Withholding Tax Rates In Pakistan On Cash Withdrawal

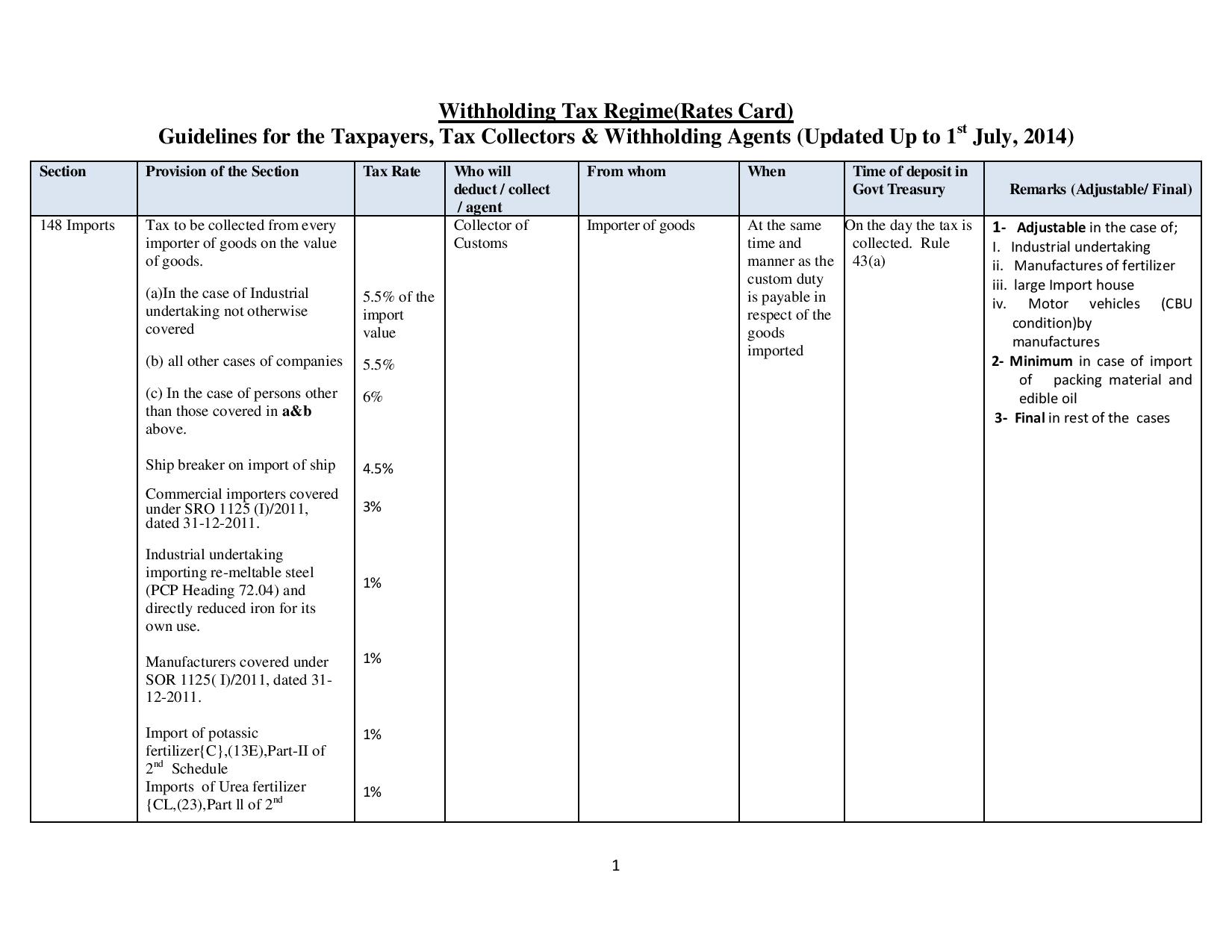

Register for Income Tax. 150 236 S Contract for construction assembly installation projects supervisory activities advertisement services rendered by TV Satellite Channels Profit on debt up to Rs.

Massive Taxation Relief To Boost Industrial Growth Newspaper Dawn Com

Withholding Tax Rates in Pakistan 2021 on Cash Withdrawal Services.

Withholding tax rates in pakistan on cash withdrawal. It further imposed withholding tax on non-cash transactions that was aimed to increase the cost of transactions made by non-filers of income tax returns. It is for the guidance that it is a kind of income tax that is applicable by using various types of bank services. It is for the guidance that it is a kind of income tax that is applicable by using various types of bank services.

It is proposed that the tax on cash withdrawals by filers be eliminated. It is different for filers and non-filers. The_ad id31605 Asad Umar alaso proposed to make 60 percent minimum tax on traders and businesses.

