Australian Withholding Tax Rates For Non Residents

The 2017 budget measure to deny access to foreign and temporary tax residents to the CGT main residence exemption from 730PM AEST on 9 May 2017 excludes properties held prior to this date until 30 June 2020. The most common types of income that could be subject to non-resident withholding tax include.

Australian Royalty Withholding Tax Au Rwt Summaries Envato Author Help Center

Cant claim the tax-free threshold.

Australian withholding tax rates for non residents. The calculator will use non-resident tax rates and will show your weekly fortnightly and monthly salary breakdown. You dont have to be citizen or permanent resident of Australia to be treated as Australian resident for tax purposes. Significantly an Australian tax resident can access an 18200 tax free threshold and a lower 19 marginal tax rate for income below 37000 which is not available to non-residents.

The marginal tax rates which apply to a resident and a non-resident are different. Provided you their tax file number TFN or Australian business number ABN. Tax returns are required to be filed by a resident individual whose total income derived from sources in and out of Australia is more than the minimum threshold AUD18200 for 201920.

Dividends paid to a non-resident parent are subject to withholding tax on the unfranked portion of the dividend at a rate of 30 percent or lower if an applicable tax treaty applies. You may also have to withhold tax if any of the above payment types have been dealt with for example reinvested or capitalised on behalf of the non-resident. Significantly an Australian tax resident can access an 18200 tax free threshold and a lower 19 marginal tax rate for income below 37000 which is not available to non-residents.

Further information for non residents. Method 1 Non-resident tax. Superannuation payment for non-resident for tax purposes but not a temporary resident A non-resident who is not a temporary resident is subject to the same conditions of release as a resident.

Usually there is some confusion when it comes to non-resident or foreign resident for tax purposes in Australia. The payment is made to a resident of a country which has a tax treaty with Australia and a lower rate. If they are Australian residents and have not provided their TFN or ABN you must withhold at.

The rates shown apply to dividends on both portfolio investments and substantial holdings other than dividends paid in connection with an Australian PE of the non-resident. Non-resident withholding taxes are a final tax on certain Australian sourced income that is not subject to income tax. For temporary residents non-employment income derived from sources outside of Australia is generally ignored for this purpose.

Unfranked dividends paid to non-residents are exempt from dividend WHT to the extent that the dividends are declared by the company to be conduit foreign income. The withholding rate for non-residents is. However a foreign resident.

Foreign residents capital gains tax. The super fund will withhold tax of 84000 35 per cent of the taxable component and pay Jenny a net amount of 166000. Payments to foreign residents.

To work out the foreign resident insurer tax on that payment using the 10 method apply the company tax rate of 30 to 10 of the insurance premiums paid that is 30 10 1000 30. Conduit foreign income rules can apply to reduce the Australian tax liability on dividends paid to a foreign resident by an Australian holding company. How foreign resident insurer tax is different Foreign resident insurer tax is different to withholding taxes.

The legislation is here. It is your responsibility to check if your foreign resident worker can legally work in. Australian expatriates or foreign investors who are non-resident for Australian tax purposes pay these rates of withholding tax on certain Australian sourced investment income.

Canadian financial institutions and other payers have to withhold non-resident tax at a rate of 25 on certain types of Canadian-source income they pay or credit you as a non-resident of Canada. Australian Non-Resident Withholding Tax Rates. Withholding rate The withholding rate is.

The withholding requirements for foreign resident employees are similar to those that apply to Australian workers. 10 for interest payments 30 for unfranked dividend and royalty payments. ATO Tax Rates 2019-2020 Year Non-Residents The 2018 Budget announced a number of adjustments to the personal tax rates taking effect in the years from 1 July 2018 through to 1 July 2024.

The marginal tax rates which apply to a resident and a non-resident are different. Non resident tax rates all years. These rates apply to all payees unless.

Is subject to special rates of withholding. The tax scale change included in the following table apply in each of the 4 tax years 2018-19 2019-20 2020-21 and 2021-22. Non-residents do not pay the Medicare Levy.

10 for interest payments and 30 for unfranked dividend and royalty payments. As an Australian resident you generally withhold tax from the following types of payments you make to someone who is not an Australian resident.

