Withholding Tax Rates Germany

Withholding tax generally is not levied on interest except for interest on publicly traded debt interest received through a German payment agent usually a bank convertible bonds and certain profit participating loans. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Payroll And Tax Services In Malaysia Tax Services Payroll Taxes Payroll

In Germany for tax purposes you are either a resident or a non-resident.

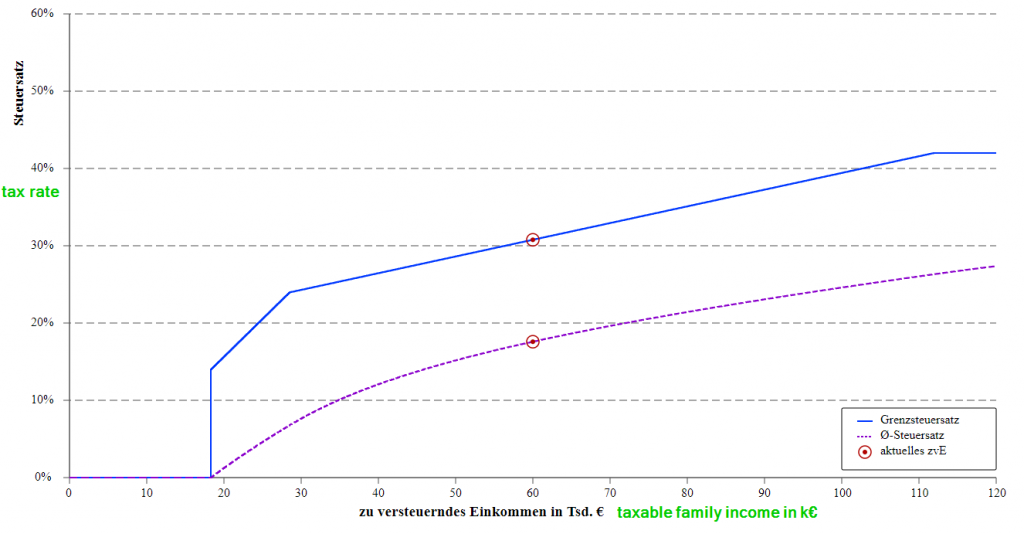

Withholding tax rates germany. The withholding tax rate for royalty payments relating to IP registered in Germany would be a flat rate of 15825 which could potentially be mitigated via double tax treaties or European Directives see Potential Taxpayer Solutions below. The German government reviews income tax bands every year. It is broken up into numerous political divisions called landers Germany is divided into 20 regions each of which has the power to levy regional taxes at a rate ranging from 123 to 203.