236A Sale by auction Every person. WITHHOLDING TAX RATES SECTION WITHHOLDING AGENT Rate 231A Cash Withdrawal from a Bank Every Banking Company cash withdrawal in a day exceeding Rs 50000- for persons not appearing in the Active TaxpayersList 06 234 Tax on Motor Vehicle Person collecting motor vehicle tax Rs. The withholding tax gets taken out of your withdrawal immediately and paid to the government.

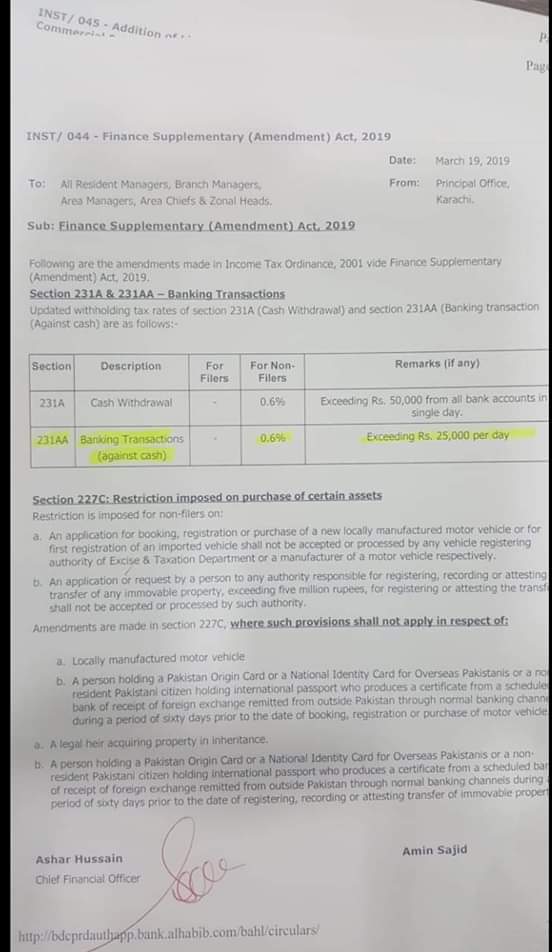

ISLAMABAD AFP - A photo of a document shared thousands of times in multiple Facebook posts in Pakistan purports to show a tax law amendment introduced in March 2019 which means any cash withdrawals exceeding 25000 rupees will be subject to a 06 percent tax down from 50000 rupees previously. Currently the tax return filers pay 03 withholding tax while non-filers pay 06 tax on the withdrawal of money from banks. It is different for filers and non-filers.

WHT on payments of royalty and FTS when royalty or FTS is not attributable to a PE in Pakistan is 15 or a lower treaty rate of royalty or gross fees. The finance act 2008 in pakistan has made certain changes increased the rate of withholding tax on cashwithdrawal from 02 to 03. Rate TY 2018-19 700 1300 WITHHOLDING TAX DEDUCTION CHART DIVIDEND IN CASH OR IN SPECIE PROFIT ON DEBT Dividend In cash or in specie.

The government imposed withholding tax on cash withdrawal through Finance Act 2005 in order to discourage cash economy. The minister said the rate of tax to be deducted is 03 percent of the cash amount withdrawn for filers and 06 percent of the cash amount withdrawn for non-filers. The text of Section 231A is as follow.

In Pakistan environment there was a need to have an organization to monitor and manage the. In the case of a non-resident where royalty or FTS. Corporate - Withholding taxes.

Usually this money goes to the government from the customer side. On the services of cash withdrawal a new Withholding tax rates in Pakistan 2021 has finalized now. On the services of cash withdrawal a new Withholding tax rates in Pakistan 2021 has finalized now.

Withholding Tax Rates - Federal Board Of Revenue Government Of Pakistan. In order to provide relief to the masses The government of Pakistan has terminates the withholding tax on cash withdrawal from the banking system and non-cash banking transfers. Withholding Tax on Cash Withdrawal from Banks Abolishes.

Change your personal details. Now through Finance Bill 2021 proposed to abolish the 06 percent withholding tax on persons not on the Active Taxpayers List ATL or non-filers. Through Finance Supplementary Second Amendment Act 2019 the withholding tax on return filer at the rate of 03 percent was abolished and non-filers were required to pay 06 percent on making cash withdrawal above Rs50000 per day.

There have been no changes in sections 231-A and 231-AA of the Income Tax Ordinance FBR stated. Establishment of Directorate General of With-holding Taxes. Cash withdrawal from a bank1 Every banking company shall deduct tax at the rate specified in Division VI of Part IV of the First Schedule if the payment for cash withdrawal.

