Income Tax Rate In Jamaica 2019

Payroll Taxes and Contribution Rates - EmployeeEmployer. It is proposed that the rate of transfer tax on such transactions will be reduced from 5 to 2 with effect from 1 April 2019.

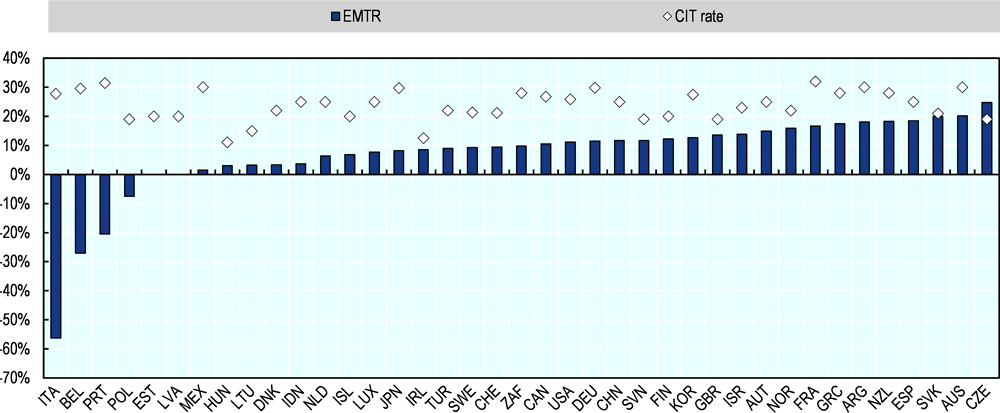

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Jamaica Income Tax Rates and Personal Allowances in 2020.

Income tax rate in jamaica 2019. Income Tax and School Leavers. An annual tax-free threshold of JMD 15 million is available to Jamaican tax resident individuals. In respect of individuals the Personal Income Tax PIT threshold or tax-free income increases to 50731200 per annum up from 44116800 per annum.

Chargeable income derived in excess of JMD 6 million per annum is subject to income tax at a rate of 30. The Tax tables below include the tax rates thresholds and allowances included in the Jamaica Tax Calculator 2020. This is currently levied at the rate of 5 of the gross consideration payable for the property or the market value in certain circumstances.

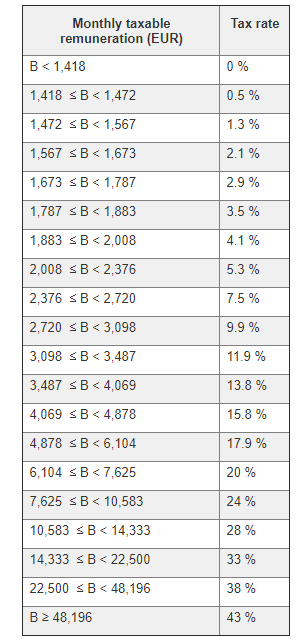

Individuals are generally liable to income tax at the rate of 25 on their chargeable income not exceeding JMD 6 million per annum less an annual tax-free threshold where applicable. The overall corporate tax rate can range approximately between 2283-3683 due to local trade tax rates. Registered taxpayers should begin making the necessary adjustments to their systems in order to be ready for this change.

Income Tax and Pensioners. 9756 weekly 19512 fortnightly. This page provides - Jamaica Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news.

New Income Tax Credit for MSMEs Income Tax Credit of JA375000 granted to companies with revenues not exceeding JA500 million per annum. Years of Assessment 2016 and onwards Income above the Threshold but below 6000000 25 Income in excess of 500000 monthly 6000000 yearly 30 For further information contact. Securities in Jamaican companies.

