Interest Withholding Tax Rate South Africa

The tax so charged shall not exceed 15 per cent of the gross amount of the interest. Previously any dividend interest and royalty payments made from Mozambique to South Africa incurred withholding tax of 20.

Practical Example On How To Use Corporate Investment Income Case Study Ibfd

The WTI is a final withholding tax charged at 15 on interest paid or that becomes due and payable from 1 March 2015 by any person to or for the benefit of a foreigner ie.

Interest withholding tax rate south africa. When completing taxpayer information during registration and activation of WTI the personal details and banking details must be the same as the information on the Income Tax registration. 75 if the non-resident seller is an individual 10 if the non-resident seller is a company or 15 if the non-resident seller is a trust. However on 11 December 2012 National Treasury issued a press release in which it stated that with effect from 1 July 2013 the South African government will introduce a withholding tax on interest at a rate of 15 s37J of the Income Tax Act 58 of 1962 the Act.

The foreigner is liable for the tax but it must be withheld by the person making the interest payment to or for the benefit of the foreigner. Any person who makes payment of any amount of interest to or for the benefit of a foreign person must withhold an amount of withholding tax on interest calculated at a rate of 15 per cent from that payment. Interest paid is taxed at a final withholding tax rate of 15.

Now that the domestic withholding tax rate is generally uniformed at 15 per cent it is imperative that our treaty negotiators re-negotiate and negotiate better rates for South Africa. Payments of dividends royalties and interest to certain recipients for instance non-residents of South Africa are subject to withholding tax. You must take into consideration when completing taxpayer information during registration and activation of WTI the personal details and banking details must be the same as the information on the Income Tax registration.

In the press release National Treasury specifically stated that the withholding tax will apply to all interest paid by South African. Royalty payments incurred a 12 withholding tax which would be reduced to 5 by the new treaty. South African domestic rates apply.

Exempt in resident State if taxed in source State. This requires the payor to withhold a prescribed portion from these amounts and to remit this portion to the South African Revenue Service. A non-resident from a source within South Africa.

The WTI is a tax charged on interest paid on or after 1 March 2015 by any person to or for the benefit of a foreign person which includes individuals companies etc from a source within South Africa. Quick Tax Guide South Africa 2122 Individuals Tax Rates and Rebates Individuals Estates Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201 R337 800. These Double Taxation Agreements DTAs should be consulted as a matter of course prior to paying any interest.

18 of income within the threshold. 40 Withholding taxes 41 Dividends 42 Interest 43 Royalties 44 Branch remittance tax 45 Wage taxsocial security contributions 46 Other 50 Indirect taxes 51 Value added tax 52 Capital tax 53 Real estate tax 54 Transfer tax 55 Stamp duty 56 Customs and excise duties 57 Environmental taxes 58 Other taxes 60 Taxes on individuals 61 Residence 62 Taxable income and rates 63. The foreigner is liable for the tax but it must be withheld by the person making the interest payment to or for the benefit of the foreigner.

Interest paid is taxed at a final withholding tax rate of 15. South African domestic rates apply. Taxable Income R Percentage rate of tax due within the threshold.

Dividend and interest payments from South Africa to Mozambique are currently not subject to any withholding tax in South Africa. Any person who pays an amount to a non-resident in respect of the sale of immovable property in South Africa must withhold from the amount payable an amount equal to. The Tax Year runs from 1 March 2019 - 28 February 2020.

It should however be noted that high withholding taxes can be a deterrent to foreign investment. In certain instances it is possible to reduce or eliminate this withholding tax when for example a treaty granting relief from withholding taxes exists between South Africa. This tax is a final withholding tax at a rate of 15 unless an applicable Agreement for the Avoidance of Double Taxation between South Africa and a foreign residents country reduces the rate South Africa is allowed to charge or denies South Africa the right to tax interest payments.

The WTI is a final withholding tax charged at 15 on interest paid or that becomes due and payable from 1 March 2015 by any person to or for the benefit of a foreigner ie. No provision made in DTA. The following tax rates thresholds and allowances are valid for the 2019 - 2020 Tax Year in South Africa which is known as the 2020 Tax Year.

A interest arising in a Contracting State and derived and beneficially owned by the Government of the. The withholding tax on interest will be levied at the rate of 15 in terms of section 50B of the Act on any interest that is paid by any person to or for the benefit of any foreign person to the extent that the amount is sourced in South Africa. Interest paid is taxed at a final withholding tax rate of 15.

4 Notwithstanding the provisions of paragraphs 1 and 2. A person must not withhold any amount from the payment to the extent that the interest is exempt from withholding tax on interest or if the foreign person to or for the benefit of which that. Section 92b of the Act determines when interest will be deemed to be sourced in South Africa.

No provision made in DTA. South Africa 2020 Tax Tables for Individuals. A non-resident from a source within South Africa.

The foreign person is responsible for the tax but it must be withheld by the person making the interest payment to or for the benefit of the foreign person.

![]()

South Africa Expat Tax Explaining The New Sars Tax Law Changes

Here Are The Basic Taxes You Should Know About If You Re Investing Your Money

2017 South Africa Budget And Tax Guide Daberistic

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

The Tax Base In South Africa Ppt Download

Pdf The Permanent Establishment Concept In Double Tax Agreements Between Developed And Developing Countries Canada South Africa As A Case In Point

The Tax Base In South Africa Ppt Download

Pdf Avoiding Tax In South Africa S Retail Industry Via Customer Loyalty Programs

2020 South Africa Budget And Tax Guide Daberistic

South African Income Tax Guide 2021 Lexisnexis Sa

The Tax Base In South Africa Ppt Download

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

The Tax Base In South Africa Ppt Download

How To File Your Income Taxes In South Africa Expatica

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Allan Gray 2018 Budget Speech Update

The Tax Base In South Africa Ppt Download

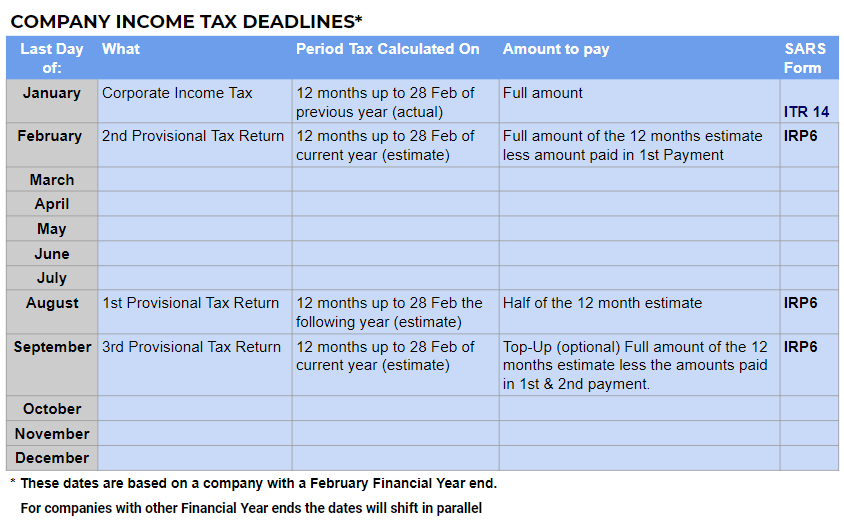

A Guide To Business Income Tax In Sa All Info Including Tax Return Deadlines And Sars Forms

Posting Komentar untuk "Interest Withholding Tax Rate South Africa"