Employees Tax Rates Nz

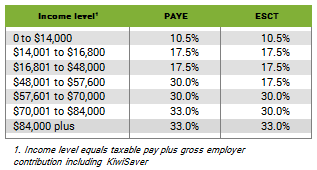

1050 1750 30 33 and 39. This is the lowest rate for over twenty years.

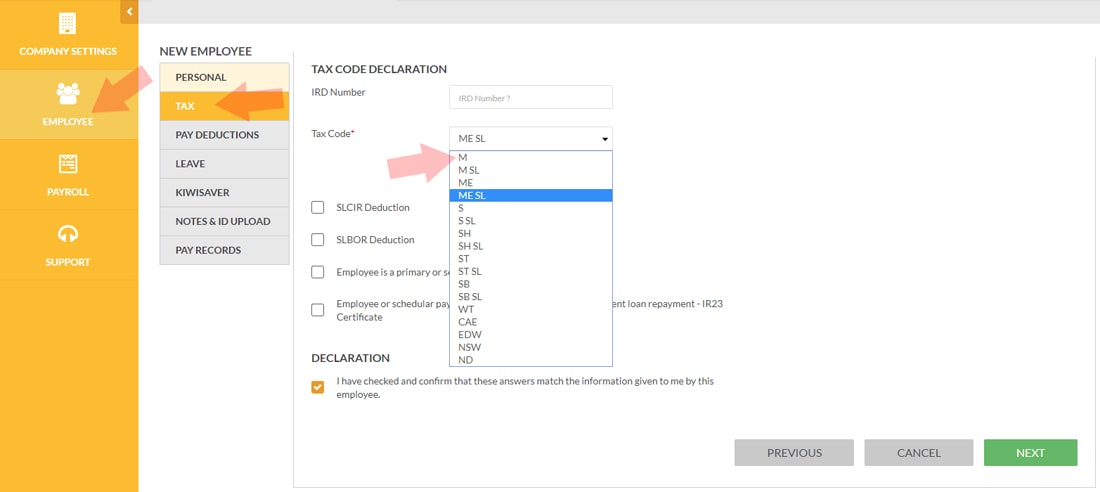

Primary Tax Code Me Your Payroll Nz

These are not employer contributions.

Employees tax rates nz. 92 if your total Class 1 National Insurance both employee and employer contributions is above 45000 for the previous tax year 103 if your total Class 1 National Insurance for the previous. You do not pay ESCT if your employee asks you to deduct money from their pay to put into a superannuation scheme. Note that to give you a more accurate estimate the tax rates displayed below are including the mandatory ACC Levy currently around 139.

You only pay ESCT on cash contributions to an employees super scheme. Find out more on the IRD website. The rate depends on how much your employee earns and how long theyve worked for you.

Up to NZ14000 Taxable Income 1050. Apply for an IRD number external link Tax codes and rates external link. They help your employer or payer work out how much tax to deduct before they pay you.

Types of wage rates. It is applied to all fringe benefits you provide. For example members savings are locked in until theyre eligible for NZ Superannuation.

Your employer will deduct tax using the code you gave them when you started work. Your income could include. The single rate is 6393.

This means you pay a graduated amount depending on how much income you get. Income tax rates are the percentages of tax that you must pay. The rates are based on your total income for the tax year.

Make sure theyre using the right code or you could pay the wrong amount of tax. They refer to it as the Unemployment Insurance Contribution Rate UI. Employers are also required to contribute 3 percent.

If youre a self-employed contractor you need to pay your own tax. Self-employed people may have to pay a higher ACC levy. New Zealanders currently pay 105 tax on the first 14000 of income.

Employees will also have a small levy called an ACC earners levy deducted from their wages. Money from renting out property. A Work and Income benefit.

The same 1000 limit per employee per year applies if you provide subsidised transport to your employees. For KiwiSaver this means you pay ESCT on your compulsory 3 employer contribution and any voluntary extras but not on the contributions deducted from your employees wages or salary. Your tax bracket depends on your total taxable income.

You need to work out the ESCT rate for each employee. Those hired and paid through a recruitment agency or other labour hire business must have tax deducted. Current minimum wage rates.

New Zealand tax residents can pick any rate from 10 per cent up to 100 per cent. New York Payroll Tax Rate Example New employers pay 313 in SUTA for employees making more than 11100 per year. Next tax year those perks will be taxed at a.

From 1 April 2021 Single rate. You need a tax code if you receive salary wages income-tested benefit or other income which has tax taken out before you get paid. From NZ14001 to NZ48000 Taxable Income 1750.

