Employment Tax Rates Virginia

For 2019 the rate. This an employer-only tax.

Calculator How Much Must You Earn At A Job In Another State To Maintain Your Quality Of Life Best Places To Live Cheapest Places To Live States In America

60 3 of excess over 3000.

Employment tax rates virginia. The default tax rate for new employers varies each year. Unlike the federal nanny tax the Virginia household employers withholding tax is filed on a separate return and is not included in the employers personal income tax filing. Others may qualify for an experience base rate or receive an assigned base tax rate.

The wage base for SUI is 8000 of each employees taxable income. The total is 153 with 124 covering Social Security and 29 covering Medicare. Virginia employees should be paid at least 15 times the regular hourly rate time-and-a-half for all hours worked over 40 in a workweek.

Current months estimates are preliminary. Detailed Virginia state income tax rates and brackets are available on this page. 2011 - Present Local Tax Rates Tax Year 2018 pdf.

From May 2020 to May 2021 the VEC estimates that establishments in Virginia gained 255300 jobs an increase of 70. The Virginia self employment tax covers Social Security and Medicare payments when you work for yourself. Virginia SUI can be complicated so if you have any questions check out the FAQ section of the Virginia Employment Commission website.

Assigned for 2 - 3 calendar years If acquiring an existing business Successor assigned Predecessor tax rate unless transfer of experience waived Must be waived within 60 days of the date of. New Virginia employers receive the initial base tax rate of 25 plus add-ons until eligible for a calculated rate. Virginia Employer Tax Rate.

Overtime compensation is not required for live-in employees. Virginia State Payroll Taxes With four marginal tax brackets based upon taxable income payroll taxes in Virginia are progressive. State Unemployment Tax Rate.

If youre a foreign contractor doing business in Virginia your UI rate is 621. This withholding formula is effective for taxable years beginning on or after January 1 2019. Employers with previous employees may be subject to a different rate.

If you choose to register for this annual filing option you will be required to file Form VA-6H the Virginia Household Employers Annual Summary of Income Tax. The annual filing provision is a filing option for qualified employers. In May the private sector recorded an over-the-year gain of 256900 jobs while.

For 2020 the standard tax rate for new employers is 25 and the tax rate for new employers that are out-of-state contractors is 62. If you are unsure of your tax rate call the Employment Commission. Wage Base and Tax Rates UI tax is paid on each employees wages up to a maximum annual amount.

New employer rate varies each year based on Trust Fund factors. Find Your Virginia Tax ID Numbers and Rates. However its always possible that amount could change.

Overtime is not required to be paid when work is performed on a holiday. 5 plus Pool Cost Charge and Fund Building Charge. Types Of New Employer Tax Rates New employers assigned Base Tax Rate 2.

Virginia Income Tax Withholding Table For Wages Paid After December 31 2018 IF WAGES ARE- AND THE TOTAL NUMBER OF PERSONAL EXEMPTIONS CLAIMED ON FORM VA-4 OR VA-4P IS-At Least But Less Than 0 1 2 3 4 5 6 7 8 9 10 and THE AMOUNT OF STATE INCOME TAX TO BE WITHHELD SHALL BE- over 120 122 529 512 494 476 458 440 422 405 387 369 351. From May 2020 to May 2021 the VEC estimates that establishments in Virginia gained 255300 jobs an increase of 70. Select the Pay Period.

You should receive your Virginia Tax Rate after completing the online registration with the Department of Taxation and the Virginia Employment Commission. A pool-cost charge is not in effect for 2020 the spokeswoman told Bloomberg Tax. The Virginia income tax has four tax brackets with a maximum marginal income tax of 575 as of 2021.

How much is the self employment tax for Virginia. Tax rates range from 20 575Since the top tax bracket begins at just 17000 in taxable income per year most Virginia taxpayers will pay the top rate. In recent years that amount known as the taxable wage base has been stable at 8000 in Virginia.

If youre a new employer your rate will be between 251 and 621. How Virginia Tax is Calculated. Household employers in Virginia are not required to have workers compensation coverage if they.

Virginias unemployment tax rates for experienced employers range from 01 to 62 in 2020 a spokeswoman for the state Employment Commission said Jan. Use the withholding tax calculator to compute the amount of tax to be withheld from each of your employees wages. Current months estimates are preliminary.

The Local Tax Rates Survey is published by the Department of Taxation as a convenient reference guide to selected local tax rates. In May the private sector recorded an over-the-year gain of 256900 jobs while. It does not establish a new requirement for withholding.

In Virginia the new employer SUI state unemployment insurance rate is 25 percent on the first 8000 of wages for each employee. 120 5 of excess over 5000.

What Are The Tax Brackets H R Block

The Differences Between Va Md And Dc Taxation Lipsey Associates Of Vienna Virginia

Average Tax Refund Climbs To 3 034 So Far This Year Income Tax Return Tax Refund Income Tax

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

2021 Federal State Payroll Tax Rates For Employers

Rdtc Franchise Owner Business Card Designed By Spectra Marketing Solutions Need Business Cards Designed And Prin Irs Taxes Tax Extension Marketing Solution

Form 1040 Is One Of Three Irs Tax Forms Used For Personal Federal Income Tax Returns Filed With The Internal Revenue Irs Tax Forms Irs Taxes Income Tax Return

Une Saison Taxante Celle De L Impot Tax Consulting Tax Lawyer Tax Services

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

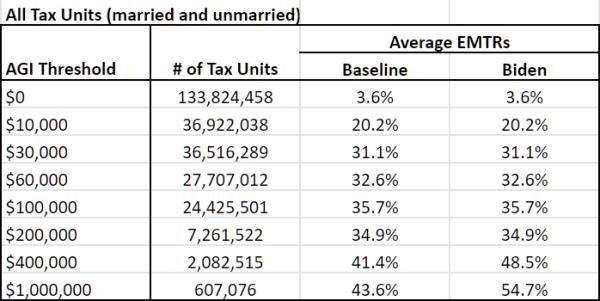

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Careers Penn Workday Career Veterinary School Job

Element Not Valid Newspaper Design Media Design Writing Tips

Federal Income Tax Brackets 2012 To 2017 Novel Investor Income Tax Brackets Tax Brackets Income Tax

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

Texas Employment Commission Employment Verification Check Temporary Employment Agencies In My Area Office Team Em Employment Agency Office Team Lettering

Pin On Management Accounting Outsourcing

Liberty Tax Liberty Tax Tax Services Income Tax Return

Shipstation Squarespace Tutorial Never Go To The Post Office Again Youtube Squarespace Tutorial Tutorial Squarespace

Posting Komentar untuk "Employment Tax Rates Virginia"