Withholding Tax Table Excel Format

Calculate your employees total weekly earnings add any allowances and irregular payments that are to be included in this weeks pay to the normal weekly earnings ignoring any cents. Inputs are the basic salary half of monthly salary deductions other allowances and overtime in hours.

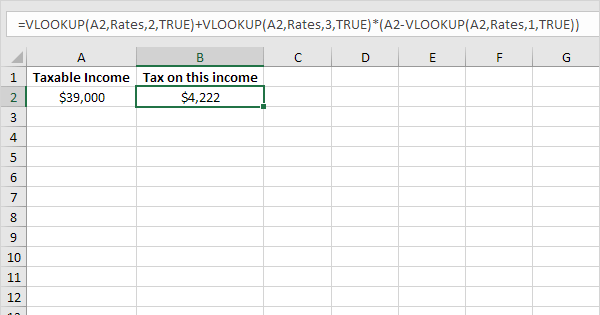

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

VLOOKUP G4 tax_table2TRUE where tax_table is the named range C5D8.

Withholding tax table excel format. Download the Excel Spreadsheet XLSX. 2021 Income Tax Withholding Tables Changes Examples Details. Formatting the Excel cells as text before pasting the data.

I use them for my own payroll calculator. How to Use the Tax Withholding Assistant. Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2021.

Add a Tax column right to the new tax table. I have a loan with a variable beginning balance and irregular payments with annual large payment. This formula determines a single tax rate.

To calculate a tax rate based on a simple tax rate table you can use the VLOOKUP function. The withholding allowance is determined by multiplying the number of allowances specified in the W-4 form by the amount indicated in the following table. To generate the WHT declaration form reports in Microsoft Excel define an ER format on the General ledger parameters page.

With a taxable income of 50000 VLOOKUP in approximate match mode matches 39475 and returns 4543 the total tax. On the Withholding tax tab in the WHT declaration format mapping field select WHT Declaration Excel. Go to Tax Setup General ledger parameters.

To automatically calculate the tax on an income execute the following steps. Now use the 2021 income tax withholding tables to find which bracket 2020 falls under for a single worker who is paid biweekly. On the second sheet create the named range Rates.

In the Cell F6 type the formula E6D6 and then drag the AutoFill Handle until negative results appear. Click on the link to download template. Register for Income Tax.

For example employee contribution to a 401k. Bir Tax Table 2017 Excel Format. Income Tax basics.

If we were to put False in the Approximate Match. Loan Amortization for randomirregular payments figures days between payment dates. This calculator was originally developed in Excel spreadsheet if you wish to get a copy please subscribe to our Youtube channel and contact us via our Contact Us Page.

Income Tax due dates. At a minimum usually a withholding allowance is subtracted from gross wages. The basic formula is vlookup lookup value table array column to return Approximate Match TrueFalse In cell E3 type this formula VLOOKUP E2A3B82TRUE We can see in this example that the formula returned a Tax Rate of 22 because 100000 falls between 82000 and 158000.

What I am saving for when all else fails. In the example shown the formula in G5 is. The Tax Withholding Assistant is available in Excel format.

In addition other nontaxable amounts are also subtracted. The obvious solution of copying row by row into one Excel cell. Input the amount from step 1 into the Withholding lookup tool XLSX 34KB as per instructions in the tool.

Valuation of Immovable Properties. Be sure that your employee has given you a completed Form W-4. Click into the cell you will place the income tax at and sum all positive numbers in the Tax column with.

Downloads Withholding 5 comments on How to Download Withholding Tax Statement Template. Withholding Tax Statement Template Category. File Income Tax Return.

Withholding tax on compensation tax calculator compute your new income withholding tax table for compensation tax tables and bir income rates. You find that this amount of 2020 falls in the At least 2000 but less than 2025 range. Lookup value is inc G4 Lookup table is rates B5D11 Column number is 3 Cumulative tax.

To work out the withholding amount. This will calculate the semi-monthly withholding tax as well as the take home pay. Then Excel would figure days since last payment interest amount principal.

The various options for Paste Special The closest I got was inserting the table as a Document Object which could be a workaround I guess. VLOOKUP inc rates31 returns 4543. Change your personal details.

Match type is 1 approximate match. If income is 39000 tax equals 3572 0325 39000 - 37000 3572 650 4222. Income Tax Return Form.

Based on collections Would like to enter payment and date. Active Taxpayer List ATL Withholding Tax Rates.

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Excel Formula Help Nested If Statements For Calculating Employee Income Tax

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

Tax Rates In Excel Easy Excel Tutorial

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

How To Calculate Federal Withholding Tax In Excel How To Calculate Federal Withholding Tax In Excel With Vlookup

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

Income Tax Calculation Formula With If Statement In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Posting Komentar untuk "Withholding Tax Table Excel Format"