What Is Withholding Tax In Jamaica

The minister of finance and planning Dr the Honourable Peter Phillips and the commissioner general Tax Administration Jamaica TAJ Mr Ainsley Powell recently. Technical service fees The same concept about CARICOM applies.

Lowtax Global Tax Business Portal Domestic Corporate Taxation Withholding Tax

Income Tax and Pensioners.

What is withholding tax in jamaica. The current rates of corporate income tax CIT are as follows. The taxpayer will be entitled to claim as a tax credit the amount withheld in the year of assessment. Tax assessments and audits.

However where withholding is not possible eg. Personal Income Tax Rates. Tax is deducted from interest paid to Jamaican residents if payment is made by a prescribed person.

Because the employer is not resident in Jamaica the taxpayer will be required to make payment of estimated tax in quarterly instalments. Lower rates of withholding are possible provided that the recipient is resident in a country that has concluded a double taxation treaty DTT with Jamaica. Tourism Operators to Begin Collecting WTSS Starting November 1 2015.

The withholding tax on specified services is aimed at capturing persons liable to income tax but who are under reporting or not registered. I ncome Tax for Individuals Businesses Income Tax Rates Thresholds and Exemption 2003-2020 Notes and Instructions for completion of Returns of Income Tax Payable IT01 - IT05. The Withholding Tax will be imposed on specified services at a rate of 3.

PwC notes that at this time only government ministries departments and agencies as well. The concept of withholding tax is not new to Jamaica. In case when the withholding is not possible as in the case when the employer is not resident in Jamaica the taxpayer is required to pay the estimated tax in quarterly installments.

Payments made by banks and financial institutions to local entities or individuals in the case of interests on bank deposits or financial investments are subject to income tax withholding. Tax is withheld at the rate of 15 where a dividend is paid by a company resident in Jamaica to a resident individual shareholder regardless of shareholding. Income Tax Withholding Return.

Dividends paid by a local entity to a local individual are subject to income tax withholding. Withholding tax at this link. Income Tax Withholding Certificate.

2020 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in Jamaica. Tax is imposed on certain sources of income such as interest dividends royalties and fees by way of withholding at a rate of 33 for non-resident corporations. The interest payable on certain securities issued by the government of Jamaica primarily to non-residents has.

Where interest is paid by a prescribed person tax is deducted at source at the rate of 25 see the Withholding taxes section for more information. PwC-Jamaica-Tax-Newsletter-3-Withholding-Tax-Regime which was released ahead of the initially scheduled implementation date with commentsconsiderations based on information available at that time. This form is to be completed and submitted with supporting documents by Tax Withholding Agencies for specified services at the rate of 3.

HOW SHOULD WITHHOLDING TAX BE DEALT WITH. Income Tax and School Leavers. September 1 2015 Implementation of Withholding Tax on Specified Services.

The Tax Withholding Agent should pay over the amount that is with-held to the Commissioner General. It is expected that this tax measure will assist in the broadening of the tax base increased reporting compliance and improved revenue collection. If you are looking for an alternative tax.

Income tax PAYE is withheld from emoluments. You are viewing the income tax rates thresholds and allowances for the 2020 Tax Year in Jamaica. However any excess credit for that year of assessment may be claimed as a refund or.

Income tax PAYE is withheld from emoluments. Please note that the new legislation is being introduced on a phased basis. Royalties The withholding tax on royalties paid to a resident of a CARICOM country is 15 and 20 on royalties paid to reident of any other counttry or to a resident of St.

Income Tax Withholding Certificate The Tax Withholding Certificate TWC is to be completed with supporting documents attached and given to suppliers of service whose invoices qualify for the 3 tax withholding. Implementation of Withholding Tax on Specified Services date postponed. This information is only a Guide and is not a substitute for the Income Tax Act and other relevant Legislation.

Implementation of Withholding Tax on Specified Services date postponed The Ministry of Finance and Planning MOFP is advising that the implementation of withholding tax on specified services is postponed until further notice. Law as the Tax Withholding Agent must withhold three percent 3 of the gross amount to be paid ie. These agents will be responsible for not only withholding the three per cent tax but also to issue the specified service provider with a withholding tax certificate in the prescribed form with.

Employers with part-time workers are reminded to withhold tax at 25 of the gross amount and to advise these workers with no other employment to contact the Tax Administration Jamaica TAJ. Withholding Tax on Specified Services to be implemented June 1. The amount payable to the service provider as the cost of the transac-tion before GCT is added.

