New Jersey State Unemployment Tax Rate 2021

These rates include the 01 Workforce Development Fund rate and the 00175 Supplemental Workforce Fund rate. Unemployment rate May 2021.

State Tax Changes Could Mean Bigger Refunds For Some This Year

New Jersey employer UI tax rates continue to be assigned on Rate Schedule B for fiscal year 2021 July 1 2020 through June 30 2021 ranging from 04 to 54.

New jersey state unemployment tax rate 2021. Detailed New Jersey state income tax rates and brackets are available on this page. In addition to the major tax changes mentioned here many states will see automatic increases in their unemployment insurance UI tax rates in 2021 due to significant trust fund drawdown in 2020 amid the pandemic and several states have enacted conformity legislation to reflect changes in the federal tax code that were made by the Coronavirus Aid Relief and Economic Security CARES. 731 2021 Maximum Temporary Disability Insurance weekly benefit rate.

EY Payroll Newsflash Vol. In fact most states in the country have done this. Employees all pay the same tax rate on their first 35300 in wages while an employers contributions depend on the overall fund balance and how many of.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. If you do you must also withhold New Jersey taxes. Federal taxes for these employees.

Standard rate 257 207 employer share. Tied for seventh-highest unemployment rate in the country with Washington DC New Jersey has a 75 unemployment rate just a 01 point jump from March. 2021 Maximum Unemployment Insurance weekly benefits rate.

030 142 including solvency surtax California. New Jersey Unemployment Tax The wage base is computed separately for employers and employees. 065 68 including employment security assessment of 006 Alaska.

Additionally the bill will permit nonprofit and governmental employers that elect to make UI payments equal to the full amount of benefits paid to individuals attributable to service in the employ of the nonprofit or governmental employer to reduce their UI benefit payments by fifty percent. The new employer rate continues to be 28 for fiscal year 2021. New Jersey Department of Labor Workforce Development.

Top corporate tax rate. The federal government has provided significant aid to states to reduce or even eliminate any tax increase by replenishing the UI fund. 050 employee share 15 59.

If you determine you are a domestic employer and are required to withhold you must file and pay annually. The new employer rate continues to be 28 for fiscal year 2020. The New Jersey income tax has seven tax brackets with a maximum marginal income tax of 1075 as of 2021.

For employers for 2021 the wage base increases to 36200 for unemployment insurance disability insurance and workforce development. But New Jersey could be doing much more. GDP growth Q1 2021.

This legislation will reduce the amount of an employers unemployment taxes through Fiscal Year 2023. New Jersey has the means to do this but has thus far been silent on whether it will save the business community from a protracted payroll tax increase estimated. 903 2021 Alternative earnings test amount for UI and TDI.

2021 New Jersey Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Employees unemployment and workforce development wage base increase to 36200 maximum withholding 15385. 28 2020 839 PM The wage base for employer contributions to unemployment insurance and temporary disability insurance is to be 36200 The wage base for employee contributions to temporary disability and family leave insurance programs is to be 138200.

03825 Unemployment Compensation Fund and 00425 Workforce Development Fund for 2021. The general unemployment tax rate for new employers is to remain at 280 during this period. The New Jersey Department of Labor Workforce Development has announced that employers should expect unemployment tax rates to be higher for the one-year period from July 1 2021 to June 30 2022.

20 101 7-25-2019 These rates include the 01 Workforce Development Fund rate and the 00175 Supplemental Workforce Fund rate. Top individual income tax rate. 52 Zeilen State SUI New Employer Tax Rate Employer Tax Rate Range 2021 Alabama.

Effective July 1 2020 New Jerseys experienced-employer unemployment tax rates are to be determined with Table B and are to range from 040 to 540. Your employee can also choose to have New Jersey taxes withheld or claim they are exempt from the withholding requirement. Effective July 1 2021 tax rates for experience-rated employers are to be determined with Schedule C and will range from 050 to 580 including the.

New Jersey Unemployment Disability Insurance Wage Bases to Rise in 2021 Aug. One of a suite of free online calculators provided by the team at iCalculator. New Jersey new employer rate includes.