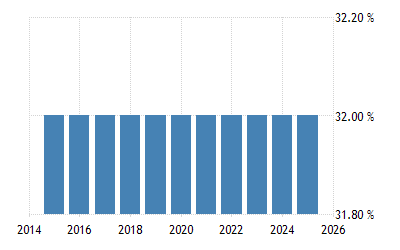

Corporate Tax Rate in Jamaica averaged 2917 percent from 2005 until 2020 reaching an all time high of 3333 percent in 2006 and a record low of 25 percent in 2013. The overall income tax rate for corporations includes corporate income tax at a rate of 15 a solidarity surcharge at a rate of 0825 55 of the corporate income tax and local trade tax. Effective April 1 2020 the standard general consumption tax GCT rate will be reduced from 165 to 15.

Lower rates of withholding are possible provided that the recipient is resident in a country that has concluded a double taxation treaty DTT with Jamaica. The personal income tax rate in jamaica stands at 30 percent. Income tax rate jamaica 2019Income tax rates thresholds and exemption 2003 2020 notes and instructions for completion of returns of income tax payable it01 it05 payroll taxes and contribution rates employee employer.

Non-resident companies are subject to tax on Jamaican-sourced income. Jamaica Income Tax Calculators 201920. Prescribed persons include commercial banks and other financial institutions.

Select a specific Income Tax Calculator to calculate your salary deductions based on your income period. Each Income Tax Calculator has the same features and advanced tax calculations and outputs the calculations are simply based on different income and expense payment periods. The increase in the threshold means that the corresponding tax-free portion to be used by employers in making periodic payments is as follows.

888-TAX-HELP 888-829-4357 or visit us on. I ncome Tax for Individuals Businesses Income Tax Rates Thresholds and Exemption 2003-2020 Notes and Instructions for completion of Returns of Income Tax Payable IT01 - IT05. Tax Admministration of Jamaica.

The Income tax rates and personal allowances in Jamaica are updated annually with new tax tables published for Resident and Non-resident taxpayers. Tax is imposed on certain sources of income such as interest dividends royalties and fees by way of withholding at a rate of 33 for non-resident corporations. Indi-viduals and companies by a prescribed person.

Income tax at the rate of 25 is deducted at source from gross interest paid to Jamaican residents ie. The Corporate Tax Rate in Jamaica stands at 25 percent. Personal Income Tax Rate in Jamaica averaged 2676 percent from 2004 until 2020 reaching an all time high of 35 percent in 2010 and a record low of 25 percent in 2005.

In summary the following are the proposed tax measures. Reduction in the Assets Tax rate imposed on Financial Institutions Reduction in the rate of Assets Tax imposed on financial institutions from 025 to 0125 of taxable assets. No other GCT rate is impacted by this change.

The Personal Income Tax Rate in Jamaica stands at 30 percent.

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Poland Personal Income Tax Rate 1995 2021 Data 2022 2023 Forecast Historical

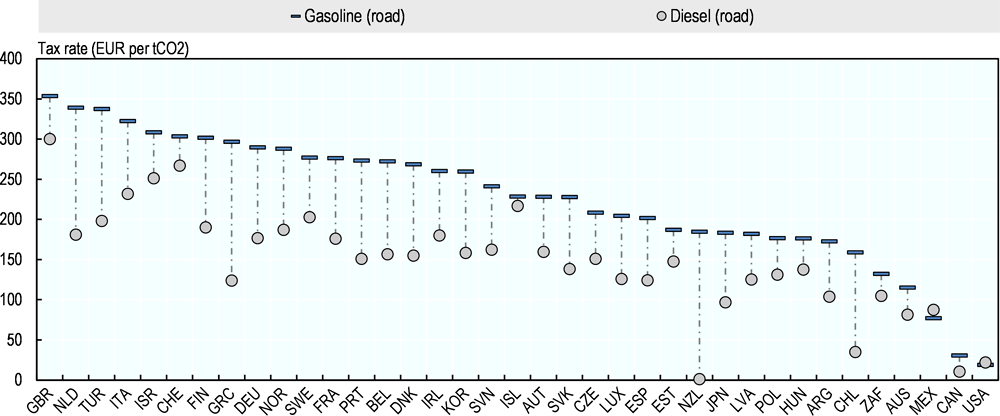

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Chapter 6 Has Tax Competition Become Less Harmful In Corporate Income Taxes Under Pressure