According to sources the PM Office in a letter has directed the. Last reviewed - 01 January 2021. The concept of withholding tax on cash withdrawal Banking Tranaction is when ever customer withdraw their money more than 50000 Rupees from their account in a single day than he will be charged tax Now it is depend on whether the customer is Filer or Non-Filer If he is Filer than he will be charged 3 Tax and if he is Non-filer than he will be Charged 6 Tax.

Non-filers will pay a 06 withholding tax on withdrawal of cash amounting to over Rs50000 and for. The FBR updated the rate of tax to be deducted under section 231A of Income Tax Ordinance shall be 06 percent of the cash amount withdrawn for the person whose name is not appearing in the active taxpayers list. Tax on cash withdrawal is a form of taxation known to exist in pakistan.

At the present time usually people in Pakistan are well aware of this Tax. The tax withheld is deemed to be the final tax liability of the non-resident. At the present time usually people in Pakistan are well aware of this Tax.

The main withholding provisions are related to salaries contracts imports bank interest securities dividends utilities technical fee cash withdrawl etc. To facilitate overseas Pakistanis and encourage foreign remittances through banking channels it is proposed that withholding tax on cash withdrawal from PKR. State Minister for Revenue Hammad Azhar has assured the business community that withholding tax WHT on cash withdrawal from bank accounts will be abolished for tax.

As per to details In its Federal Budget 2021-22 the federal government took major relief. 25 per kg of the laden weight for filers. It is suggested that the WHT on cash withdrawals should be removed as it will help improve the deposit mobilization and growth of financial inclusion.

Why Bank Deduct Tax On Cash Withdrawal 231a Withholding Tax On Cash Withdrawal Fbr 2021 Youtube

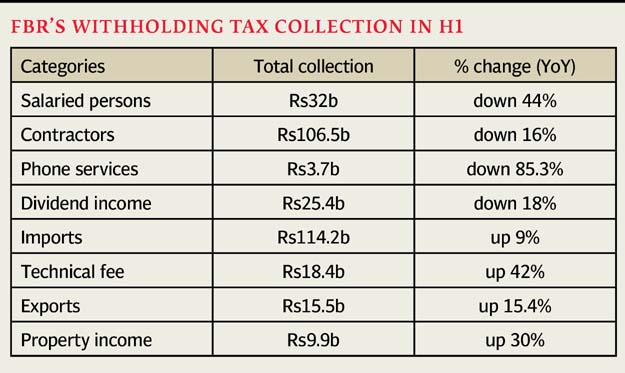

Withholding Tax Collection Drops 9 In First Half

153 1b Withholding Tax On Services Practical Example Fbr Ty 2020 21 Youtube

Ne Accounting Financial Solutions 153 1b Withholding Tax On Services How To Deduct Tax On Payment Of Services In Pakistan Fbr 2021 Facebook

Govt Imposes 0 6pc Tax On Cash Withdrawals Over 25 000 Rupees Here Is The True Story Pakistan Dunya News

Ne Accounting Financial Solutions 153 1b Withholding Tax On Services How To Deduct Tax On Payment Of Services In Pakistan Fbr 2021 Facebook

Fbr Issues Withholding Tax Rate Card For Fiscal Year 2014 2015 Customnews Pk

Bank Transaction Withholding Tax Removed For Non Filers Budget 2021 Cash Withdrawal Tax Update Youtube

Ne Accounting Financial Solutions 153 1b Withholding Tax On Services How To Deduct Tax On Payment Of Services In Pakistan Fbr 2021 Facebook

Fact Check Govt Has Not Imposed New Tax On Bank Transactions

Ne Accounting Financial Solutions 153 1b Withholding Tax On Services How To Deduct Tax On Payment Of Services In Pakistan Fbr 2021 Facebook

Online Tax Consulting In 2020 Online Taxes Tax Consulting Business Finance Management

Ne Accounting Financial Solutions 153 1b Withholding Tax On Services How To Deduct Tax On Payment Of Services In Pakistan Fbr 2021 Facebook

Govt Imposes 0 6pc Tax On Cash Withdrawals Over 25 000 Rupees Here Is The True Story Pakistan Dunya News

Ne Accounting Financial Solutions 153 1b Withholding Tax On Services How To Deduct Tax On Payment Of Services In Pakistan Fbr 2021 Facebook

Budget 2020 21 Finance Bill Shows All Relief No Clear Revenue Plan Newspaper Dawn Com

Govt Imposes 0 6pc Tax On Cash Withdrawals Over 25 000 Rupees Here Is The True Story Pakistan Dunya News

Debt Taxes And Inflation Highlights From The Last 10 Years Of Pakistan S Economy Dawn Com

Why Bank Deduct Tax On Cash Withdrawal 231a Withholding Tax On Cash Withdrawal Fbr 2021 Youtube

Posting Komentar untuk "Withholding Tax Rates In Pakistan On Cash Withdrawal"