State Tax Changes Could Mean Bigger Refunds For Some This Year

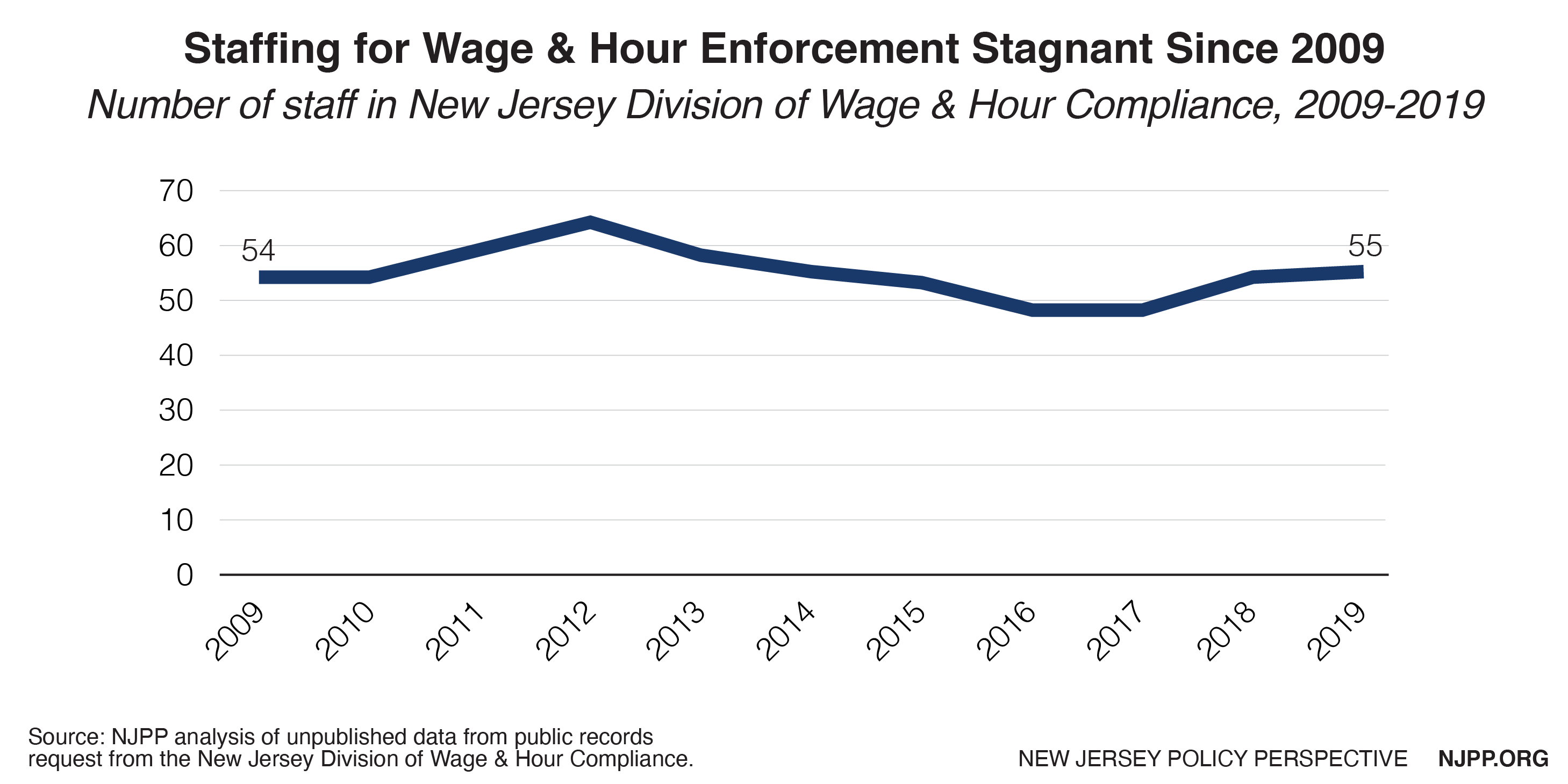

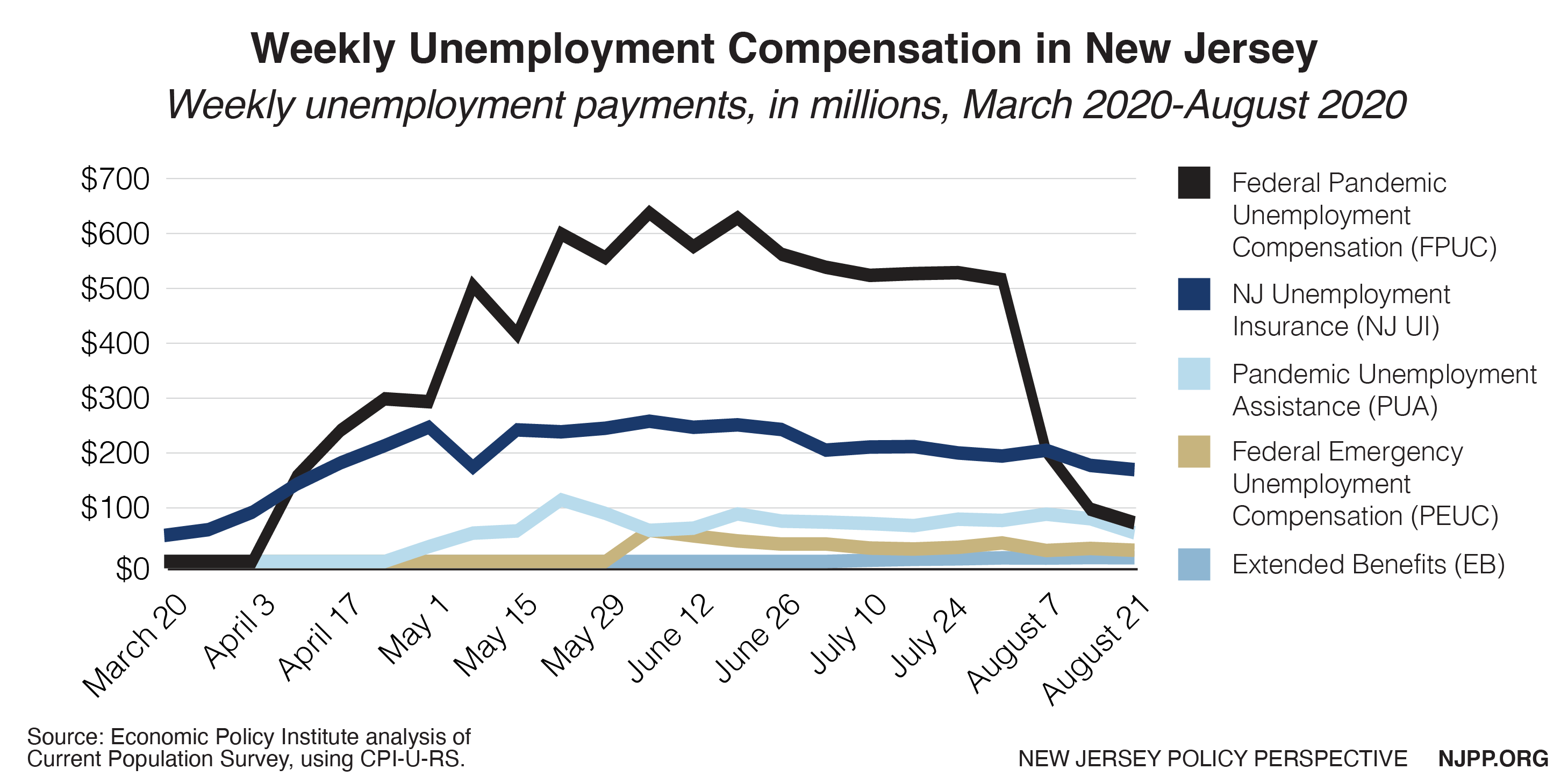