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

How Your Country S Tax Rate Compares To Us And The World Infographic

Chapter 6 Has Tax Competition Become Less Harmful In Corporate Income Taxes Under Pressure

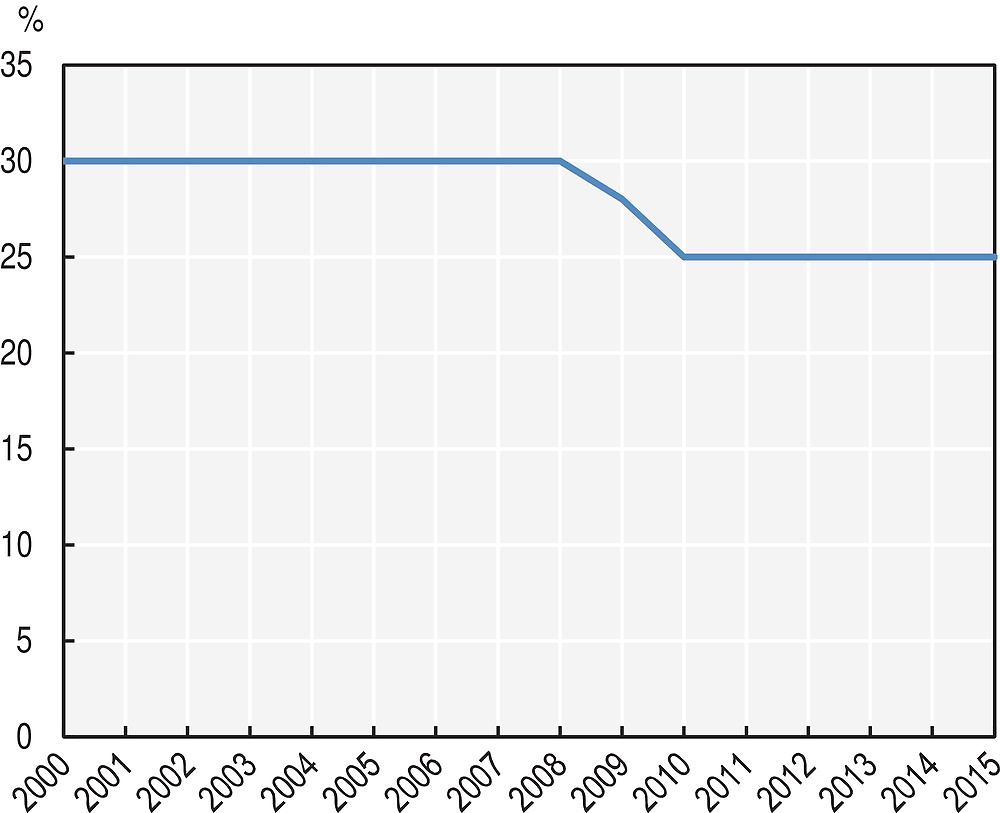

Israel Corporate Tax Rate 2000 2021 Data 2022 2023 Forecast Historical Chart

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Chapter 6 Has Tax Competition Become Less Harmful In Corporate Income Taxes Under Pressure

Chart Lower Effective Tax Rates For Large Companies In Europe Statista

Germany Taxing Wages 2021 Oecd Ilibrary

Personal Income Tax Progressivity Trends And Implications In Imf Working Papers Volume 2018 Issue 246 2018

United States Corporate Tax Rate 2021 Take Profit Org

Https Www Econstor Eu Bitstream 10419 222490 1 1724769251 Pdf

France S 2020 Social Security Finance And Income Tax Bills To Introduce Significant Changes Ey Global

Chapter 6 Has Tax Competition Become Less Harmful In Corporate Income Taxes Under Pressure

Posting Komentar untuk "Income Tax Rate In Jamaica 2019"