Tax codes only apply to individuals. All full-time and part-time employees aged between 18 and 65 are eligible to participate in the scheme. When working out your total income from all sources do not include any losses you may be carrying forward from the previous tax year.

All contractors can pick the rate to have tax deducted at. Tax rates are used to work out how much tax you need to pay on your total income for the year from all sources. Existing employers pay between 006 and 79.

There are five PAYE tax brackets for the 2021-2022 tax year. The income tax rates in New Zealand are as follows. The new top tax rate of 39 per cent on income earned over 180000 meant the tax rate for employee perks has also changed.

Tax codes are different from tax rates. Individuals pay progressive tax rates. These are the rates for taxes due in April 2022.

For 2019-20 the rate is 139 of earnings. Minimum wage rates apply to all employees aged 16 and over who are full-time part-time fixed-term casual working from home and paid by wages salary commission or piece rates some exceptions. Previous minimum wage rates.

Short form alternate rate. Your tax code might be different for different types of income. Tax rate estimation tool for contractors.

If any of your employees earn less than 180000 per year you will pay more FBT than if you use an alternate rate. KiwiSaver contributions are deducted from employees wages at the rate of 3 percent of gross earnings options exist for higher levels of employee contributions to be made. The tax year is from 1 April to 31 March.

Interest from a bank account or investment.