Payroll Taxes and Contribution Rates - EmployeeEmployer.

Https Japarliament Gov Jm Attachments Article 1261 1261 Corrigendum 20to 202014 20ministry 20paper 2044 Pdf

Mexico Global Payroll Tax Information Guide Payslip

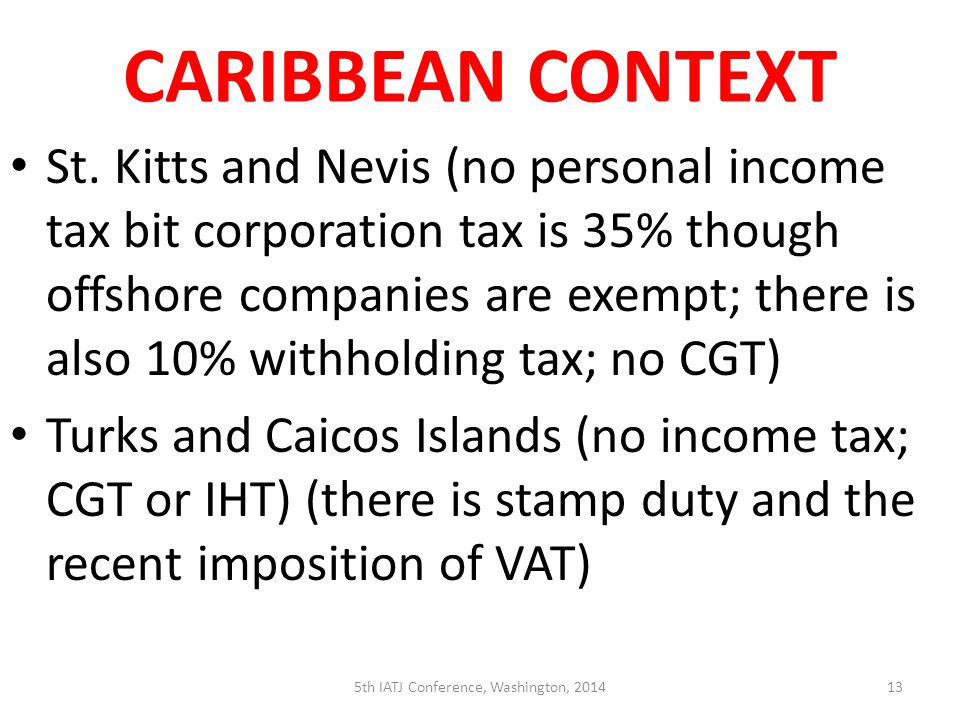

Tax Havens And The Caribbean A Sunny Place For Shady People Anthony D J Gafoor Trinidad Tobago 5th Iatj Conference Washington Ppt Download

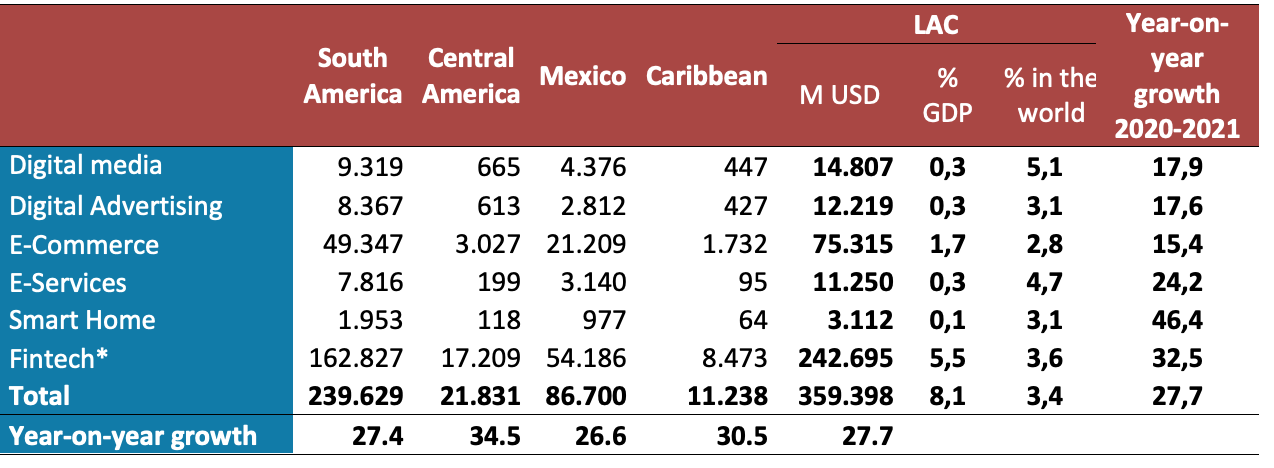

Leveling The Playing Field In Times Of Crisis Indirect Taxation On The Digital Economy In Latin America And Its Potential Revenue Voxlacea