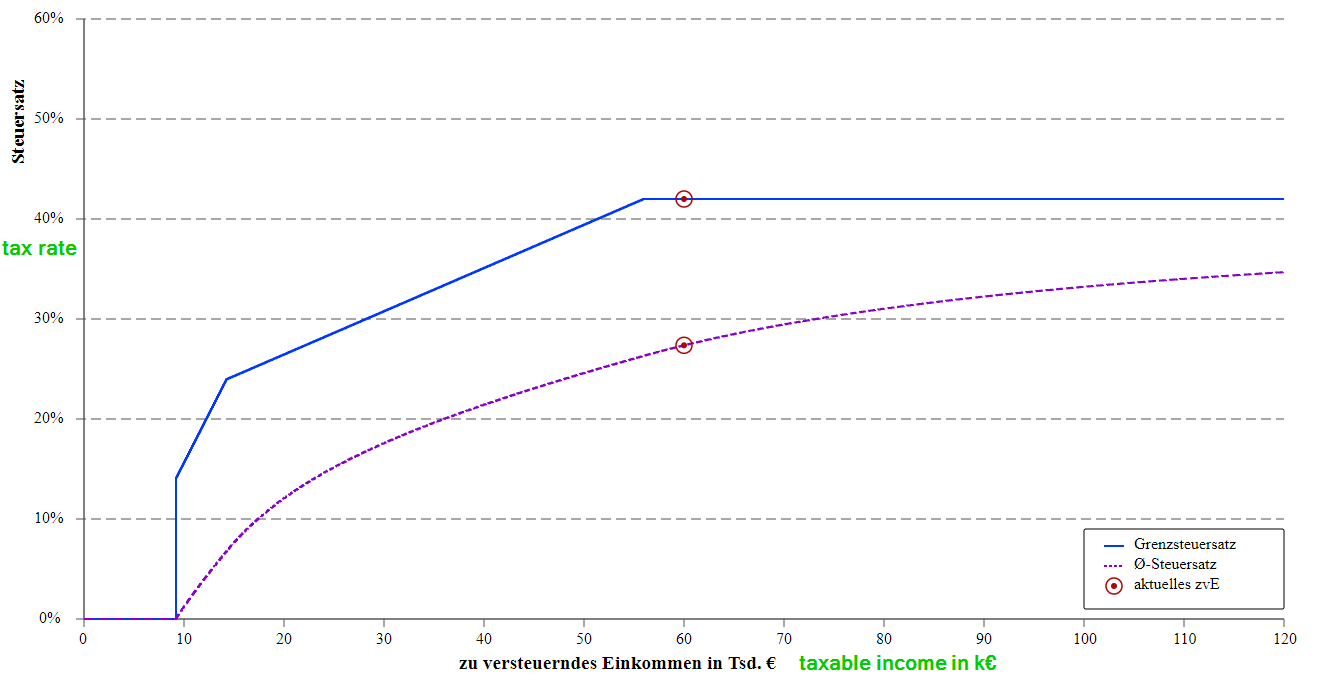

Review the 2021 Germany income tax rates and thresholds to allow calculation of salary after tax in 2021 when factoring in health insurance contributions pension contributions and other salary taxes in Germany. The withholding tax from German investment income interest dividends gains from shares sold will be credited against the German tax on investment income if investment income is included in the assessment. Corporate recipients can obtain a reduction of the withholding tax to 15 even if they cannot benefit from a tax treaty.

77 rnduri Tax on loans secured on German property is not imposed by withholding but by assessment to. 15 percent withholding tax WHT plus 55 percent solidarity surcharge on WHT exemptions available under domestic law implementing the EU Interest-Royalties Directive if applicable and certain requirements are fulfilled. You are exempt from this tax rate however if you have lived in the property for more than 10 years.

- the transfer tax which is levied at rates. The capital gains tax in Germany is currently a flat rate of 25. Capital and capital gains tax Abgeltungsteuer This type of tax applies when you make a profit when selling your property in Germany.

Reduction of WHT under most German tax. A top rate of 45 is also present for those with very high earnings. DTA with 5 residual tax refund of EUR 100 in withholding tax and EUR 825 in solidarity surcharges EUR 50 in residual tax is retained by Germany as the state of source.

Solidarity surcharge Solidaritaetszuschlag capped at 55 of your income tax. In principle Germany levies a 25 withholding tax on dividends plus a surcharge of 55 of that tax both on domestic and foreign recipients. - the real estate tax which is levied at a rate of 035 established based on the value of the property.

If you have been present in Germany for over 183 days you are generally considered to be a resident for tax purposes. One of a suite of free online calculators provided by the team at iCalculator. The rate is 25 for withholding tax that is required by a tax office under section 50a subsection 7 of the Income Tax Act for the purposes of ensuring the collection of tax.

Income tax in Germany is progressive. The other taxes rates that need to be paid in Germany. No solidarity surcharge is levied on residual tax.

The foreign withholding tax on investment income if taxable in Germany can also be credited against the German tax on investment income. The statutory rate is 25 26375 including the solidarity surcharge unless the EU interest and royalties directive applies or the rate is reduced under a tax treaty. - the personal income tax which is levied on a progressive basis with the highest rate of 45.

25 0 0 The Parliament has adopted a 15 withholding tax. The solidarity surcharge has to be added in each case. Church tax 8 9 if you are a member of a registered church in Germany.

Rates start at 14 and incrementally rise to 42. Generally 15825 percent ie. Germany is a European Union member country comprising 16 federal states.

German Rental Income Tax How Much Property Tax Do I Have To Pay

Taxes In Germany Vs Us Full Comparison 2021 Russianvagabond

Your Bullsh T Free Guide To Taxes In Germany

German Registered Ip New Taxation Of Transactions Between Non German Parties Morrison Foerster

Faq German Tax System Steuerkanzlei Pfleger

Germany S Tax Laws In A Nutshell Updated 30 May 2021 Berlin Tax Legal

German Ip Withholding Tax White Case Llp

Faq German Tax System Steuerkanzlei Pfleger

German Rental Income Tax How Much Property Tax Do I Have To Pay

Germany S Tax Treatment Of Cross Border Royalty Payments To Grin

Budget 2020 Affordable Homes Get Tax Holiday Boost Income Tax Tax Payment Tax Attorney

Taxes In Switzerland Income Tax For Foreigners Academics Com

Firpta Real Estate Tax Illustration World Map Map Earth Map

Pin Von Sankt Sign Auf 0010 Tax Revenue Accounting Office Imperial

Your Bullsh T Free Guide To Taxes In Germany

Income Tax In Germany For Foreigners Academics Com

Down Payment With Withholding Tax Process Sapspot Down Payment Tax Payment

Posting Komentar untuk "Withholding Tax Rates Germany"