Employment Rate Unemployment Benefits

20132014 has seen the employment rate increase from 1935836 to 2173012 as supported by showing the UK is creating more job opportunities and forecasts the rate of increase in 20142015 will be another 72. Under these conditions your employer should issue a Low Earnings Report for the week showing your gross wages.

Causes Of Unemployment In The United States Wikipedia

You will need to have your incomewages earned during the four prior calendar quarters base year period and also number of hours worked in some instances for each of these quarters.

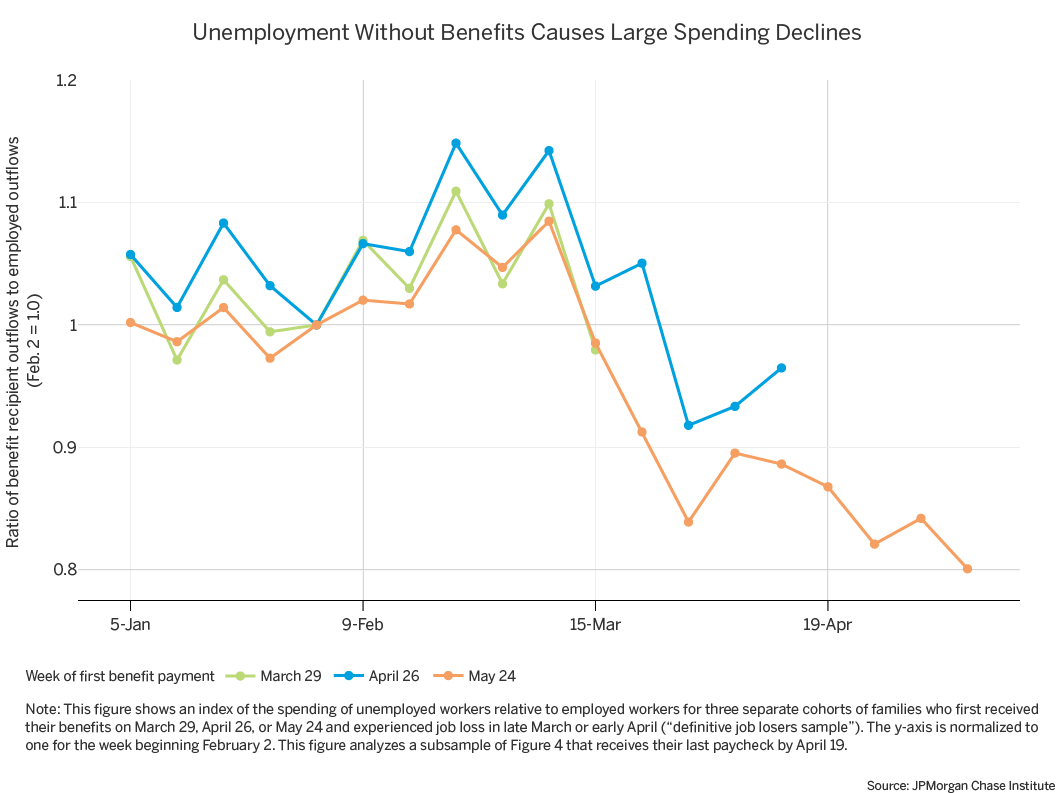

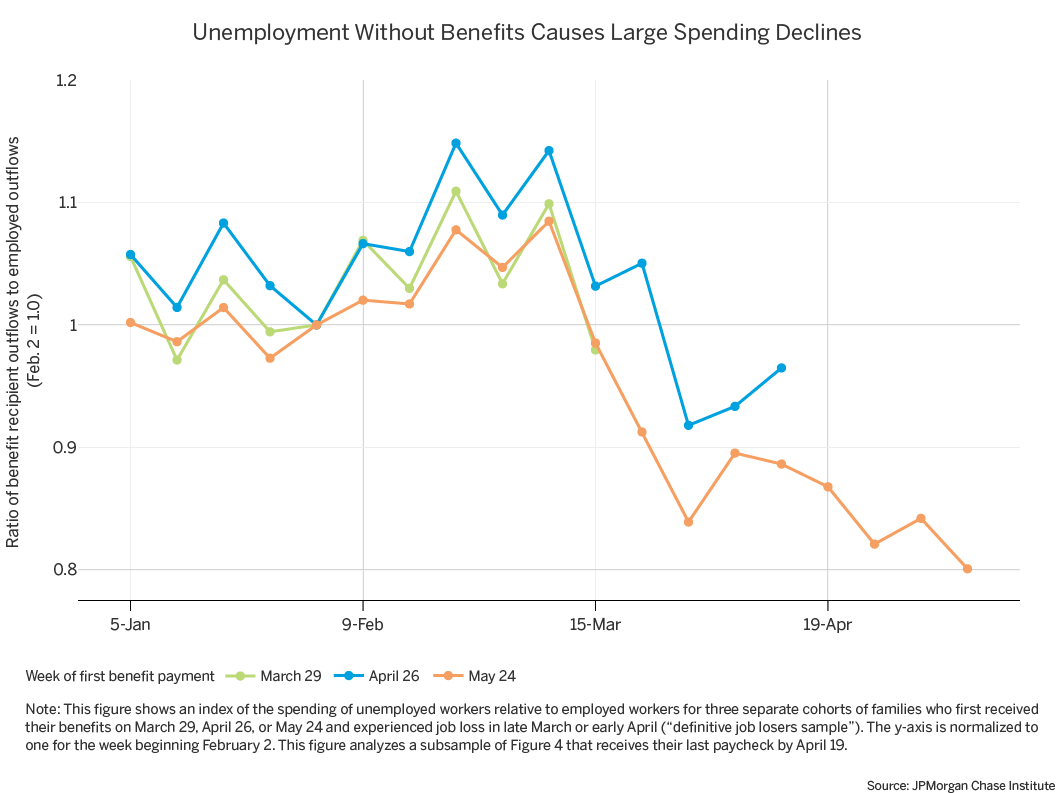

Employment rate unemployment benefits. The study analyzed. If youre not sure about your eligibility check with your state unemployment office. Unemployment benefits and unemployment benefit replacement rate reduces the drop in consumption among unemployed workers by 265 and that people who do not receive unemployment benefits have to reduce their consumption by more than 22.

Since the wages you earn can vary significantly from. How long you could receive EI regular benefits. On the other hand hiring rates of teenagers 15-19 rise in states keeping enhanced UI benefits through September before also.

Some GOP governors have blamed unemployment benefits for sluggish jobs growth. The unemployment rate of Britains young black people was 474 in 2011. The week that state governors announced UI benefits would soon end in mid-June 2021 we observe a rise in hiring rates of adult workers 25 or older compared to later states after which both return to nearly identical levels as these benefits actually expire.

As of January 1 2021 the maximum yearly insurable earnings amount is 56300. Less than what your weekly unemployment benefit amount would be plus 60. With the 300 supplement almost half of jobless workers 48 make as much or more money on unemployment benefits than their lost paychecks.