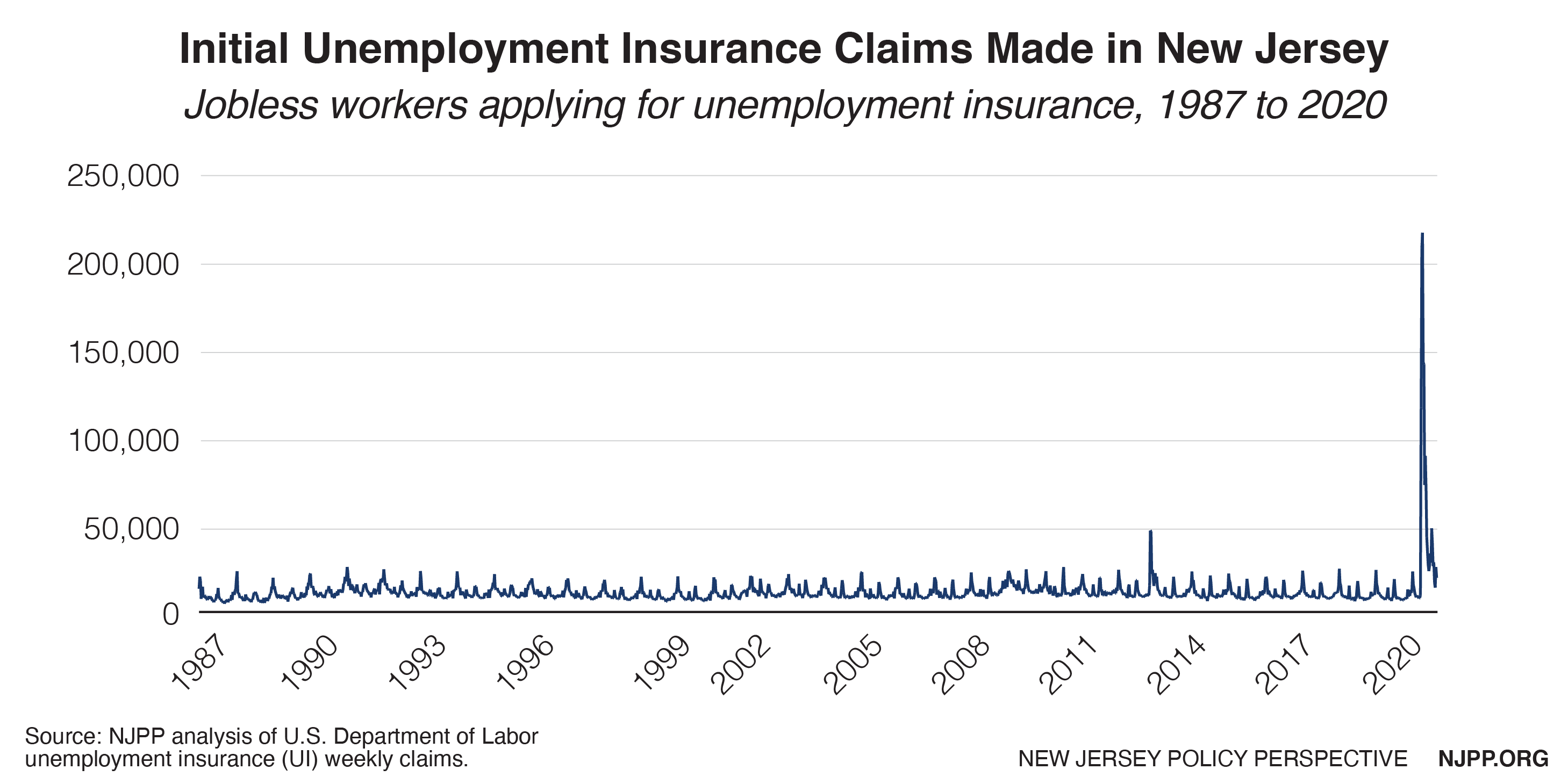

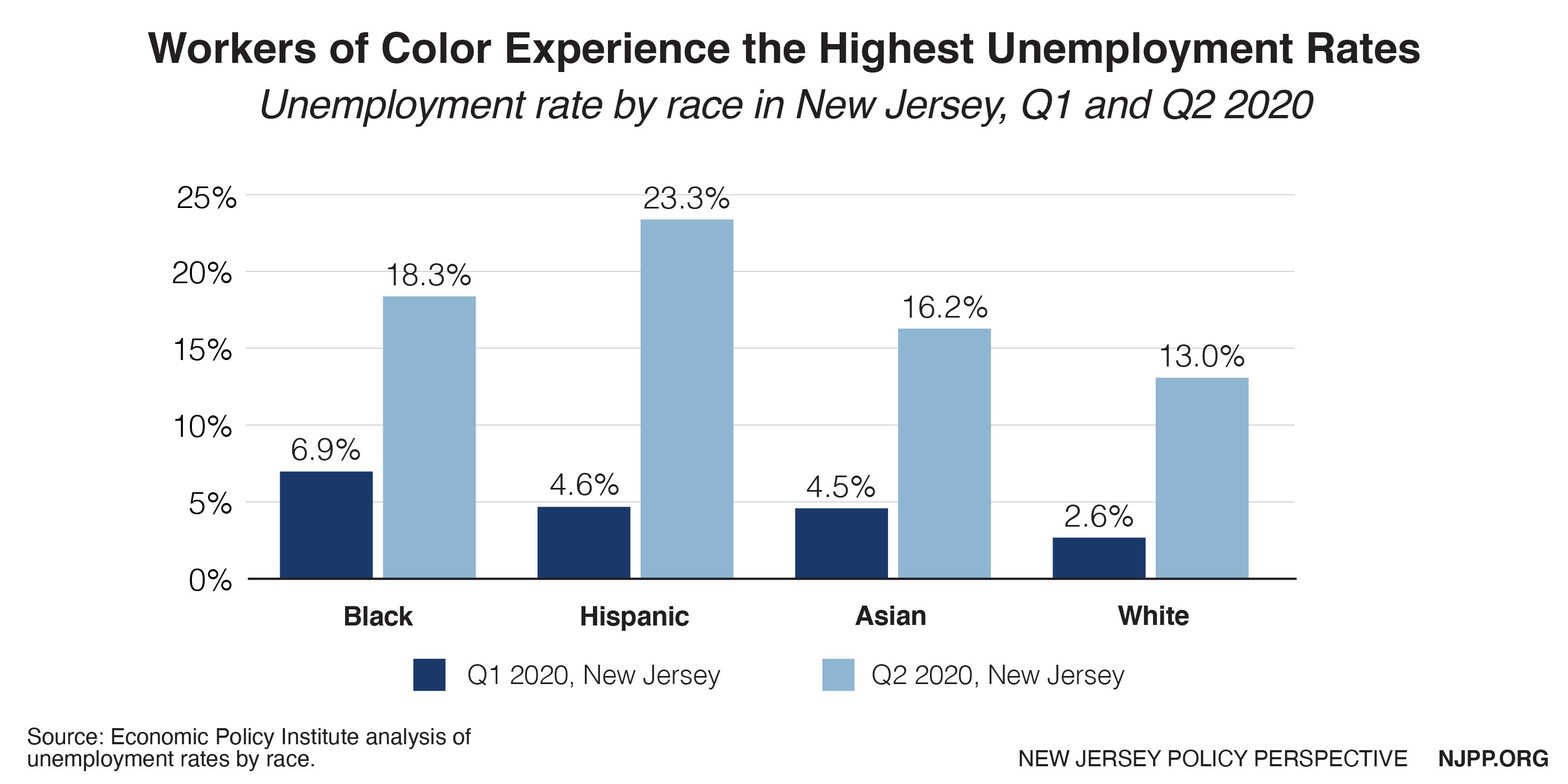

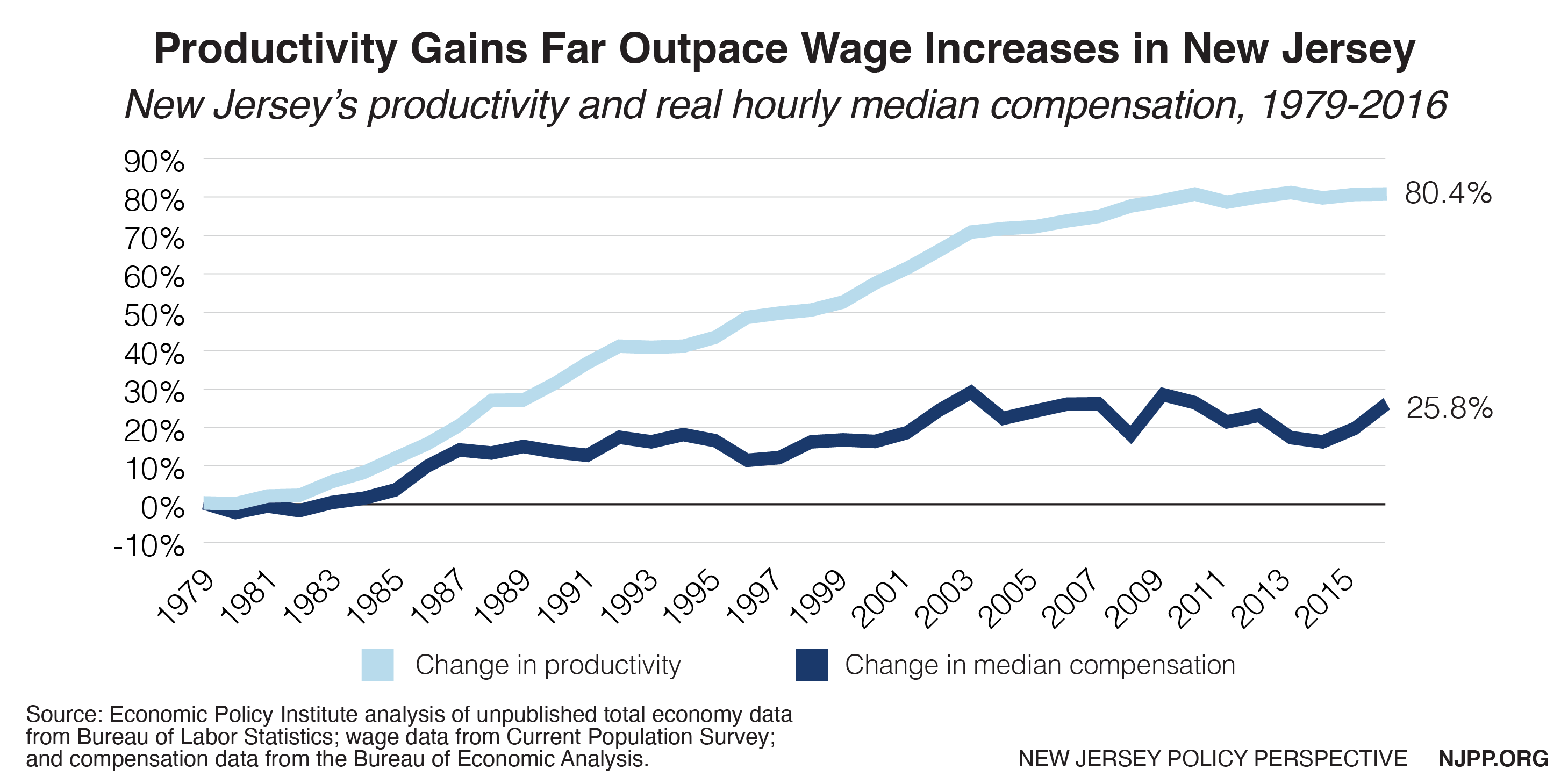

