tax Rates Kpmg Global

Global Corporate And Withholding Tax Rates Tax Deloitte

The Ultimate List Of Tax Deductions For Online Sellers Tax Deductions Business Tax Deduction

2021 Federal State Payroll Tax Rates For Employers

Sui Sit Employment Taxes Explained Emptech Com

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

What Is Ess Features Of An Employee Self Service Portal Self Service Employee Self

Trump S Proposed Payroll Tax Elimination Itep

Sui Sit Employment Taxes Explained Emptech Com

Trump S Proposed Payroll Tax Elimination Itep

The Dual Tax Burden Of S Corporations Tax Foundation

Sui Sit Employment Taxes Explained Emptech Com

2021 Federal State Payroll Tax Rates For Employers

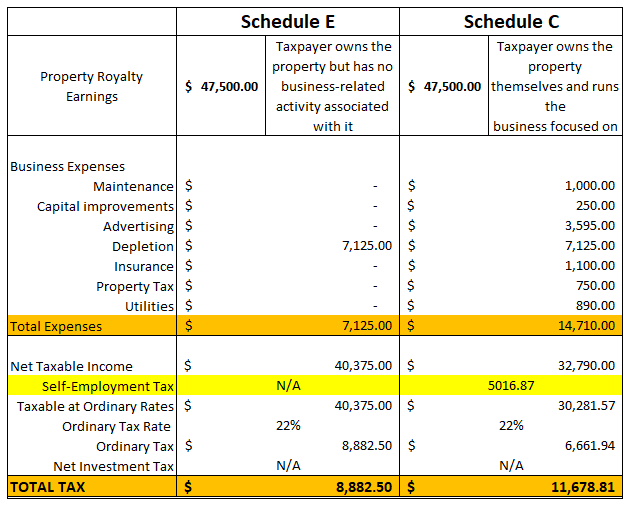

Royalty Income Taxes For 2020 With Filling Procedures Taxhub

How Much Should I Set Aside For Taxes 1099

Tax Withholding For Pensions And Social Security Sensible Money

Posting Komentar untuk "Employment Tax Rates Delaware"