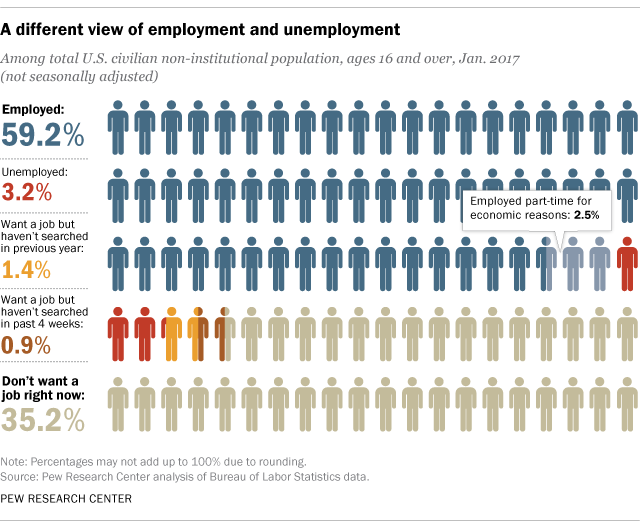

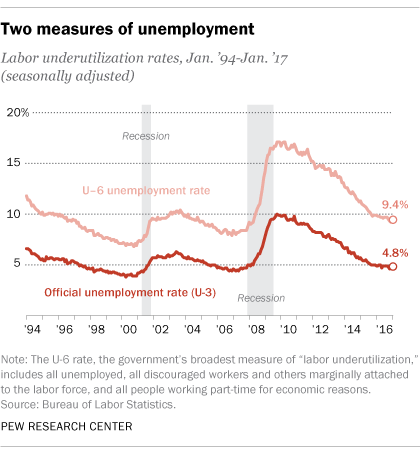

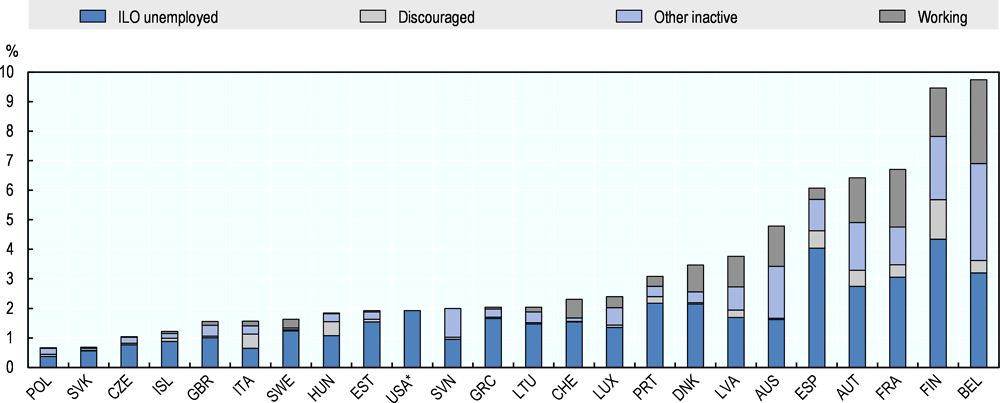

43 Zeilen For most people the basic rate for calculating EI benefits is 55 of their average insurable weekly earnings up to a maximum amount. Unemployment benefit spending compared to social security spending. The unemployment rate is the proportion of unemployed persons in the labor force.

Your state unemployment website will generally allow you to calculate your estimated state unemployment benefits prior to or when submitting a claim. Unemployment benefit is now dwarfed by housing benefit. Once the state approves your claim you can apply to.

If youve been laid off or furloughed youre qualified to apply for unemployment benefits in the state where you live. A new study found employment fell slightly in states that cut federal unemployment benefits early. This means that you can receive a maximum amount of 595 per week.

You must complete the claims portion of the Low Earnings Report and file it with the local unemployment office as directed on the form. Once you find out whether you are eligible you can file a claim for unemployment benefits. Bureau of Labor Statistics Division of Labor Force Statistics PSB Suite 4675 2 Massachusetts Avenue NE Washington DC 20212-0001 Telephone.

Unemployment adversely affects the disposable income of families erodes purchasing power diminishes employee. The current FUTA tax rate is 6 but most states receive a 54 credit reducing that to 06. There is no action an employer can take to affect this rate.