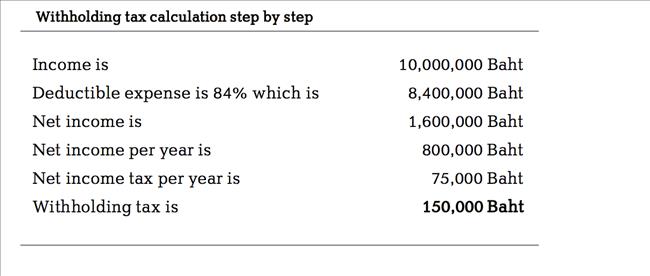

Thai Property Taxes Explained What You Need To Know Sansiri Public Company Limited

How To Apply For A Tax Compliance Certificate Tcc Youtube

Capital Gains And Investment Income In Jamaica Dawgen Global

Https Www Reit Com Sites Default Files 2019 Uswithholdingtax 1 Pdf

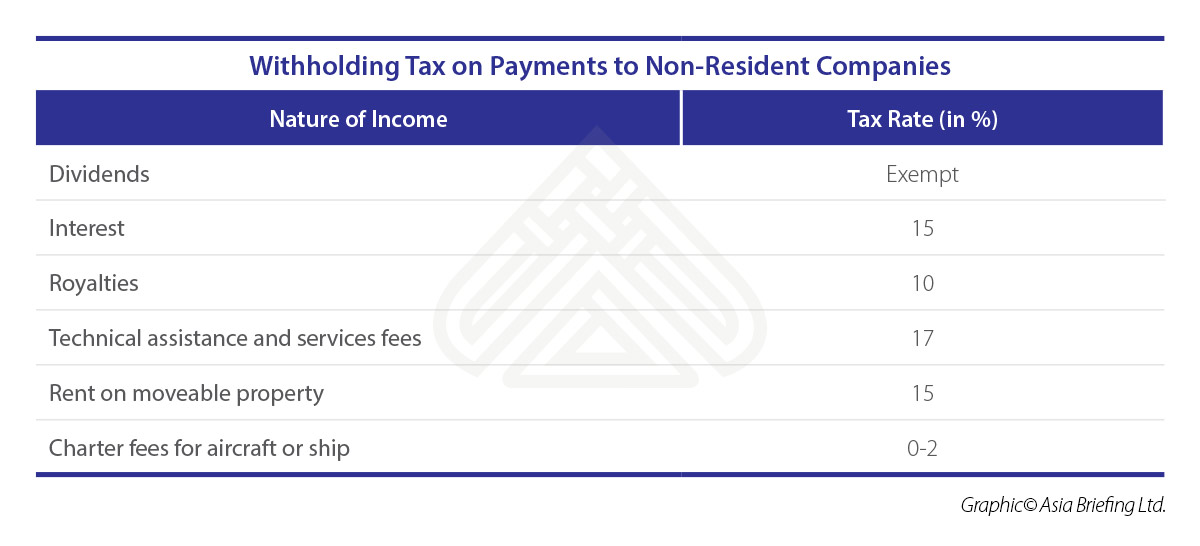

Asiapedia Singapore S Corporate Income Tax Quick Facts Dezan Shira Associates

Global Payroll Peo Vietnam Payroll Outsourcing Hr Insights

Lowtax Global Tax Business Portal Domestic Corporate Taxation Withholding Tax

Income Taxation System In Indonesia

Leveling The Playing Field In Times Of Crisis Indirect Taxation On The Digital Economy In Latin America And Its Potential Revenue Voxlacea

Central African Republic Accounting And Tax

Leveling The Playing Field In Times Of Crisis Indirect Taxation On The Digital Economy In Latin America And Its Potential Revenue Voxlacea

Posting Komentar untuk "What Is Withholding Tax In Jamaica"