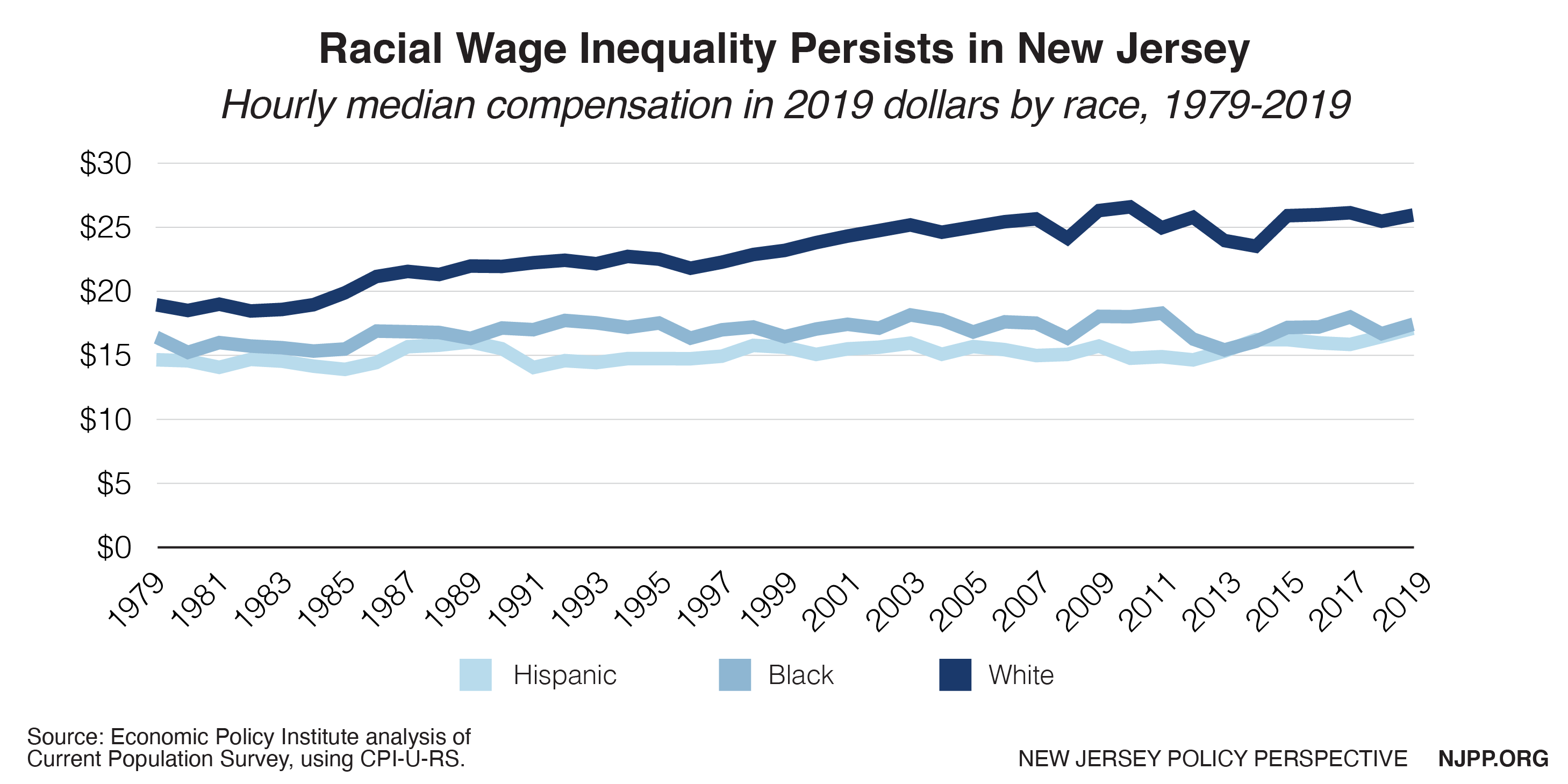

Labor Day Snapshot How New Jersey Can Honor Workers And Improve Economic Security New Jersey Policy Perspective

Labor Day Snapshot How New Jersey Can Honor Workers And Improve Economic Security New Jersey Policy Perspective

Labor Day Snapshot How New Jersey Can Honor Workers And Improve Economic Security New Jersey Policy Perspective

What Is Sui State Unemployment Insurance Tax Ask Gusto

Labor Day Snapshot How New Jersey Can Honor Workers And Improve Economic Security New Jersey Policy Perspective