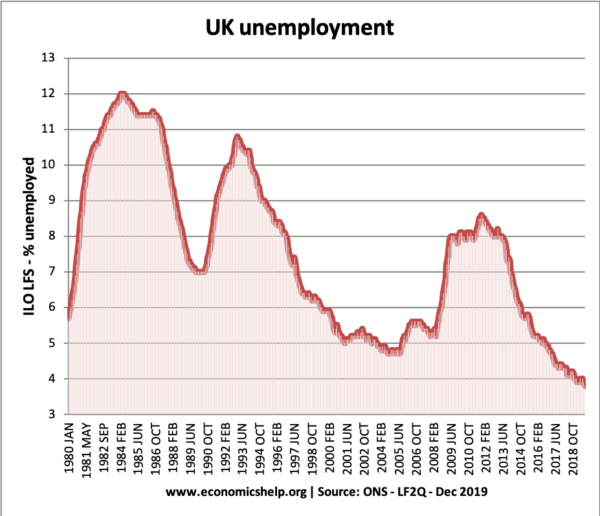

Thats why the unemployment rate inched up 01 percentage points to 61 last month. Nevertheless over time unemployment rates remain a crucial indicator of the health level of development and growth trajectory of an economy. Each state has a different rate and benefits vary based on your earnings record and the date you became unemployed.

Jobseekers Allowance JSA is an unemployment benefit you can claim while looking for work - how to apply online new style JSA eligibility rates rapid reclaim JSA interview when payment can. 1-202-691-6378 wwwblsgovCPS Contact CPS resources. You dont want to lose out on unemployment compensation because you didnt think you.

Fraudulent Unemployment benefit claims. The more workers are actively looking for employment. Rising unemployment results in loss of income for individuals and reduced collection of taxes for governments forcing them to spend greater amounts on unemployment benefits and social subsidies.