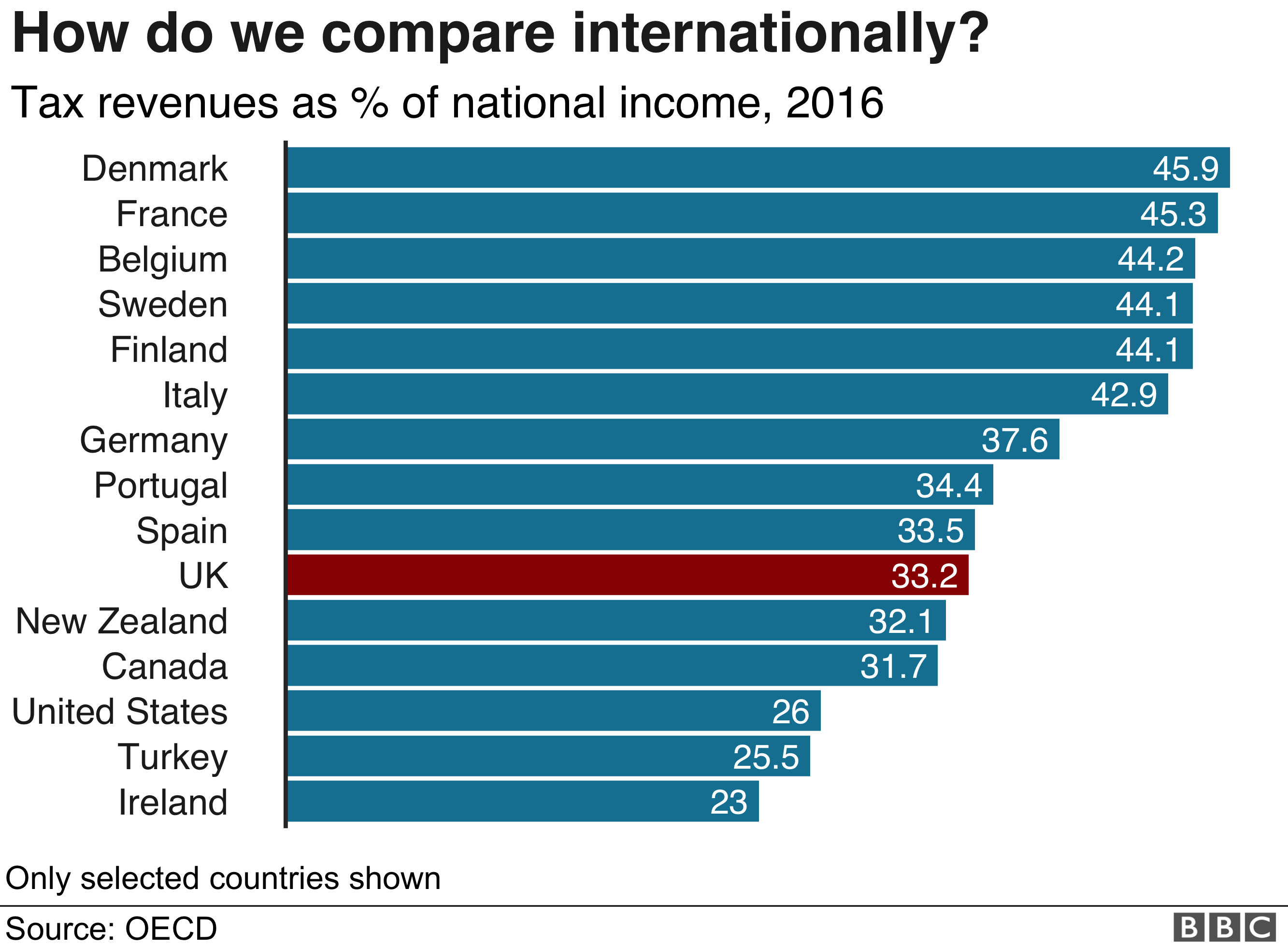

General Election 2019 How Much Tax Do British People Pay Bbc News

New Zealand Paye Tax Rates Moneyhub Nz

New Zealand Tax Codes And Rates Your Refund Nz

Varadkar Says High Irish Tax Rates Are A Problem Is He Correct

Allowing Contractors To Elect Their Own Withholding Rate

Oecd Ulkeleri Bordro Ve Gelir Vergisi Income Tax Payroll Payroll Taxes

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-01-671165481d094f6bb0a0c363689bfa67.jpg)