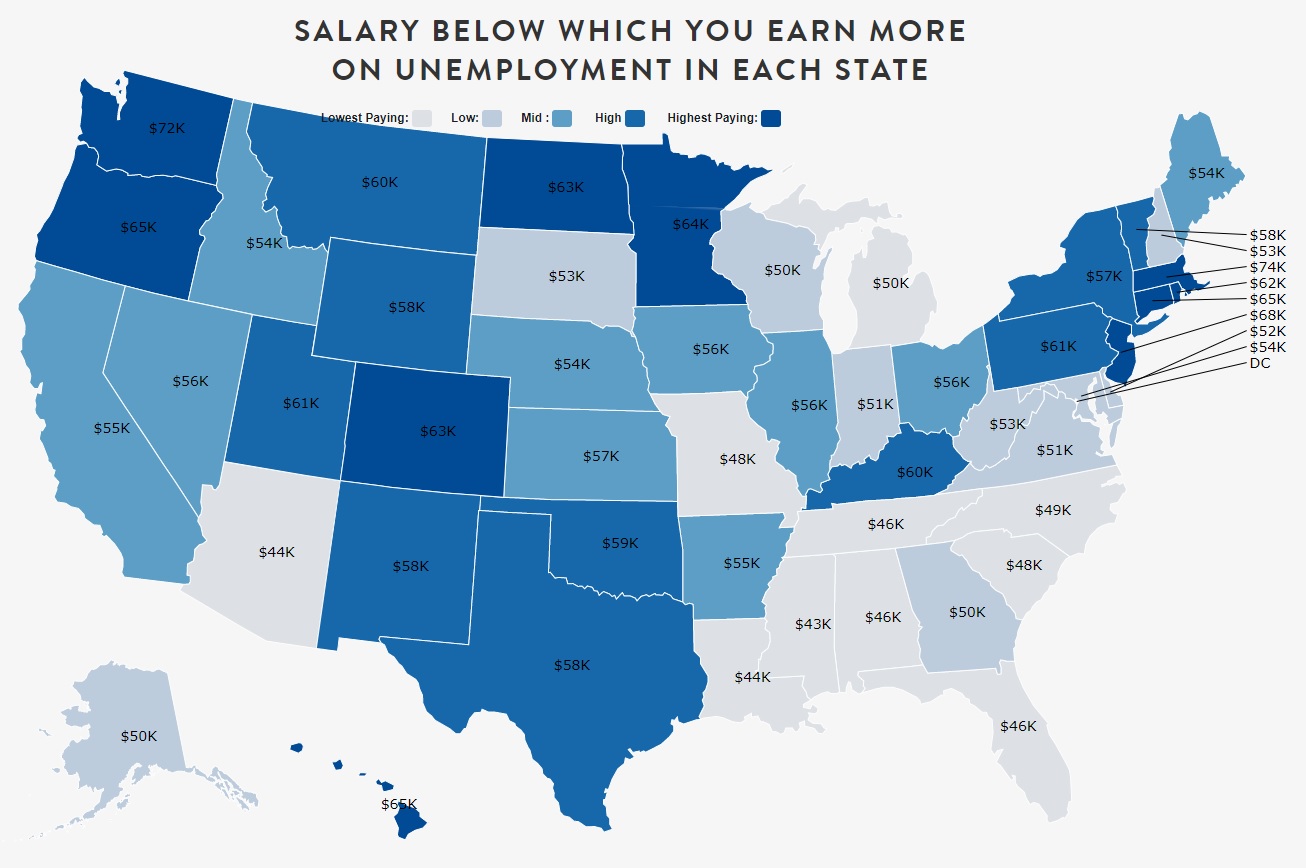

Pandemic Unemployment Assistance Pua Calculator For Self Employed Freelancers And Gig Workers Zippia

Labor Day Snapshot How New Jersey Can Honor Workers And Improve Economic Security New Jersey Policy Perspective

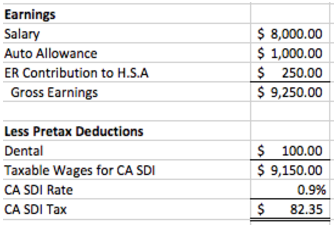

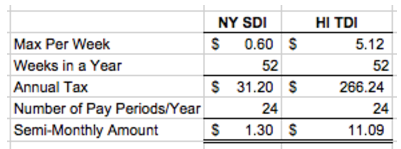

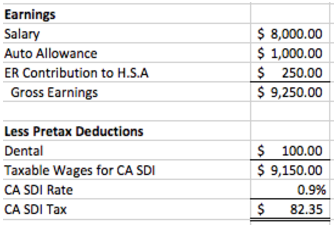

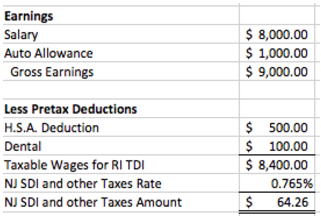

How Are State Disability Insurance Sdi Payroll Taxes Calculated

How Are State Disability Insurance Sdi Payroll Taxes Calculated

N J Needs To Clear Up Unemployment Insurance Uncertainty For Employers Roi Nj

Labor Day Snapshot How New Jersey Can Honor Workers And Improve Economic Security New Jersey Policy Perspective

Unemployment Income In 2020 And State Tax Returns 2021

What Is Sui State Unemployment Insurance Tax Ask Gusto

500 Stimulus Check In New Jersey When Is It Coming As Com

Njbia 2020 Business Climate Analysis Shows Nj Remains Worst In Region Njbia New Jersey Business Industry Association

Unemployment Income In 2020 And State Tax Returns 2021

Nj Covid Latest Sunday July 25 2021 Pix11

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Posting Komentar untuk "New Jersey State Unemployment Tax Rate 2021"