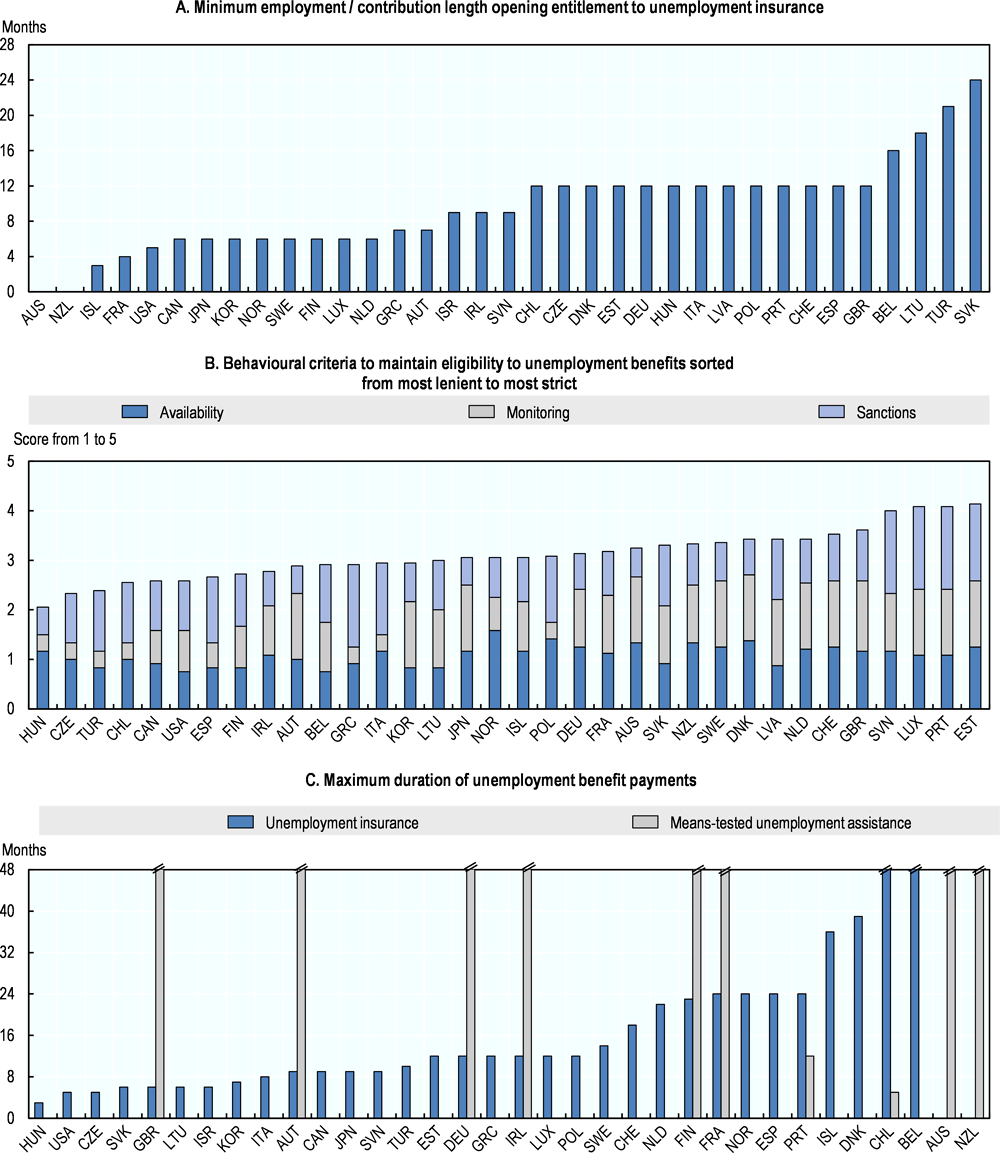

The Federal Unemployment Tax Act FUTA tax is imposed at a flat rate on the first 7000 paid to each employee. Benefits in unemployment share of previous income After 2 months After 6 months After 1 year After 5 years of previous in-work income 2020 or latest available. Long-term unemployment can also weaken the.

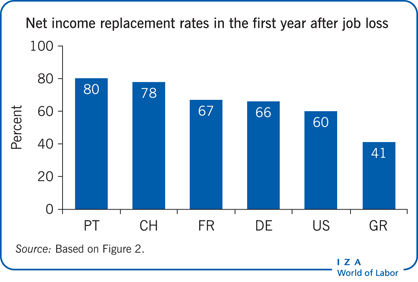

In the 2014 the public expenditure survey the total cost of unemployment benefit payments fell from 55 bn to 49 bn Claimant count method. Replacement rates at or above 84the case in. Calculations refer to a single person without children whose previous in-work earnings were 67 of the average wage.

Uk Unemployment Stats And Graphs Economics Help

/UnemploymentandGDP2008-80ffa8c6bee640208888f8cc26cb38e2.jpg)

What Happens To Unemployment During A Recession

Going Beyond The Unemployment Rate Pew Research Center

Going Beyond The Unemployment Rate Pew Research Center

Social Protection Statistics Unemployment Benefits Statistics Explained

The Downside Of Low Unemployment

Many Americans Are Getting More Money From Unemployment Than They Were From Their Jobs Fivethirtyeight

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

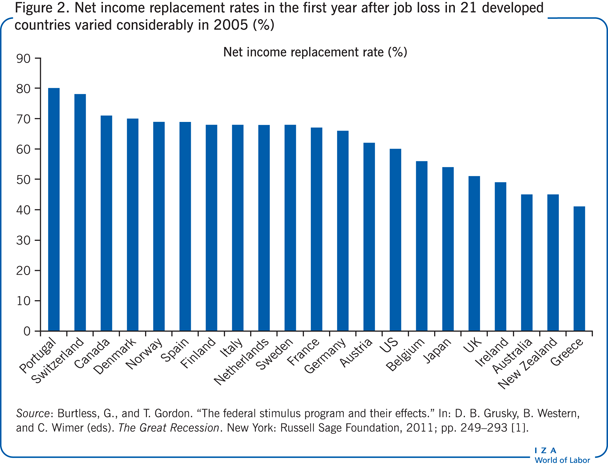

Iza World Of Labor Unemployment Benefits And Unemployment

Social Protection Statistics Unemployment Benefits Statistics Explained

Sweden Monthly Unemployment Rate 2020 2021 Statista

Iza World Of Labor Unemployment Benefits And Unemployment

How Inflation And Unemployment Are Related

Social Protection Statistics Unemployment Benefits Statistics Explained

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Posting Komentar untuk "Employment Rate Unemployment Benefits"