Tax Treaties Database Global Tax Treaty Information Ibfd

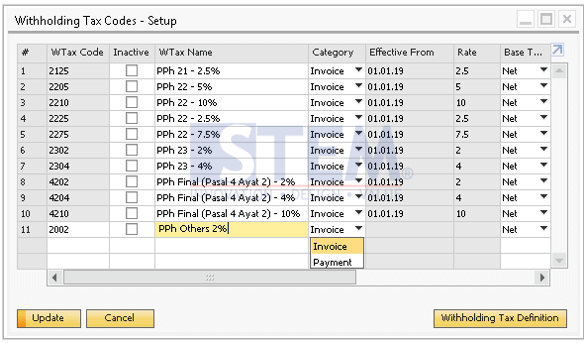

Step By Step Document For Withholding Tax Configuration Sap Blogs

Withholding Tax Sap Help Portal

Step By Step Document For Withholding Tax Configuration Sap Blogs

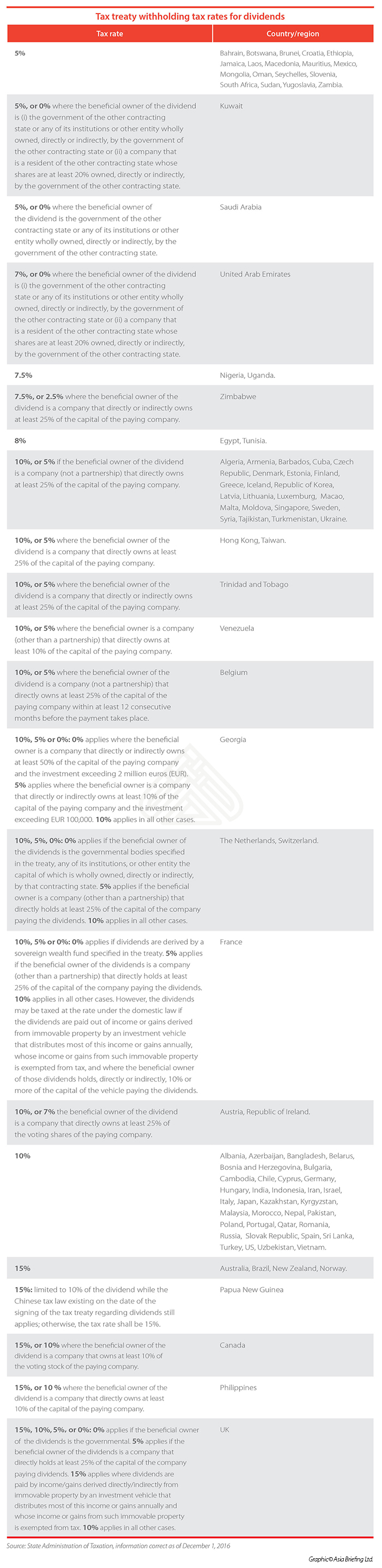

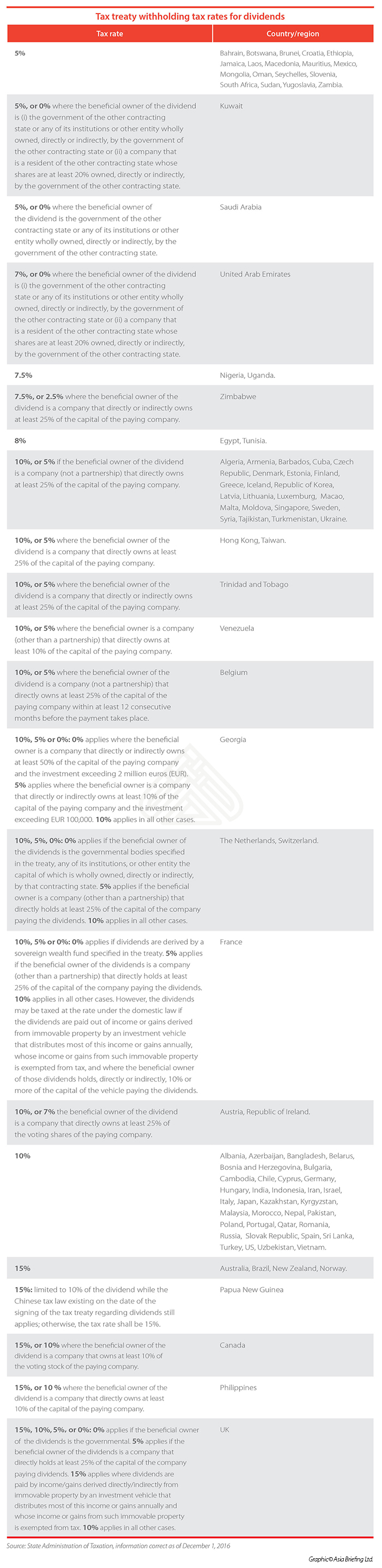

Withholding Tax In China China Briefing News

Global Corporate And Withholding Tax Rates Tax Deloitte

Australian Withholding Tax Artist Escrow Services Pty Ltd

Manage Withholding Taxes Odoo 14 0 Documentation

Step By Step Document For Withholding Tax Configuration Sap Blogs

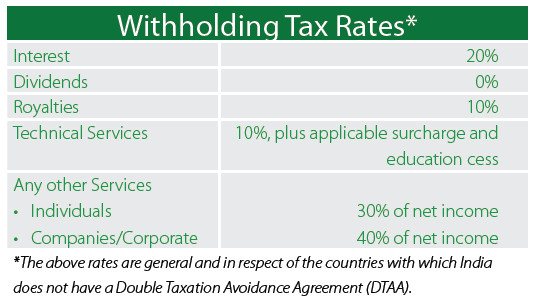

Asiapedia Withholding Tax Rates In India Dezan Shira Associates

Step By Step Document For Withholding Tax Configuration Sap Blogs

Manage Withholding Taxes Odoo 14 0 Documentation

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Global Corporate And Withholding Tax Rates Tax Deloitte

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Manage Withholding Taxes Odoo 14 0 Documentation

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Posting Komentar untuk "Australian Withholding Tax Rates For Non Residents"