Countries With The Highest Lowest Corporate Tax Rates

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

New Zealand Tax Codes And Rates Your Refund Nz

What You Need To Know About Income Tax Calculation In Malaysia

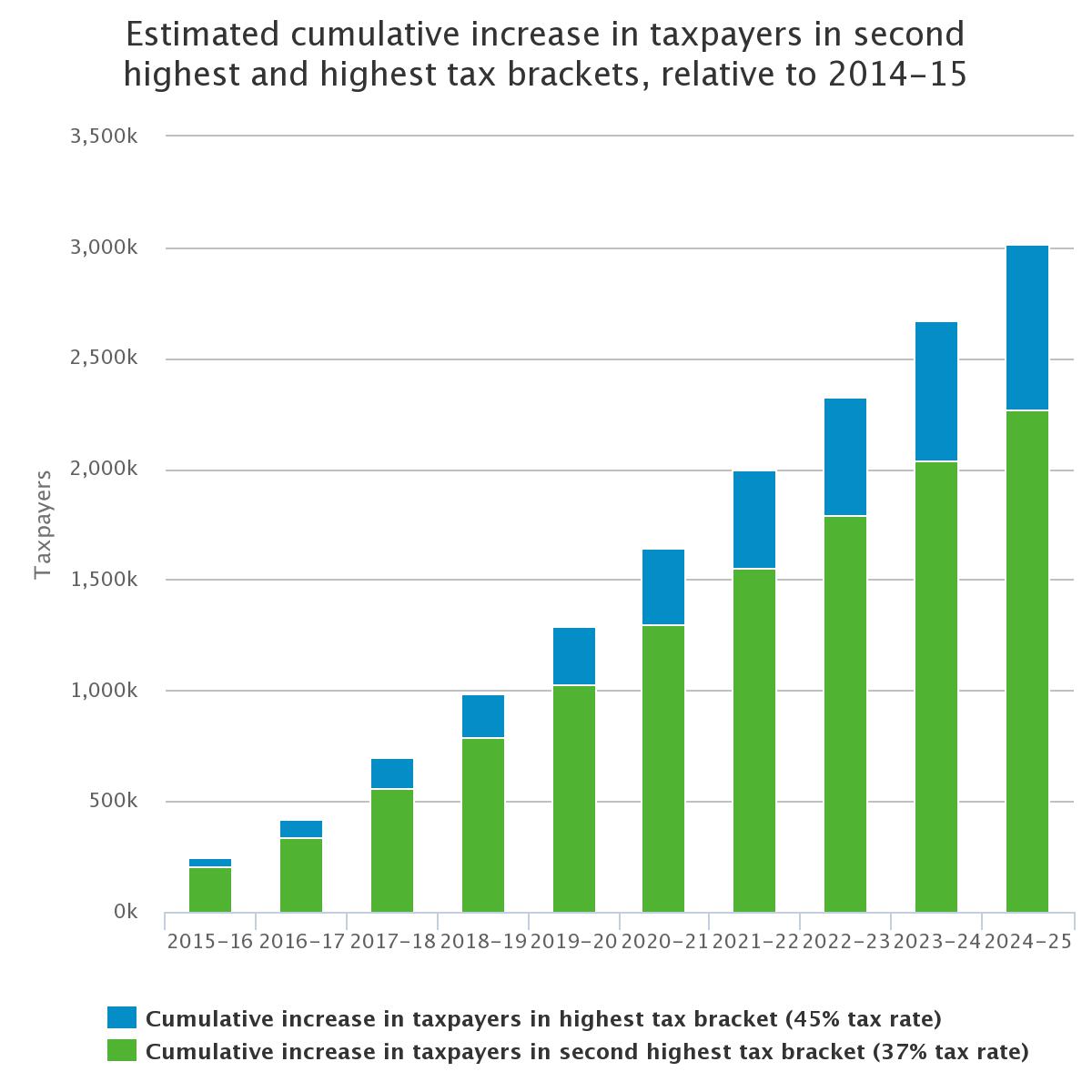

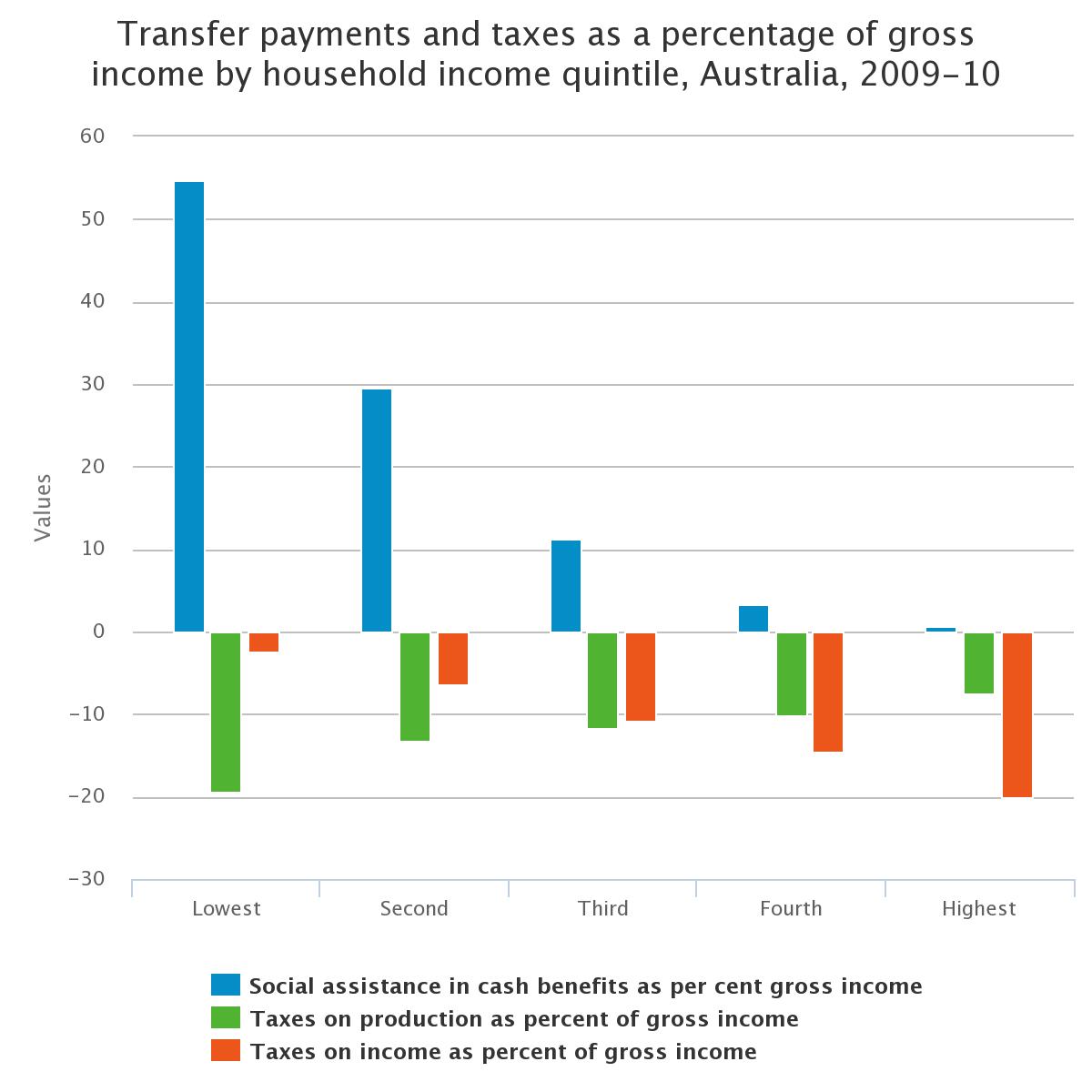

2 Australia S Tax System Treasury Gov Au

2 Australia S Tax System Treasury Gov Au

More Than 40 Of Millionaires Paying Tax Rates Lower Than The Lowest Earners Government Data Reveals Stuff Co Nz

Posting Komentar untuk "Employees Tax Rates Nz"